- Japan

- /

- Trade Distributors

- /

- TSE:8066

Discovering May 2025's Undiscovered Gems in Global Stocks

Reviewed by Simply Wall St

As global markets navigate through volatility, with small- and mid-cap indexes facing significant declines amid tariff threats and fiscal concerns, investors are keenly observing economic indicators for signs of stability. Despite these challenges, the recent rebound in U.S. business activity suggests potential opportunities for discerning investors willing to explore beyond the well-trodden paths. In such a dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience and adaptability in uncertain market conditions. This article aims to uncover three lesser-known stocks that may offer unique growth prospects amid the current global economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AIC | NA | 26.88% | 54.47% | ★★★★★★ |

| YAPP Automotive Systems | 1.38% | -1.99% | -0.31% | ★★★★★★ |

| Ampire | NA | -2.21% | 8.00% | ★★★★★★ |

| Zhejiang JW Precision MachineryLtd | 12.36% | 4.29% | -22.66% | ★★★★★★ |

| Kangping Technology (Suzhou) | 23.90% | 1.60% | 16.23% | ★★★★★☆ |

| Jiangsu Rainbow Heavy Industries | 21.06% | 21.85% | -4.03% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Hangzhou Zhengqiang | 26.03% | 2.95% | 16.75% | ★★★★★☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

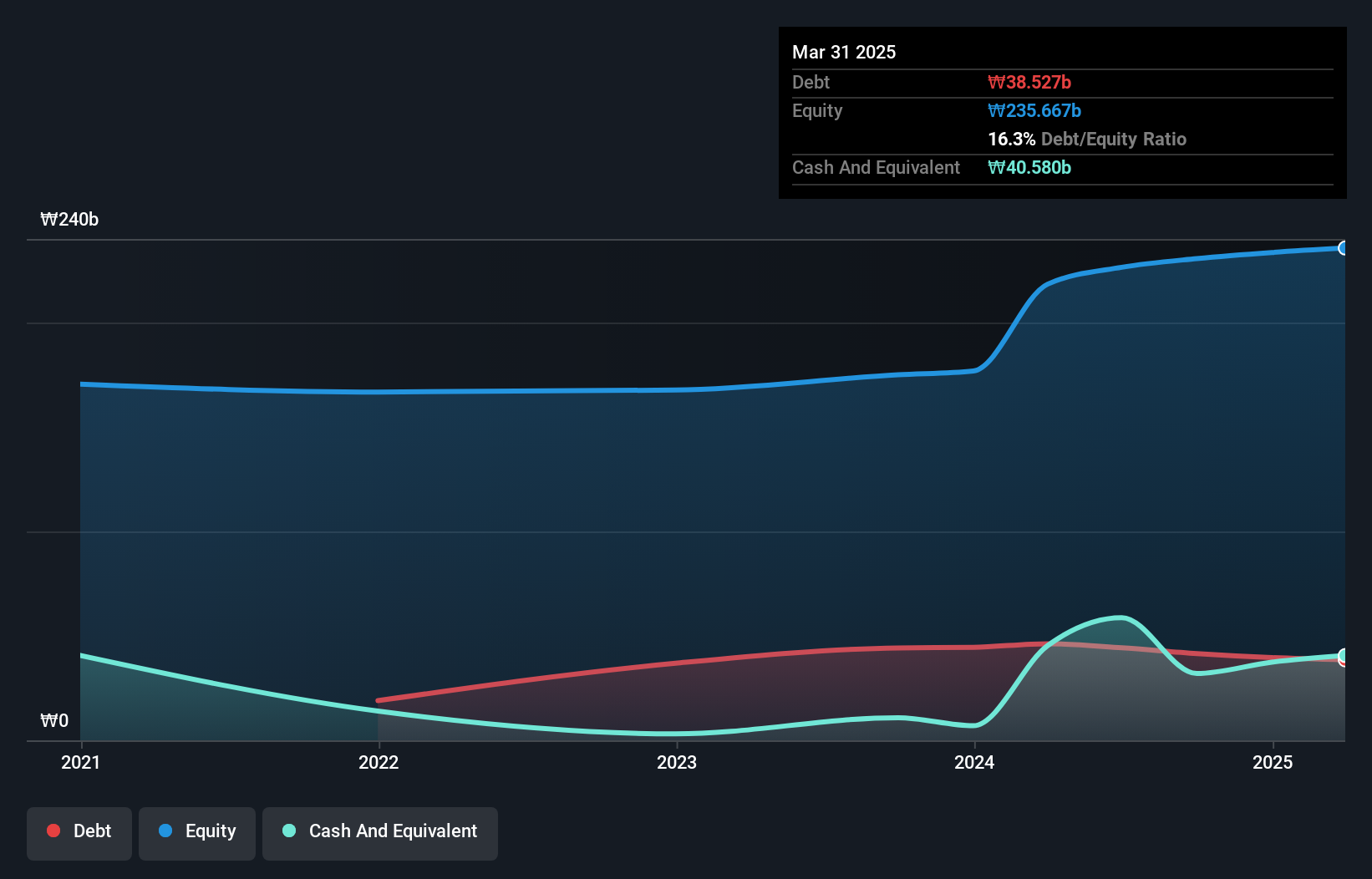

Hyundai Hyms (KOSDAQ:A460930)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai Hyms Co., Ltd. is a South Korean company that focuses on manufacturing and selling shipbuilding equipment, with a market capitalization of ₩621 billion.

Operations: Hyundai Hyms generates revenue primarily from its shipbuilding segment, amounting to ₩226.42 billion. The company's market capitalization stands at ₩621 billion.

Hyundai Hyms, a smaller player in the machinery sector, has showcased impressive financial resilience. The company's earnings surged by 47% over the past year, outpacing the industry's modest 2.6% growth. With its interest payments comfortably covered by EBIT at a ratio of 12.5 times, Hyundai Hyms demonstrates robust financial health. Additionally, it trades at approximately 4% below its estimated fair value and boasts high-quality earnings while holding more cash than debt on its books. Despite recent share price volatility, these factors paint a promising picture for this under-the-radar contender in machinery manufacturing.

- Take a closer look at Hyundai Hyms' potential here in our health report.

Examine Hyundai Hyms' past performance report to understand how it has performed in the past.

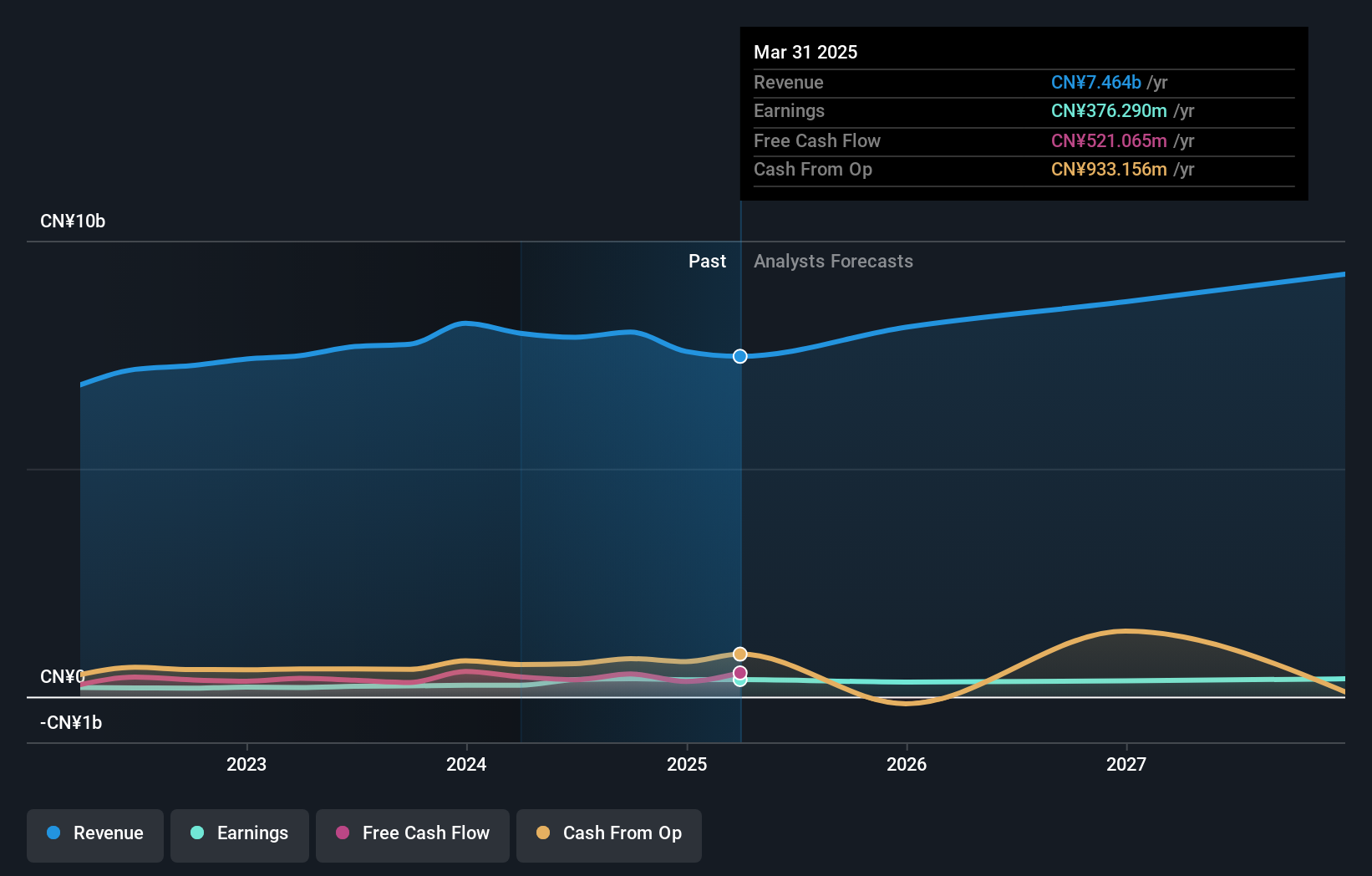

Advanced Technology & Materials (SZSE:000969)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Technology & Materials Co., Ltd. operates in the advanced materials industry and has a market capitalization of approximately CN¥13.28 billion.

Operations: The company generates revenue primarily from its Metal Materials and Products segment, which reported earnings of CN¥7.46 billion.

Advanced Technology & Materials, a compact player in its field, is making waves with notable financial metrics. Its earnings surged by 49.7% last year, outpacing the broader Metals and Mining sector's -3.9%. Trading at 43.4% below estimated fair value suggests potential upside for investors eyeing undervalued opportunities. The company's debt-to-equity ratio has impressively decreased from 27.4% to 13% over five years, indicating prudent financial management. With net income rising to CNY 82 million in Q1 2025 from CNY 79 million a year earlier and maintaining positive free cash flow, this entity showcases both growth and stability amidst industry challenges.

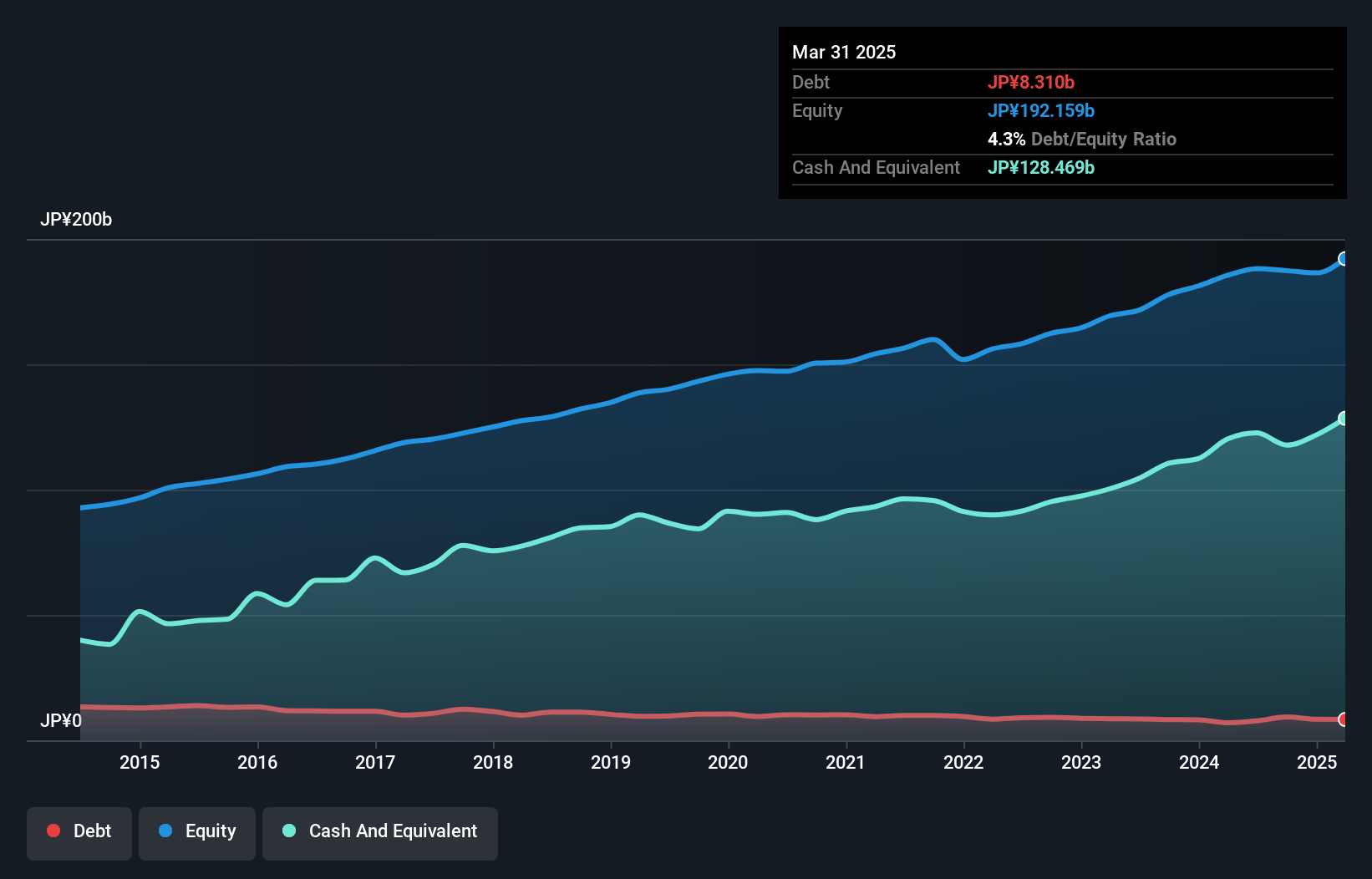

Mitani (TSE:8066)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitani Corporation operates in the information system, construction, and energy sectors both in Japan and internationally, with a market cap of ¥169.81 billion.

Operations: Mitani Corporation derives its revenue primarily from the information system, construction, and energy sectors. The company's financial performance is influenced by its diverse operational segments across Japan and international markets.

Mitani, a smaller player in the market, has shown promising financial health with earnings growing at 13% annually over the past five years. Despite not outpacing its industry peers recently, it trades at a notable 25% below estimated fair value. The company's debt-to-equity ratio has improved from 6.4 to 4.3, indicating better leverage management. Additionally, Mitani's ability to cover interest payments comfortably and maintain high-quality earnings reflects its robust operational framework. With free cash flow remaining positive and more cash than total debt on hand, Mitani seems well-positioned for sustainable growth in its sector.

Turning Ideas Into Actions

- Embark on your investment journey to our 3177 Global Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8066

Mitani

Engages in the information systems, construction materials, energy, lifestyle-related business and development business in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives