- China

- /

- Electrical

- /

- SHSE:601567

3 Stocks Estimated To Be Trading Up To 27.8% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, alongside mixed performances across major indices, investors are keenly observing opportunities that may arise amidst these fluctuations. With the Nasdaq hitting record highs while other indexes face declines, identifying stocks trading below their intrinsic value could offer potential advantages in a market characterized by volatility and shifting economic indicators. In such an environment, a good stock is often one that not only shows resilience but also offers value relative to its fundamentals and current market price.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.70 | CN¥11.35 | 49.8% |

| Hanwha Systems (KOSE:A272210) | ₩20850.00 | ₩41692.30 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.92 | CA$11.83 | 50% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP579.00 | 49.9% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Compagnia dei Caraibi (BIT:TIME) | €0.542 | €1.08 | 50% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.28 | 49.9% |

| Fnac Darty (ENXTPA:FNAC) | €29.45 | €58.67 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.00 | CN¥125.29 | 49.7% |

We'll examine a selection from our screener results.

YIT Oyj (HLSE:YIT)

Overview: YIT Oyj offers construction services across Finland, Central Eastern Europe, the Czech Republic, Slovakia, Poland, Baltic countries, and internationally with a market cap of €548.77 million.

Operations: The company's revenue is segmented into Housing (€743 million), Infrastructure (€399 million), and Business Premises (€789 million).

Estimated Discount To Fair Value: 15.2%

YIT Oyj is trading at €2.38, slightly below its fair value estimate of €2.81, indicating it may be modestly undervalued based on discounted cash flow analysis. Despite expected annual profit growth and revenue increases outpacing the Finnish market, YIT's low forecasted return on equity and high volatility are concerns. Recent contracts, including a €105 million project with Hitachi Energy, bolster its order book but do not fully offset financial challenges such as shareholder dilution and uncovered debt by operating cash flow.

- The growth report we've compiled suggests that YIT Oyj's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of YIT Oyj stock in this financial health report.

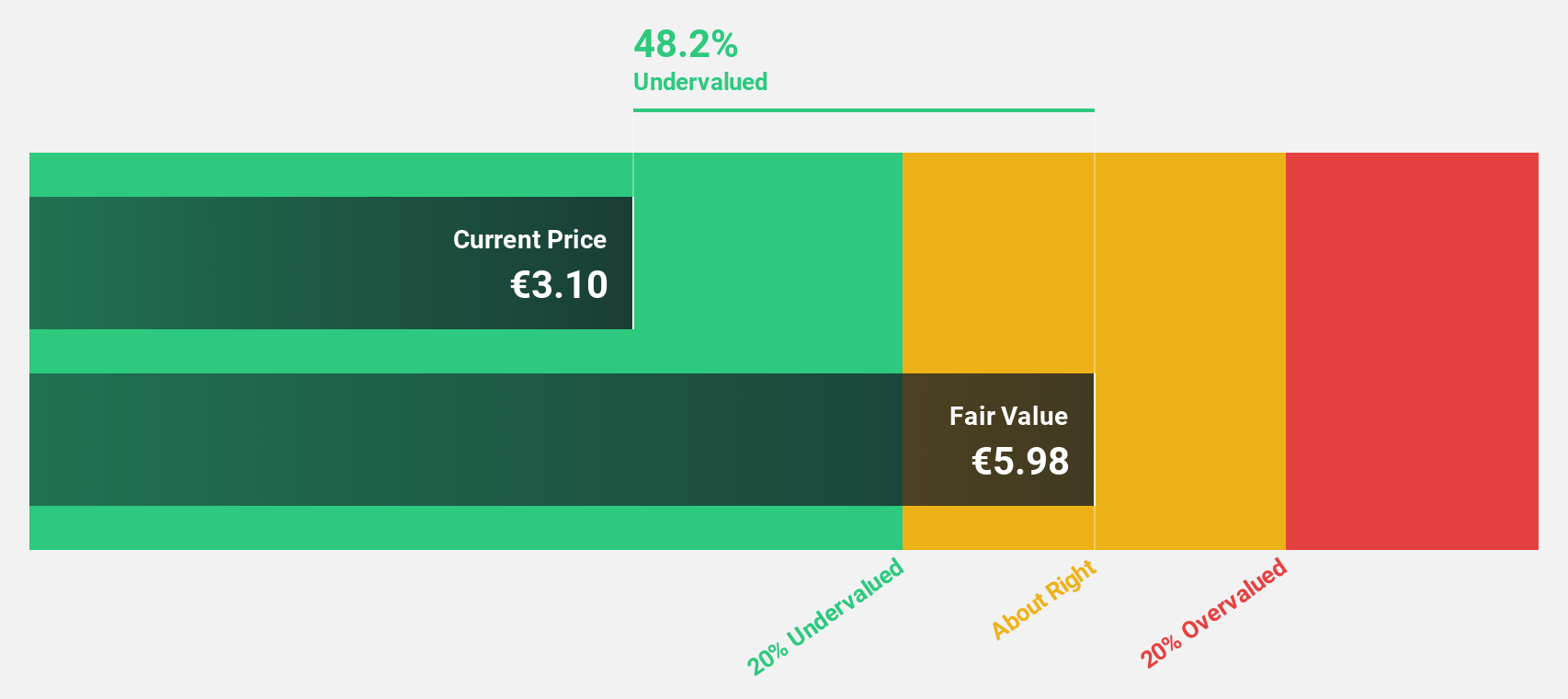

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems both in China and internationally, with a market cap of CN¥46.81 billion.

Operations: Revenue Segments (in millions of CN¥): Power distribution systems: 7,500; Utilization systems: 5,200.

Estimated Discount To Fair Value: 17.6%

Ningbo Sanxing Medical Electric Ltd., trading at CNY 33.17, is undervalued relative to its estimated fair value of CNY 40.24, presenting a potential opportunity based on discounted cash flow analysis. The company's revenue and earnings are forecasted to grow significantly, with annual growth rates exceeding 20%. Despite this positive outlook, Ningbo's dividend track record remains unstable. Recent financial results show robust sales and net income growth over the past year.

- Upon reviewing our latest growth report, Ningbo Sanxing Medical ElectricLtd's projected financial performance appears quite optimistic.

- Take a closer look at Ningbo Sanxing Medical ElectricLtd's balance sheet health here in our report.

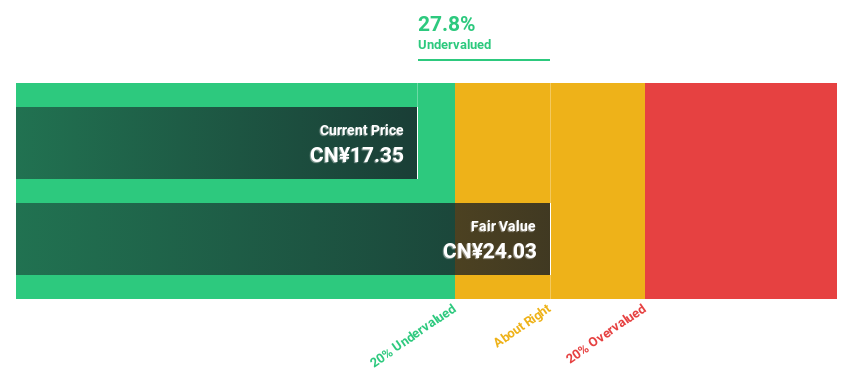

Western Metal Materials (SZSE:002149)

Overview: Western Metal Materials Co., Ltd. processes nonferrous and rare metal materials in China and internationally, with a market cap of CN¥8.47 billion.

Operations: The company generates revenue from processing nonferrous and rare metal materials both domestically and internationally.

Estimated Discount To Fair Value: 27.8%

Western Metal Materials, trading at CNY 17.35, is undervalued compared to its fair value of CNY 24.03 based on discounted cash flow analysis. Earnings are projected to grow significantly faster than the market at 37.2% annually over the next three years, although revenue growth is expected at a slower pace of 16%. The company faces challenges with an unstable dividend history and large one-off items affecting financial results. Recent earnings show a decline in sales and net income year-over-year.

- In light of our recent growth report, it seems possible that Western Metal Materials' financial performance will exceed current levels.

- Get an in-depth perspective on Western Metal Materials' balance sheet by reading our health report here.

Make It Happen

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 885 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sanxing Medical ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601567

Ningbo Sanxing Medical ElectricLtd

Manufactures and sells power distribution and utilization systems in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.