3 Promising Penny Stocks With Market Caps Under US$3B To Consider

Reviewed by Simply Wall St

Global markets have been experiencing a mix of volatility and growth, with U.S. stocks facing pressure from AI competition fears and political uncertainties, while European markets find support from strong earnings and interest rate cuts. In such a climate, investors often seek opportunities in less conventional areas like penny stocks—companies typically smaller or newer that offer potential for significant growth at lower price points. Although the term "penny stocks" might seem outdated, these investments can still present compelling prospects when backed by strong balance sheets and sound fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.73 | HK$42.85B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £472.83M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £432.34M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.09M | ★★★★★☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tongda Group Holdings (SEHK:698)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tongda Group Holdings Limited is an investment holding company that supplies high-precision structural parts for smart mobile communications and consumer electronic products across China, the Asia Pacific region, Europe, the United States, and internationally, with a market cap of HK$847 million.

Operations: The company generates revenue from two main segments: Consumer Electronics Structural Components, contributing HK$5.58 billion, and Household and Sports Goods, accounting for HK$951.23 million.

Market Cap: HK$847M

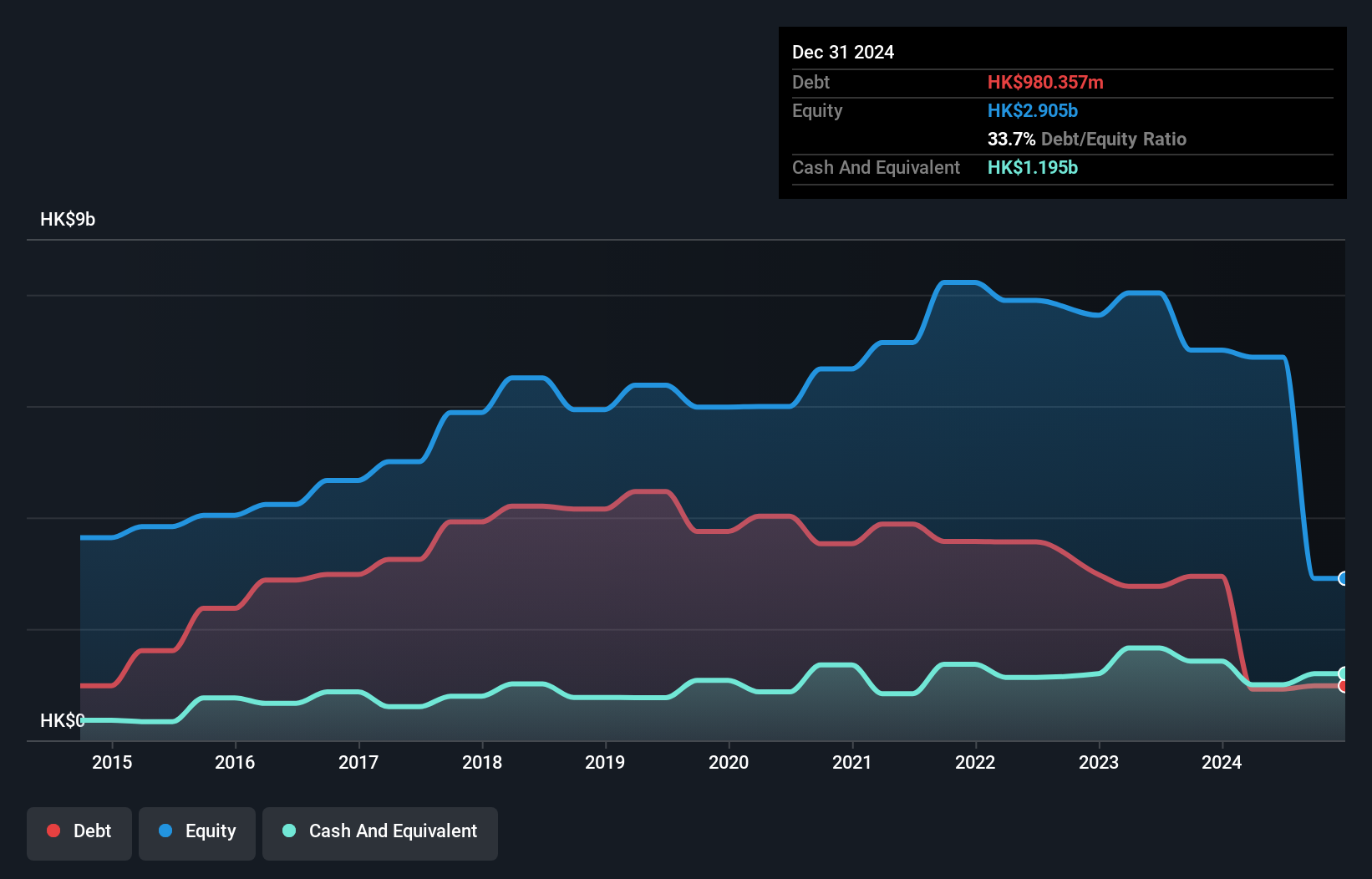

Tongda Group Holdings, with a market cap of HK$847 million, operates in the consumer electronics and household goods sectors. Despite being unprofitable and having increasing losses over the past five years, the company shows potential due to its seasoned management and board. The company's short-term assets exceed both its short- and long-term liabilities, indicating strong financial positioning. It has reduced its debt-to-equity ratio significantly over five years and has more cash than total debt. While earnings are forecasted to grow substantially annually, current profitability remains a challenge for investors considering penny stocks like Tongda Group Holdings.

- Take a closer look at Tongda Group Holdings' potential here in our financial health report.

- Gain insights into Tongda Group Holdings' outlook and expected performance with our report on the company's earnings estimates.

CNNC Hua Yuan Titanium Dioxide (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

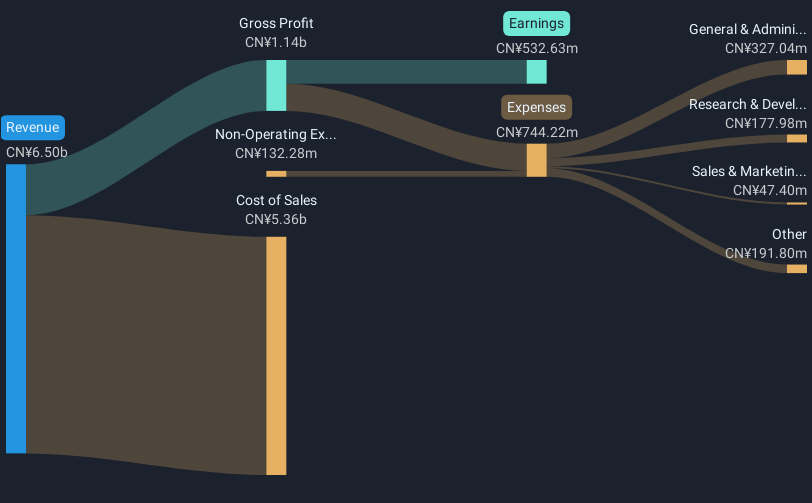

Overview: CNNC Hua Yuan Titanium Dioxide Co., Ltd is involved in the production and sale of rutile titanium dioxide in China, with a market cap of CN¥15.57 billion.

Operations: There are no specific revenue segments reported for CNNC Hua Yuan Titanium Dioxide Co., Ltd.

Market Cap: CN¥15.57B

CNNC Hua Yuan Titanium Dioxide, with a market cap of CN¥15.57 billion, has shown substantial earnings growth of 47.8% over the past year, outpacing the broader chemicals industry. The company maintains more cash than its total debt and covers interest payments comfortably, although its operating cash flow remains negative. Despite a low return on equity at 4.4%, the company's net profit margins have improved to 8.2%. A recent extraordinary shareholders meeting addressed strategic financial decisions like credit line applications and foreign exchange hedging, reflecting proactive management efforts amidst stable weekly volatility in stock performance.

- Unlock comprehensive insights into our analysis of CNNC Hua Yuan Titanium Dioxide stock in this financial health report.

- Understand CNNC Hua Yuan Titanium Dioxide's track record by examining our performance history report.

Liaoning Kelong Fine ChemicalInc (SZSE:300405)

Simply Wall St Financial Health Rating: ★★★★☆☆

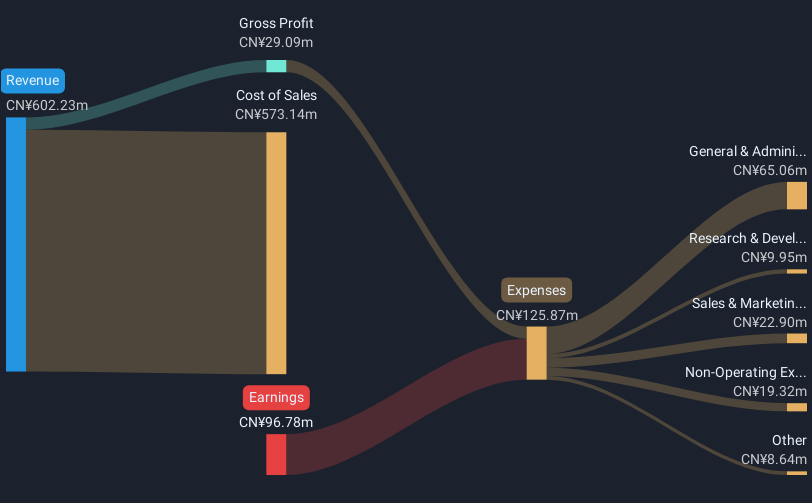

Overview: Liaoning Kelong Fine Chemical Inc. is a company that manufactures and sells fine chemicals globally, with a market cap of CN¥1.36 billion.

Operations: Liaoning Kelong Fine Chemical Inc. has not reported any specific revenue segments.

Market Cap: CN¥1.36B

Liaoning Kelong Fine Chemical Inc., with a market cap of CN¥1.36 billion, is currently unprofitable and has seen its losses increase by 32.6% annually over the past five years. The company's short-term assets exceed both its short and long-term liabilities, offering some financial cushion despite a high net debt to equity ratio of 89.4%. The stock has experienced significant volatility recently, higher than most CN stocks. A special shareholders meeting is scheduled to address board elections and financing matters for 2025, indicating active corporate governance amidst financial challenges and an experienced management team averaging 15.3 years in tenure.

- Dive into the specifics of Liaoning Kelong Fine ChemicalInc here with our thorough balance sheet health report.

- Gain insights into Liaoning Kelong Fine ChemicalInc's past trends and performance with our report on the company's historical track record.

Next Steps

- Click this link to deep-dive into the 5,708 companies within our Penny Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300405

Liaoning Kelong Fine ChemicalInc

Manufactures and sells fine chemicals worldwide.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives