As global markets navigate a landscape of economic shifts, including rate cuts from the ECB and SNB and expectations for a Fed cut, small-cap stocks have faced challenges with the Russell 2000 underperforming against larger indices like the S&P 500. Amidst these dynamics, discovering undervalued or overlooked stocks can offer intriguing opportunities for investors willing to explore beyond the mainstream, especially in sectors that might benefit from current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.86% | 6.39% | 4.69% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Huangshan NovelLtd (SZSE:002014)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huangshan Novel Co., Ltd is engaged in the manufacturing and sale of packaging materials both in China and internationally, with a market capitalization of CN¥6.38 billion.

Operations: Huangshan NovelLtd generates revenue primarily from the manufacturing and sale of packaging materials. The company has a market capitalization of CN¥6.38 billion, indicating its substantial presence in the industry.

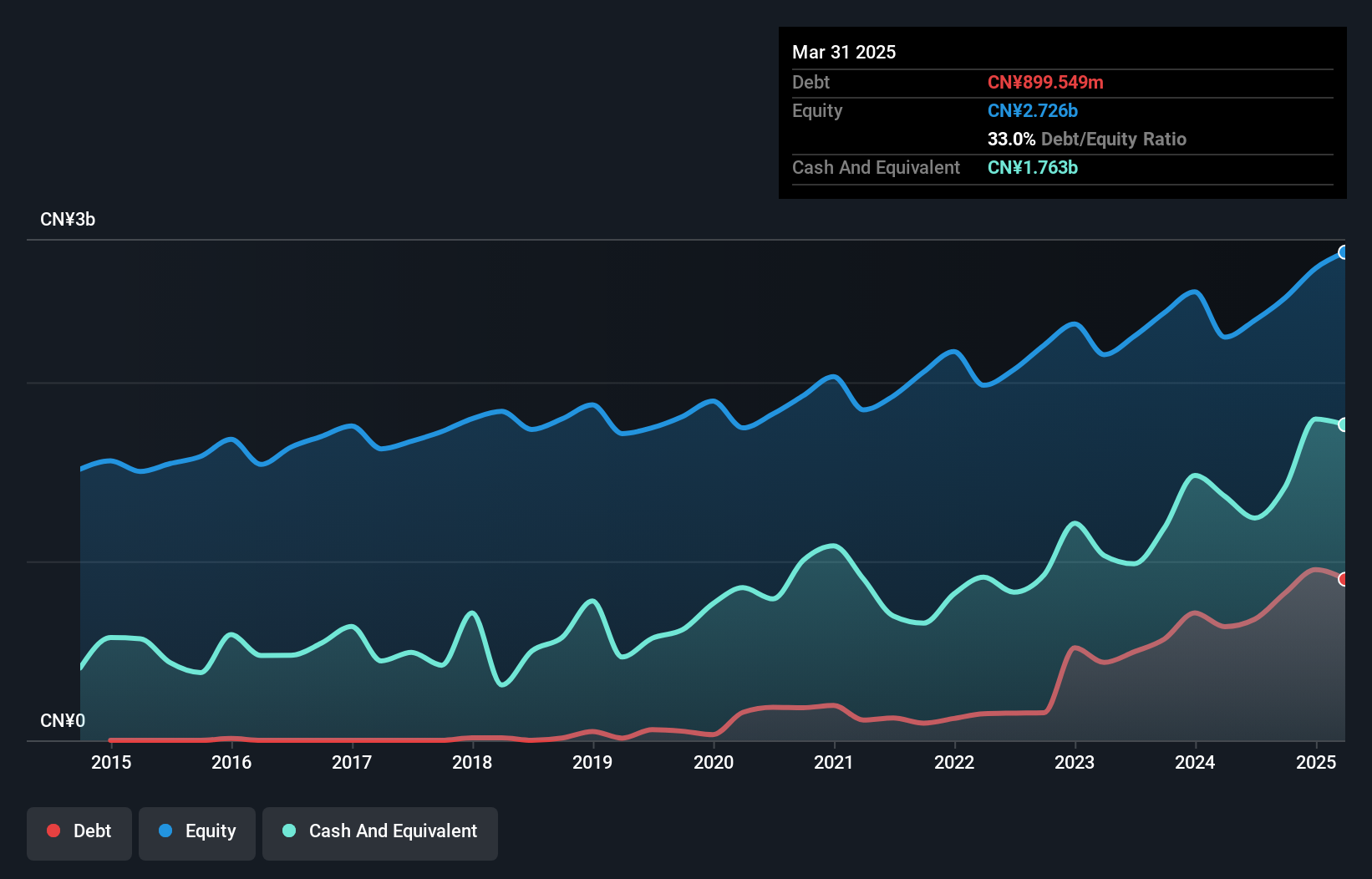

Huangshan NovelLtd, a compact player in its field, has shown consistent growth with earnings rising 10% annually over the last five years. Despite a debt-to-equity ratio climb from 2.8 to 33.3 over this period, the company holds more cash than total debt, suggesting financial stability. Recent earnings announcements highlight sales of CNY 2.54 billion and net income of CNY 304.84 million for nine months ending September 2024, indicating steady performance compared to the previous year’s figures of CNY 2.48 billion in sales and CNY 293 million in net income. Trading at about 15% below estimated fair value positions it as an attractive option for investors seeking potential undervaluation opportunities within its sector.

Jinsanjiang (Zhaoqing) Silicon Material (SZSE:301059)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jinsanjiang (Zhaoqing) Silicon Material Company Limited focuses on the research, development, production, and sale of precipitated silica with a market capitalization of CN¥2.76 billion.

Operations: Jinsanjiang (Zhaoqing) Silicon Material primarily generates revenue through the sale of precipitated silica. The company has a market capitalization of CN¥2.76 billion.

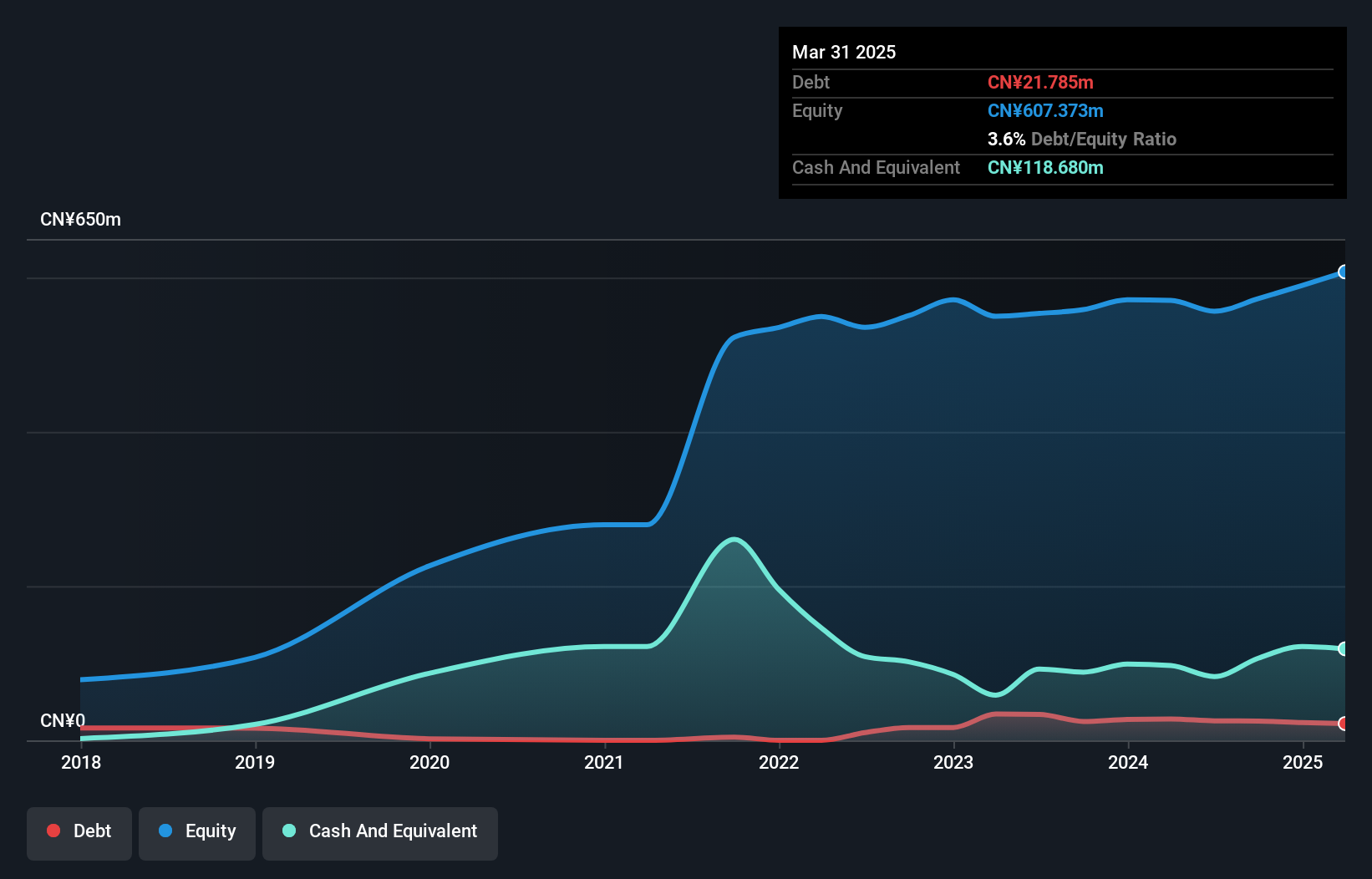

Jinsanjiang Silicon Material, a relatively small player in the chemicals sector, has shown resilience with a notable earnings growth of 17.1% over the past year, outpacing the industry's -4.7%. The company reported CNY 271.5 million in sales for nine months ending September 2024, up from CNY 195.4 million last year, while net income rose to CNY 37.67 million from CNY 22.2 million. Despite an increase in debt-to-equity ratio from 2.8% to 4.4% over five years, it holds more cash than total debt and generates positive free cash flow of US$62.93 million as of September 2024, indicating financial stability amidst market volatility.

TDC SOFT (TSE:4687)

Simply Wall St Value Rating: ★★★★★★

Overview: TDC SOFT Inc. is a Japanese company that offers IT consulting services, with a market capitalization of ¥67.79 billion.

Operations: The primary revenue stream for TDC SOFT comes from its System Development segment, generating ¥42.19 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

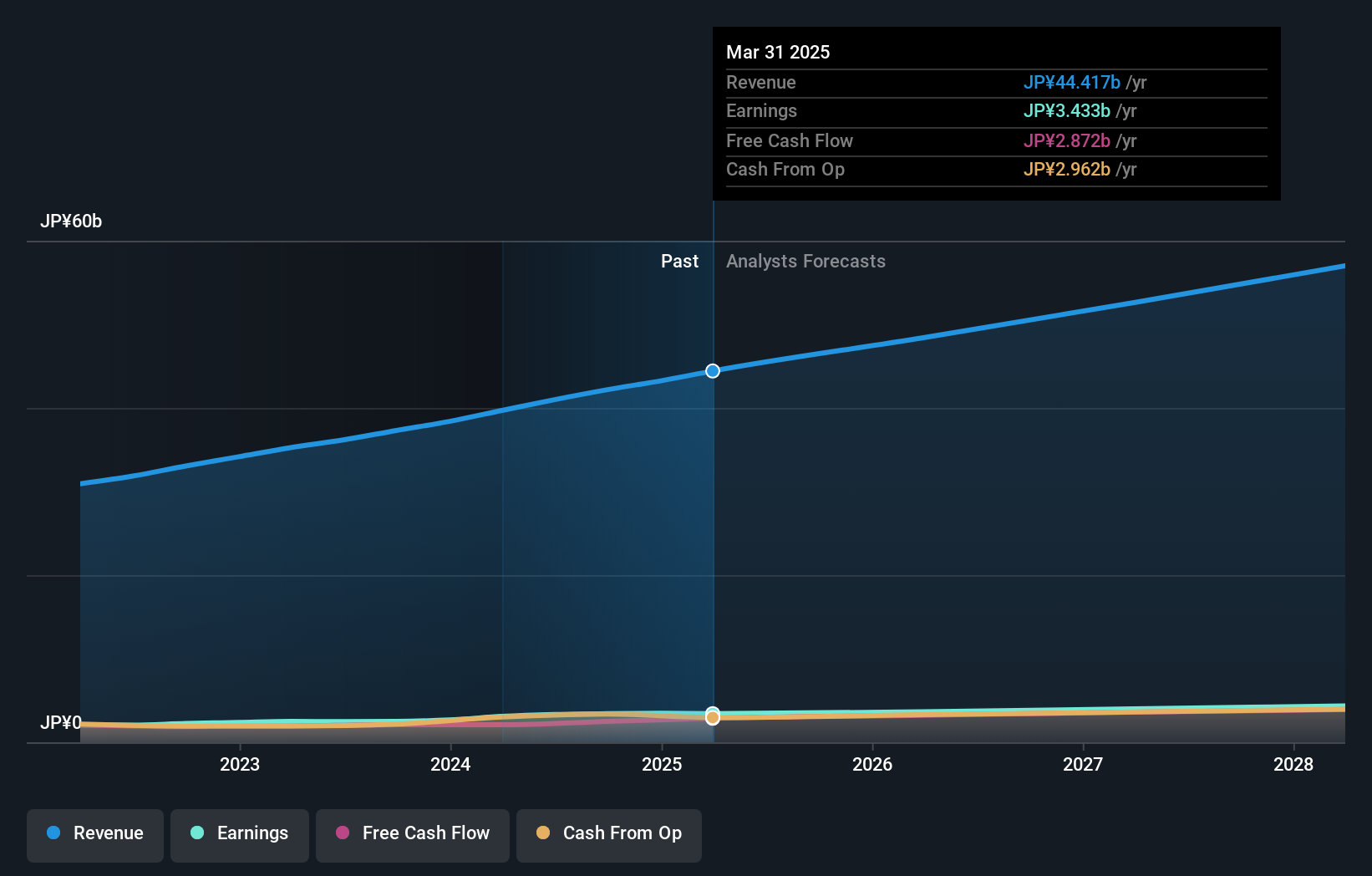

TDC SOFT, a nimble player in the IT sector, has shown impressive earnings growth of 37% over the past year, outpacing the industry average of 9.7%. The company is trading at a value 16% below its estimated fair value and boasts high-quality earnings. Its debt to equity ratio has improved from 4.8% to 3.2% over five years, indicating prudent financial management. Recently, TDC SOFT announced a dividend of ¥24 per share post-stock split for fiscal year ending March 2025 and forecasted net sales of ¥44 billion with an operating profit of ¥4.75 billion for the same period.

- Delve into the full analysis health report here for a deeper understanding of TDC SOFT.

Evaluate TDC SOFT's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4504 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301059

Jinsanjiang (Zhaoqing) Silicon Material

Engages in the research and development, production, and sale of precipitated silica.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives