Global markets have recently experienced a turbulent week, with U.S. stocks facing significant declines due to ongoing trade policy uncertainties and inflation concerns. Amidst this backdrop, investors often seek opportunities in less conventional areas of the market, such as penny stocks. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer unique growth potential when supported by strong financials and sound fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| NEXG Berhad (KLSE:DSONIC) | MYR0.26 | MYR723.36M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.38 | SGD9.4B | ★★★★★☆ |

| Lever Style (SEHK:1346) | HK$1.28 | HK$812.53M | ★★★★★★ |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.28 | MYR636.19M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.59 | A$79.72M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.72 | £423.13M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.85 | £283.45M | ★★★★☆☆ |

Click here to see the full list of 5,730 stocks from our Global Penny Stocks screener.

We'll examine a selection from our screener results.

Liaoning SG Automotive Group (SHSE:600303)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Liaoning SG Automotive Group Co., Ltd. manufactures and sells automobiles, axles, and other auto parts in China with a market cap of CN¥2.13 billion.

Operations: Revenue Segments: No specific revenue segments are reported.

Market Cap: CN¥2.13B

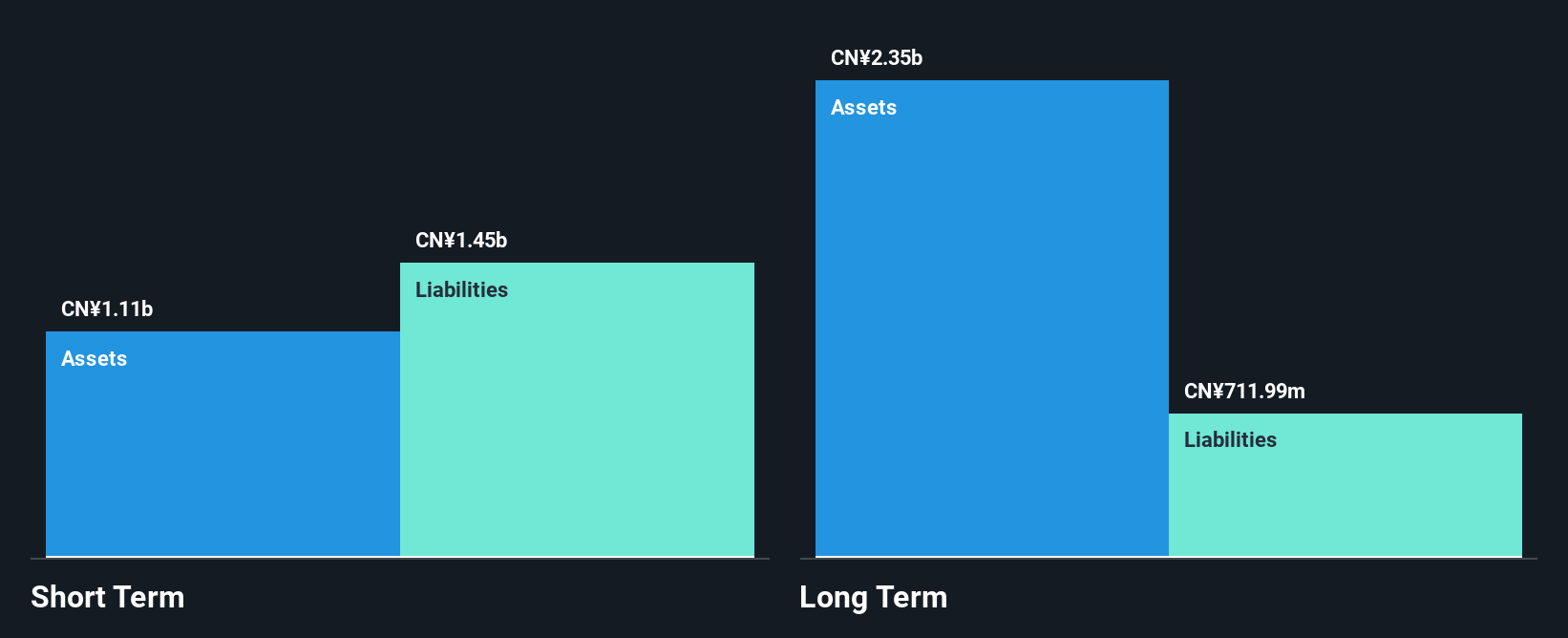

Liaoning SG Automotive Group, with a market cap of CN¥2.13 billion, faces challenges as it remains unprofitable and has seen its earnings decline by 43.9% annually over the past five years. Despite having short-term assets of CN¥1.1 billion, these do not cover its short-term liabilities of CN¥1.4 billion, though long-term liabilities are adequately covered. The company's debt to equity ratio is satisfactory at 33.9%, but it has increased over the last five years from 34.4% to 41%. A special shareholders meeting is scheduled for January 15, 2025, indicating potential strategic changes or developments ahead.

- Unlock comprehensive insights into our analysis of Liaoning SG Automotive Group stock in this financial health report.

- Assess Liaoning SG Automotive Group's previous results with our detailed historical performance reports.

Huapont Life SciencesLtd (SZSE:002004)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Huapont Life Sciences Co., Ltd. operates in the fields of medicine, medical care, agrochemicals, new materials, tourism, and other industries both in China and internationally with a market capitalization of CN¥7.71 billion.

Operations: No specific revenue segments are reported for Huapont Life Sciences Co., Ltd.

Market Cap: CN¥7.71B

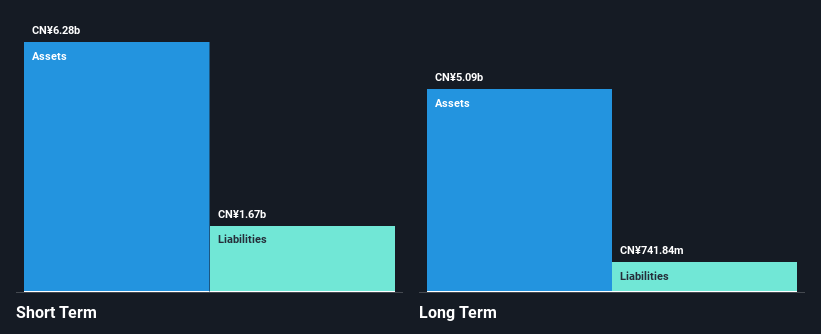

Huapont Life Sciences Co., Ltd., with a market capitalization of CN¥7.71 billion, presents a mixed picture for investors. The company's earnings grew by 12.6% over the past year, outperforming the Chemicals industry average decline of 5.4%. Despite this growth, its Return on Equity is low at 2.4%, and its operating cash flow does not adequately cover debt obligations, which are nonetheless well managed with a satisfactory net debt to equity ratio of 31%. Additionally, while the dividend yield stands at 5.56%, it is not well supported by earnings or free cash flows due to recent one-off losses impacting financial results.

- Dive into the specifics of Huapont Life SciencesLtd here with our thorough balance sheet health report.

- Explore historical data to track Huapont Life SciencesLtd's performance over time in our past results report.

Tianjin Chase Sun PharmaceuticalLtd (SZSE:300026)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tianjin Chase Sun Pharmaceutical Co., Ltd is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥10.63 billion.

Operations: No specific revenue segments are reported for Tianjin Chase Sun Pharmaceutical Co., Ltd.

Market Cap: CN¥10.63B

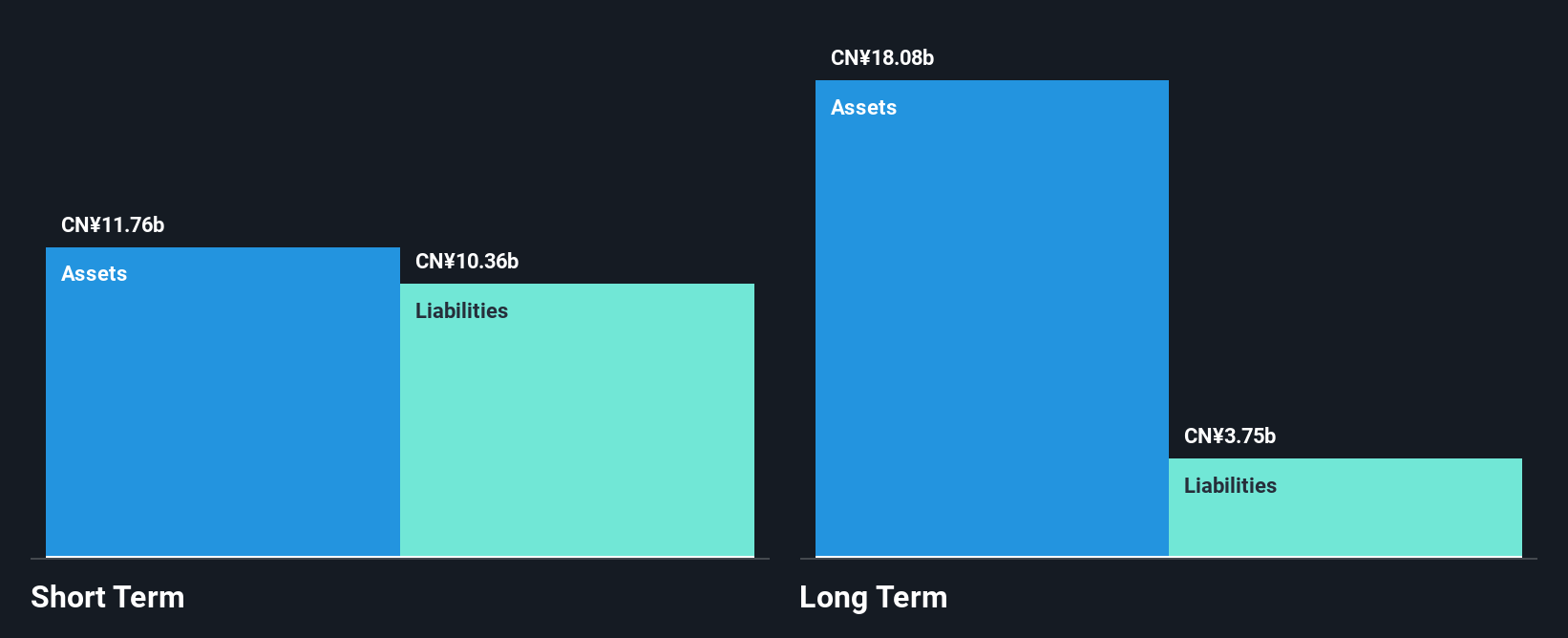

Tianjin Chase Sun Pharmaceutical Co., Ltd, with a market cap of CN¥10.63 billion, shows a complex investment landscape. Despite having substantial short-term assets exceeding both short and long-term liabilities, the company's earnings have declined significantly by 89.9% over the past year, which is below industry averages. The net profit margin has decreased to 0.9% from last year's 8.3%, and Return on Equity remains low at 0.6%. While debt is well covered by operating cash flow and cash exceeds total debt, interest coverage by EBIT is insufficient at 2.2x, raising concerns about financial stability despite trading below fair value estimates.

- Click here to discover the nuances of Tianjin Chase Sun PharmaceuticalLtd with our detailed analytical financial health report.

- Evaluate Tianjin Chase Sun PharmaceuticalLtd's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Discover the full array of 5,730 Global Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Chase Sun PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300026

Tianjin Chase Sun PharmaceuticalLtd

Engages in the research and development, production, and sale of various pharmaceutical products in China and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives