- China

- /

- Metals and Mining

- /

- SZSE:000962

There's Reason For Concern Over Ningxia Orient Tantalum Industry Co., Ltd.'s (SZSE:000962) Massive 30% Price Jump

Those holding Ningxia Orient Tantalum Industry Co., Ltd. (SZSE:000962) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

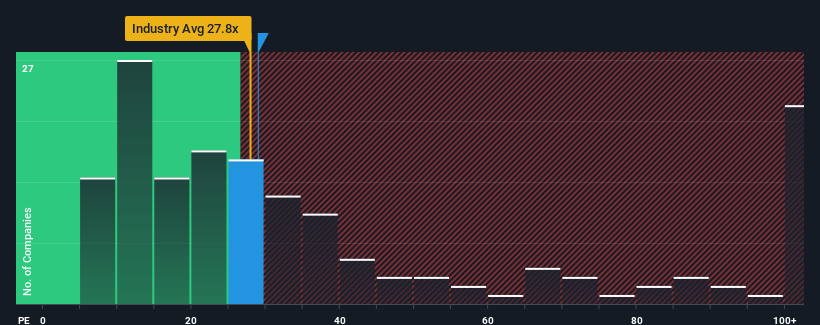

In spite of the firm bounce in price, there still wouldn't be many who think Ningxia Orient Tantalum Industry's price-to-earnings (or "P/E") ratio of 28.9x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Ningxia Orient Tantalum Industry has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Ningxia Orient Tantalum Industry

Is There Some Growth For Ningxia Orient Tantalum Industry?

In order to justify its P/E ratio, Ningxia Orient Tantalum Industry would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 4.9% gain to the company's bottom line. Pleasingly, EPS has also lifted 227% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 21% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

In light of this, it's curious that Ningxia Orient Tantalum Industry's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Ningxia Orient Tantalum Industry's P/E

Its shares have lifted substantially and now Ningxia Orient Tantalum Industry's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Ningxia Orient Tantalum Industry's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Ningxia Orient Tantalum Industry, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Orient Tantalum Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000962

Ningxia Orient Tantalum Industry

Ningxia Orient Tantalum Industry Co., Ltd.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives