- China

- /

- Metals and Mining

- /

- SZSE:002160

A Piece Of The Puzzle Missing From Jiangsu Alcha Aluminium Group Co., Ltd.'s (SZSE:002160) Share Price

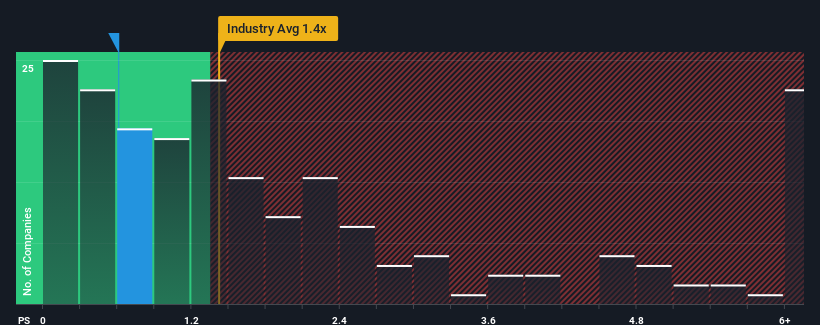

When you see that almost half of the companies in the Metals and Mining industry in China have price-to-sales ratios (or "P/S") above 1.4x, Jiangsu Alcha Aluminium Group Co., Ltd. (SZSE:002160) looks to be giving off some buy signals with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jiangsu Alcha Aluminium Group

How Jiangsu Alcha Aluminium Group Has Been Performing

We'd have to say that with no tangible growth over the last year, Jiangsu Alcha Aluminium Group's revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Jiangsu Alcha Aluminium Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Jiangsu Alcha Aluminium Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jiangsu Alcha Aluminium Group's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 68% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this information, we find it odd that Jiangsu Alcha Aluminium Group is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Jiangsu Alcha Aluminium Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Jiangsu Alcha Aluminium Group with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002160

Jiangsu Alcha Aluminium Group

Provides industrial heat transfer materials, heat transfer equipment, and comprehensive solutions in China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives