- China

- /

- Metals and Mining

- /

- SZSE:000762

Tibet Mineral Development Co., LTD's (SZSE:000762) P/E Is Still On The Mark Following 40% Share Price Bounce

Tibet Mineral Development Co., LTD (SZSE:000762) shareholders have had their patience rewarded with a 40% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 9.8% isn't as attractive.

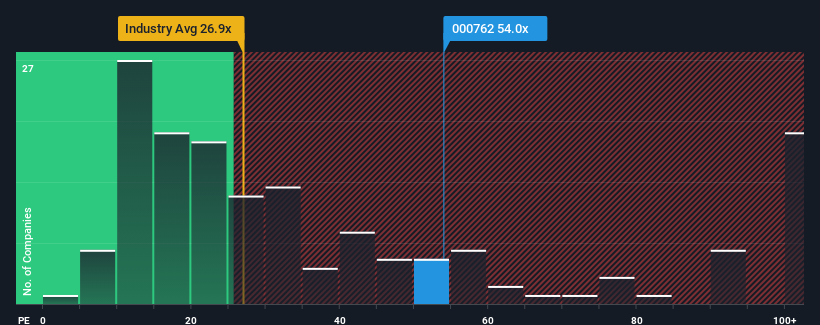

After such a large jump in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 33x, you may consider Tibet Mineral Development as a stock to avoid entirely with its 54x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Tibet Mineral Development's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Tibet Mineral Development

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Tibet Mineral Development would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. Even so, admirably EPS has lifted 889% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Tibet Mineral Development is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Tibet Mineral Development's P/E?

Shares in Tibet Mineral Development have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Tibet Mineral Development revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Tibet Mineral Development with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000762

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives