- China

- /

- Metals and Mining

- /

- SZSE:002110

Sansteel MinGuangLtd.Fujian (SZSE:002110 shareholders incur further losses as stock declines 7.2% this week, taking five-year losses to 58%

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Sansteel MinGuang Co.,Ltd.,Fujian (SZSE:002110) share price dropped 67% in the last half decade. That is extremely sub-optimal, to say the least. And it's not just long term holders hurting, because the stock is down 23% in the last year. Unfortunately the share price momentum is still quite negative, with prices down 20% in thirty days. We do note, however, that the broader market is down 9.1% in that period, and this may have weighed on the share price.

With the stock having lost 7.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Sansteel MinGuangLtd.Fujian

Sansteel MinGuangLtd.Fujian wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Sansteel MinGuangLtd.Fujian reduced its trailing twelve month revenue by 1.5% for each year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 11% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

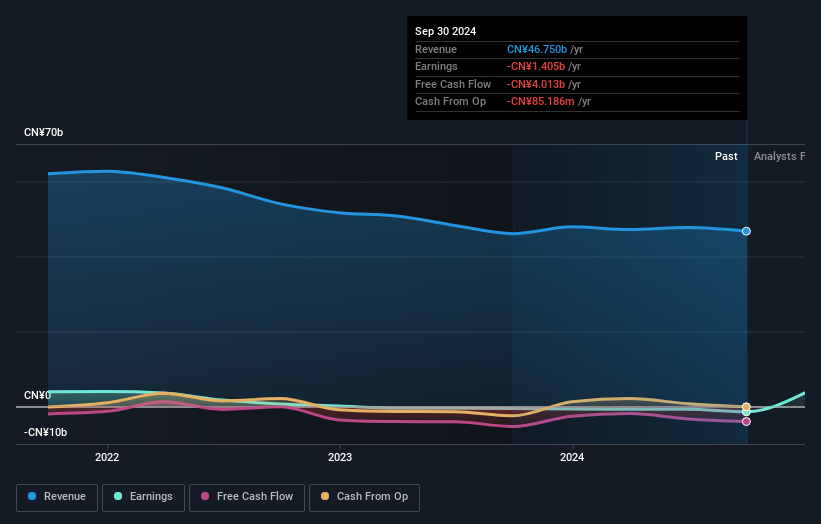

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Sansteel MinGuangLtd.Fujian's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Sansteel MinGuangLtd.Fujian the TSR over the last 5 years was -58%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Sansteel MinGuangLtd.Fujian shareholders are down 23% for the year (even including dividends), but the market itself is up 7.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Sansteel MinGuangLtd.Fujian that you should be aware of before investing here.

Of course Sansteel MinGuangLtd.Fujian may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002110

Sansteel MinGuangLtd.Fujian

Manufactures and sells iron and steel products in China.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives