- Germany

- /

- Entertainment

- /

- XTRA:EDL

3 Dividend Stocks To Consider With Up To 6.6% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by political developments and economic shifts, U.S. stocks have surged to record highs, buoyed by optimism surrounding potential trade deals and AI investments. Amid this backdrop of growth and enthusiasm, investors may find value in dividend stocks that offer stability through regular income streams while potentially capitalizing on market momentum.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

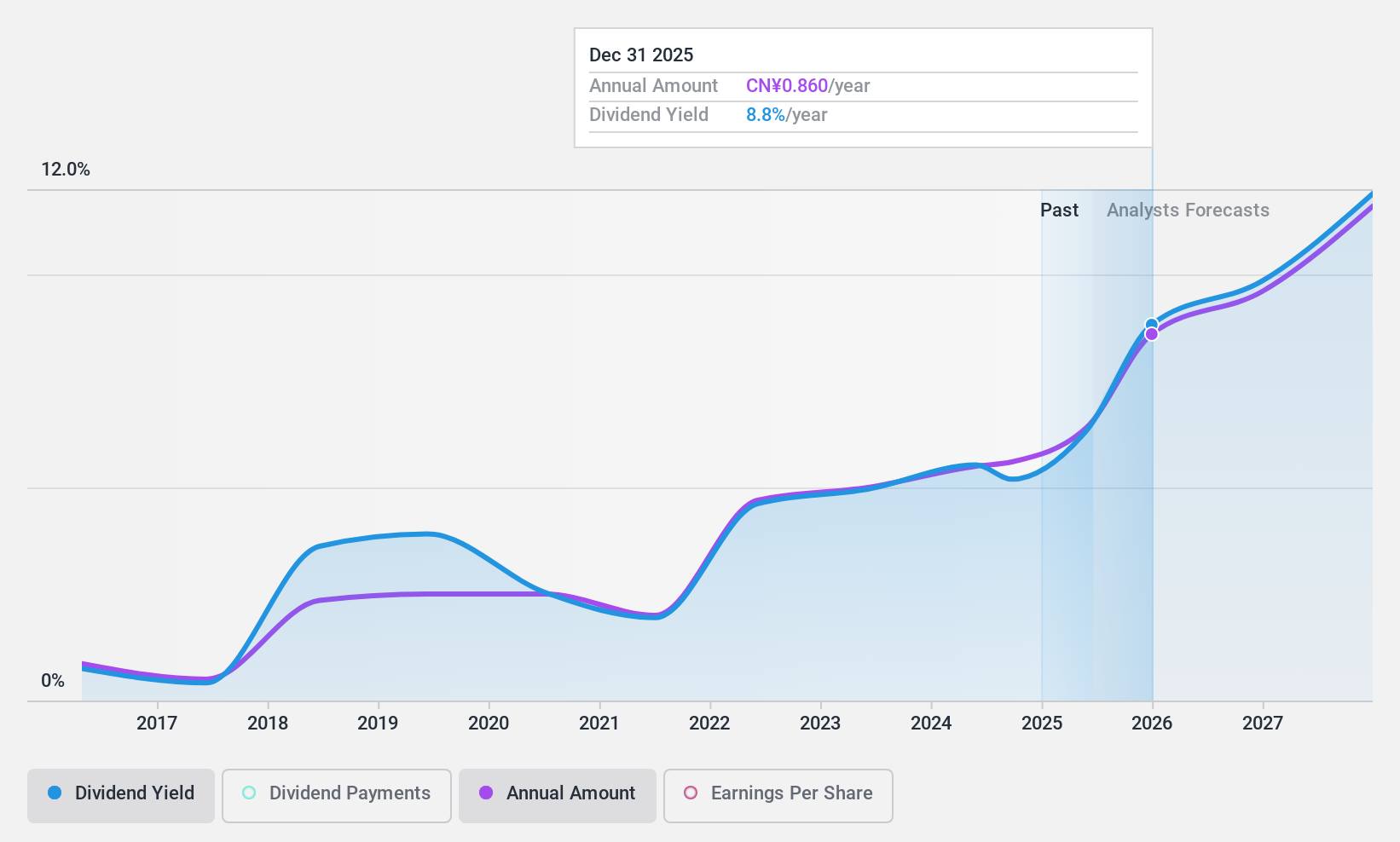

DeHua TB New Decoration MaterialLtd (SZSE:002043)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DeHua TB New Decoration Material Co., Ltd specializes in producing and selling environmentally friendly furniture panels both in China and internationally, with a market cap of CN¥9.02 billion.

Operations: DeHua TB New Decoration Material Co., Ltd generates its revenue from the production and sale of eco-friendly furniture panels domestically and abroad.

Dividend Yield: 5.1%

DeHua TB New Decoration Material Ltd. offers a dividend yield of 5.1%, placing it in the top 25% of dividend payers in China. However, its high payout ratio of 93.3% indicates dividends are not well covered by earnings, though cash flow coverage is better with a lower cash payout ratio of 39.3%. Despite trading at a significant discount to estimated fair value, its dividends have been volatile and unreliable over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of DeHua TB New Decoration MaterialLtd.

- According our valuation report, there's an indication that DeHua TB New Decoration MaterialLtd's share price might be on the cheaper side.

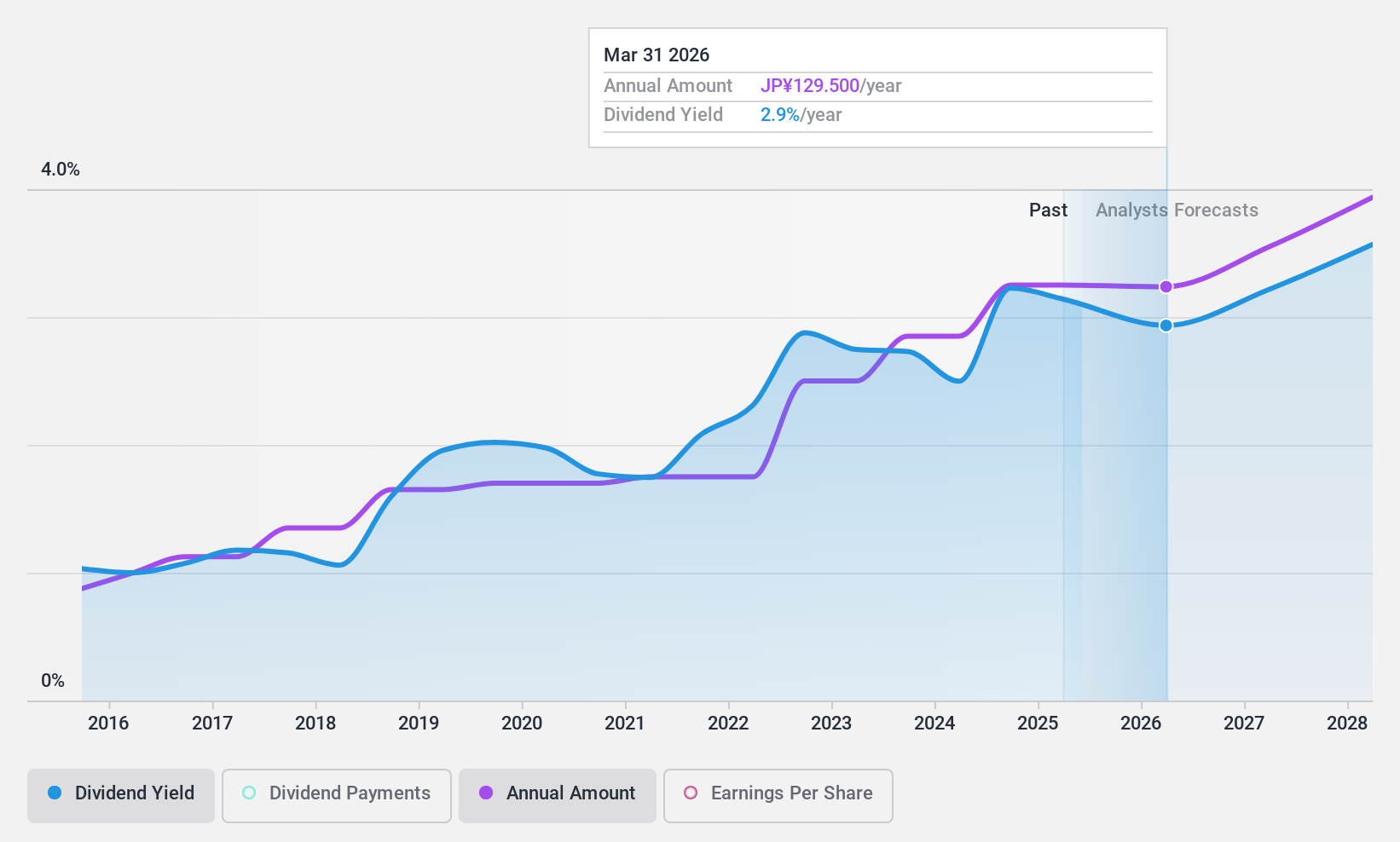

SundrugLtd (TSE:9989)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sundrug Co., Ltd. operates and manages drug stores and dispensing pharmacies in Japan, with a market cap of ¥489.63 billion.

Operations: Sundrug Co., Ltd. generates revenue through its Drugstore Business, which accounts for ¥504.24 billion, and its Discount Store Business, contributing ¥327.23 billion.

Dividend Yield: 3.1%

Sundrug Ltd. offers a dividend yield of 3.11%, below the top 25% in Japan. The dividend has grown steadily over the past decade but is not well covered by free cash flows, with a high cash payout ratio of 746.5%. However, earnings coverage is reasonable with a payout ratio of 48.6%. Despite reliable and stable dividends historically, sustainability concerns arise due to inadequate cash flow coverage for payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of SundrugLtd.

- Our valuation report here indicates SundrugLtd may be overvalued.

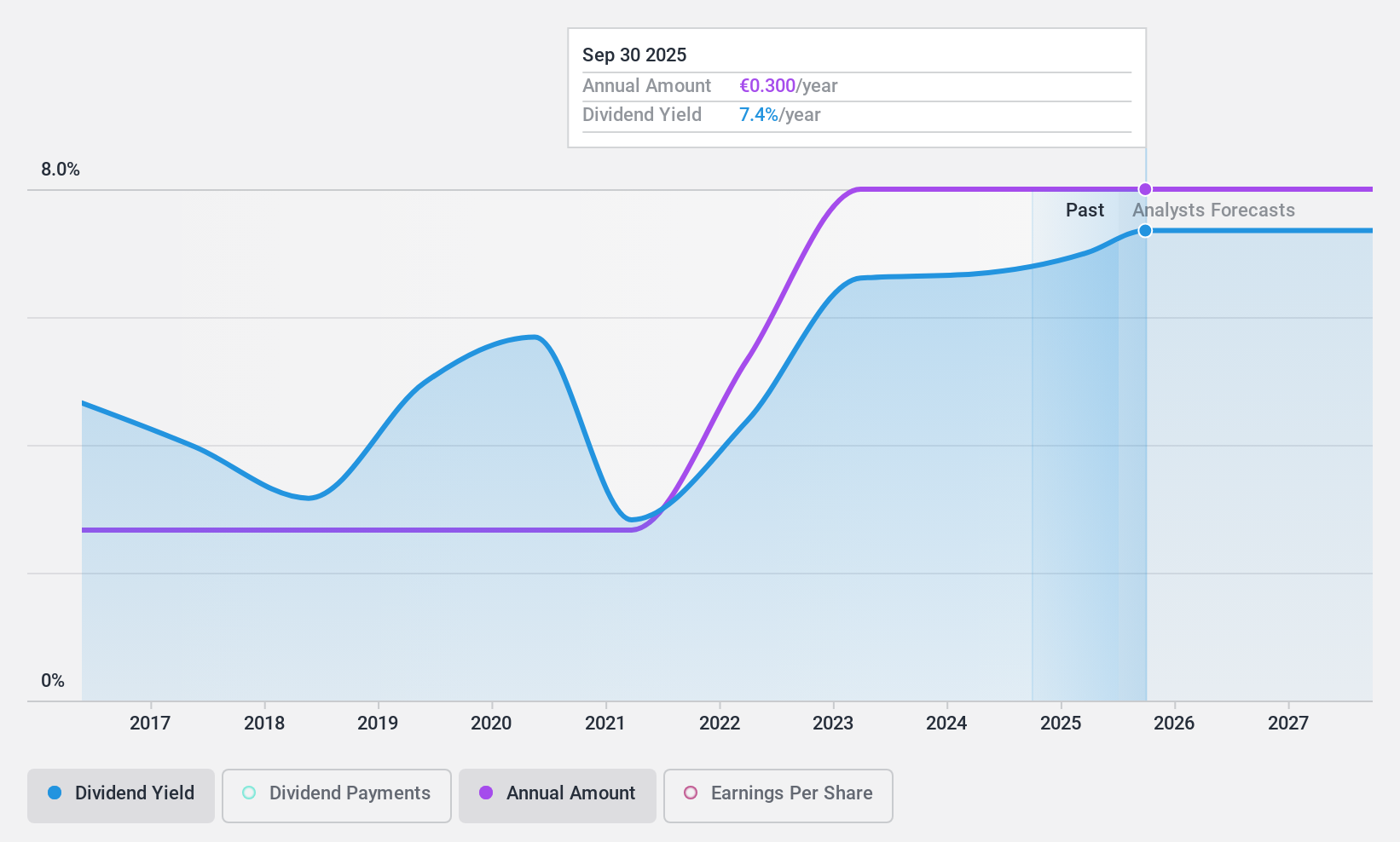

Edel SE KGaA (XTRA:EDL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Edel SE & Co. KGaA, with a market cap of €96.16 million, operates as an independent music company in Europe through its subsidiaries.

Operations: Edel SE & Co. KGaA generates its revenue through various segments, including music production, distribution services, and publishing activities across Europe.

Dividend Yield: 6.6%

Edel SE KGaA offers a high dividend yield of 6.64%, placing it among the top 25% in Germany. Its dividends have been reliable and stable over the past decade, with consistent growth and minimal volatility. The payout ratio of 52.7% suggests earnings coverage is adequate, though insufficient data prevents assessment of cash flow coverage. Trading significantly below estimated fair value, Edel presents a potentially attractive option for dividend-focused investors despite anticipated earnings decline.

- Click here to discover the nuances of Edel SE KGaA with our detailed analytical dividend report.

- The analysis detailed in our Edel SE KGaA valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1951 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edel SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EDL

Undervalued established dividend payer.

Market Insights

Community Narratives