- China

- /

- Metals and Mining

- /

- SZSE:000758

Investors Still Waiting For A Pull Back In China Nonferrous Metal Industry's Foreign Engineering and Construction Co.,Ltd. (SZSE:000758)

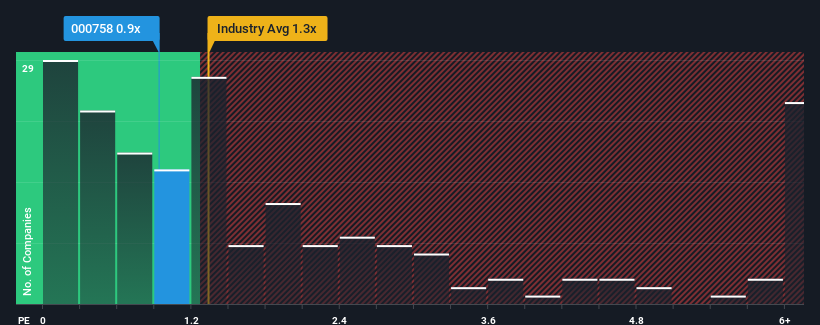

It's not a stretch to say that China Nonferrous Metal Industry's Foreign Engineering and Construction Co.,Ltd.'s (SZSE:000758) price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in China, where the median P/S ratio is around 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd's P/S Mean For Shareholders?

China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. Pleasingly, revenue has also lifted 47% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 14% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000758

China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd

Engages in the project contracting and mineral resource development in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success