As global markets navigate a landscape marked by steady interest rates and mixed economic signals, Asia presents a fertile ground for investors seeking opportunities in small-cap stocks. With economic indicators showing resilience in key Asian economies, the region offers potential gems that align well with current market conditions, where strategic selection based on growth potential and stability is paramount.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 7.78% | 15.50% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Donpon Precision | 38.56% | 0.47% | 48.37% | ★★★★★★ |

| AIC | 23.80% | 25.41% | 61.47% | ★★★★★★ |

| CHT Security | NA | 15.94% | 24.82% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 0.80% | 18.00% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Lungteh Shipbuilding | 55.17% | 28.09% | 42.33% | ★★★★★☆ |

| Kinpo Electronics | 99.44% | 5.80% | 41.38% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Billion Industrial Holdings (SEHK:2299)

Simply Wall St Value Rating: ★★★★★☆

Overview: Billion Industrial Holdings Limited, along with its subsidiaries, is engaged in the development, manufacturing, and sale of polyester filament yarns and related products both in China and internationally, with a market capitalization of approximately HK$10.15 billion.

Operations: Billion Industrial Holdings generates revenue primarily from the sale of polyester filament yarns and related products. The company's cost structure includes expenses associated with manufacturing and distribution, impacting its financial performance. Notably, it has reported varying net profit margins over recent periods, reflecting changes in operational efficiency and market conditions.

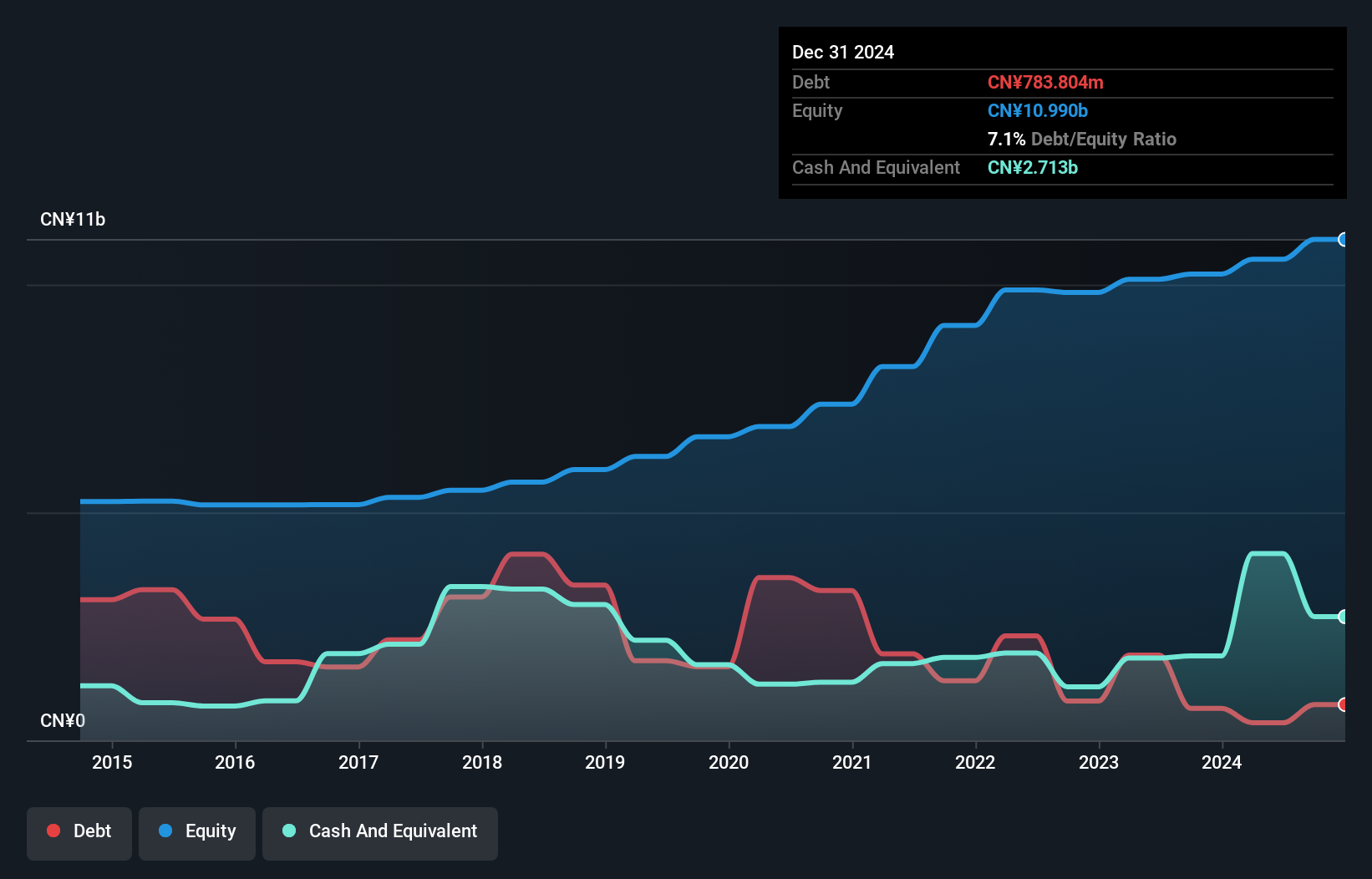

Billion Industrial Holdings, a noteworthy player in the textile sector, has shown impressive earnings growth of 111.6% over the past year, surpassing industry averages. Despite a decline in earnings by 14.4% per year over the last five years, recent performance suggests resilience and potential for recovery. Trading at 55.2% below its estimated fair value, it appears undervalued with well-covered interest payments at 7.3 times EBIT coverage and a satisfactory net debt to equity ratio of 4.9%. Recent board changes aim to enhance governance and diversity as the company expands into polyamide production with an investment plan worth RMB2.40 billion through 2027.

Jintuo Technology (SHSE:603211)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jintuo Technology Co., Ltd. specializes in the research, development, production, and sale of aluminum alloy precision die castings with a market capitalization of CN¥6.23 billion.

Operations: Jintuo Technology's revenue is primarily derived from the sale of aluminum alloy precision die castings. The company's market capitalization stands at CN¥6.23 billion.

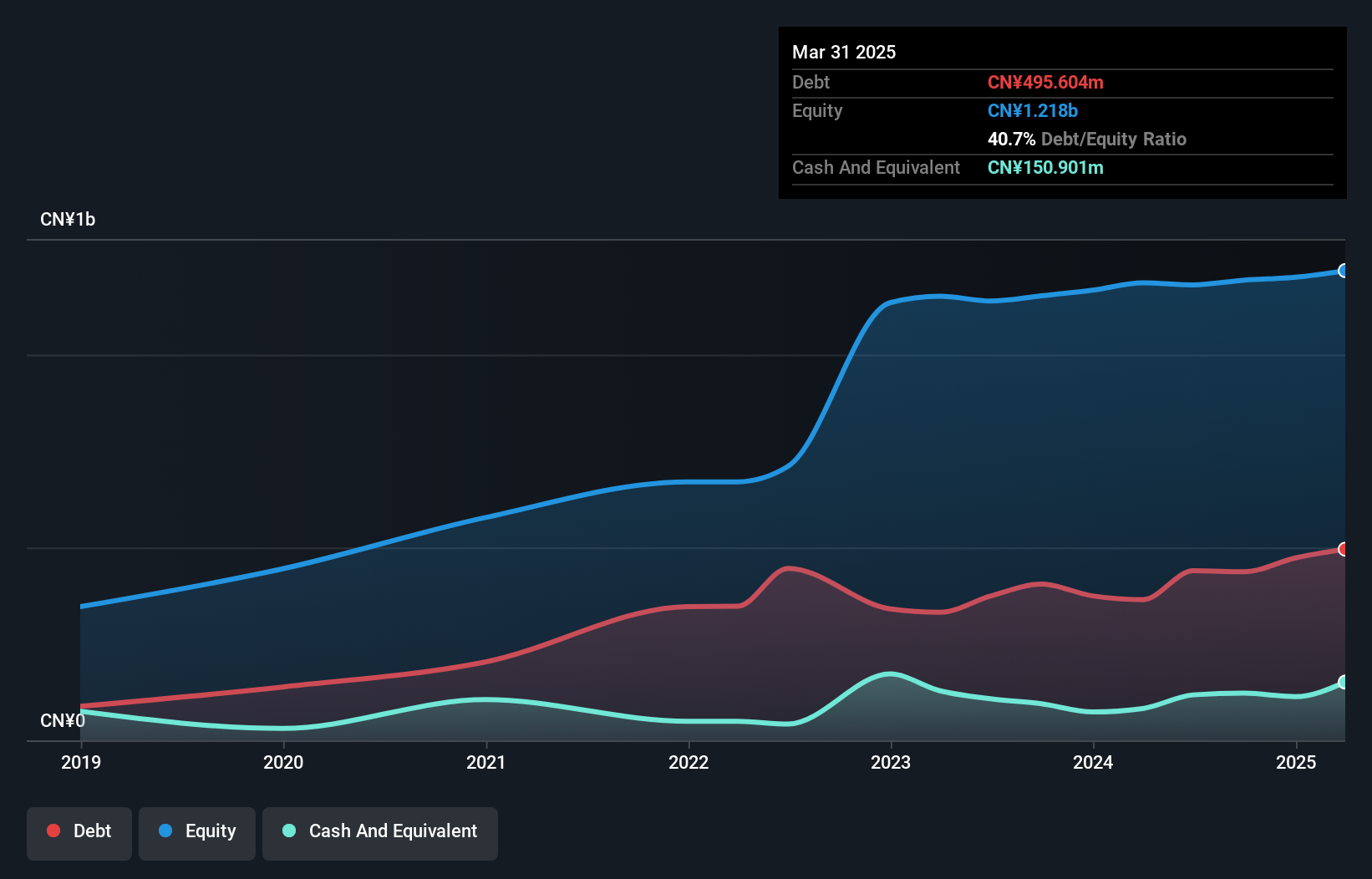

Jintuo Technology, a small player in the tech sector, has shown resilience with its earnings growing by 7.8% over the past year, outpacing the broader Metals and Mining industry, which saw a decline of 1.3%. The company's debt to equity ratio has risen from 29.9% to 36.6% over five years but remains satisfactory at a net debt to equity ratio of 26.4%. Despite recent share price volatility, Jintuo's interest payments are well covered by EBIT at a multiple of 5.8x, indicating robust financial health and potential for continued growth amidst industry challenges.

- Dive into the specifics of Jintuo Technology here with our thorough health report.

Explore historical data to track Jintuo Technology's performance over time in our Past section.

Huangshan NovelLtd (SZSE:002014)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huangshan Novel Co., Ltd specializes in the manufacturing and sale of packaging materials both within China and internationally, with a market capitalization of approximately CN¥7.32 billion.

Operations: Huangshan Novel Co., Ltd generates revenue through the manufacturing and sale of packaging materials, serving both domestic and international markets. The company has a market capitalization of approximately CN¥7.32 billion.

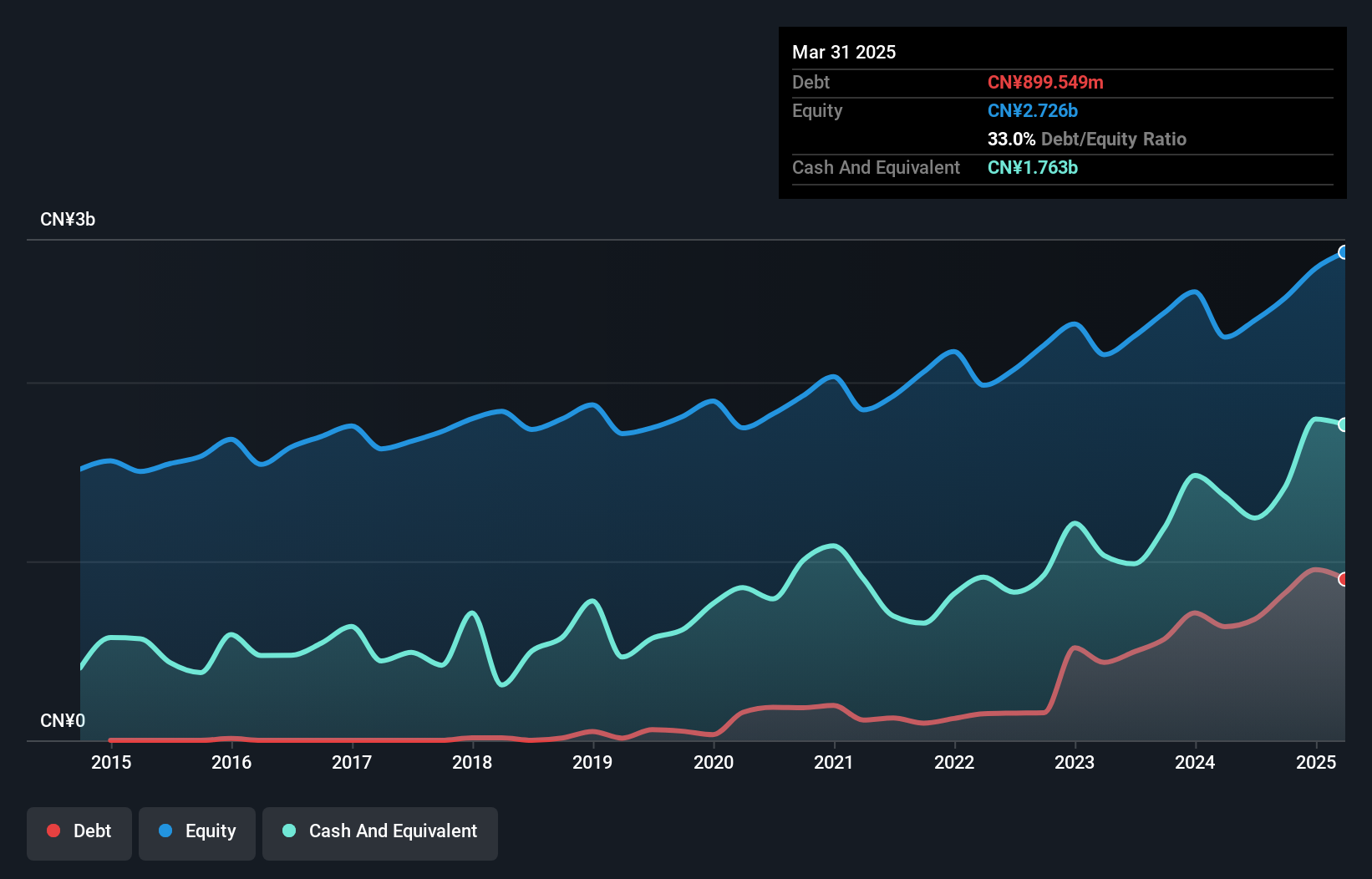

Huangshan NovelLtd, a promising player in the Asian market, has shown consistent earnings growth of 10% annually over five years. With a Price-To-Earnings ratio of 15.6x, it appears attractively valued against the broader CN market at 38.5x. Despite a notable rise in its debt to equity ratio from 1.7 to 36 over five years, interest coverage remains solid as it earns more interest than it pays. The company is free cash flow positive and recently proposed a dividend of CNY 6 per ten shares for fiscal year 2024, reflecting robust financial health and shareholder value focus.

- Get an in-depth perspective on Huangshan NovelLtd's performance by reading our health report here.

Examine Huangshan NovelLtd's past performance report to understand how it has performed in the past.

Make It Happen

- Click this link to deep-dive into the 2639 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Billion Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2299

Billion Industrial Holdings

Engages in manufacturing and sales of polyester filament yarns, polyester, polyester industrial yarns, and ES fiber products in the People’s Republic of China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives