Hefei Fengle Seed Co.,Ltd's (SZSE:000713) Price Is Right But Growth Is Lacking

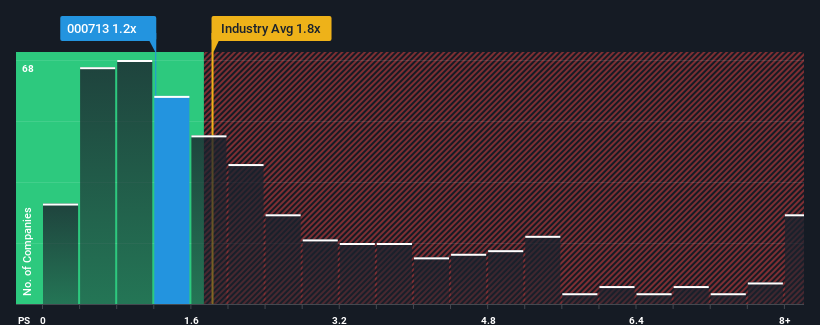

You may think that with a price-to-sales (or "P/S") ratio of 1.2x Hefei Fengle Seed Co.,Ltd (SZSE:000713) is a stock worth checking out, seeing as almost half of all the Chemicals companies in China have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Hefei Fengle SeedLtd

What Does Hefei Fengle SeedLtd's Recent Performance Look Like?

Recent revenue growth for Hefei Fengle SeedLtd has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Hefei Fengle SeedLtd will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Hefei Fengle SeedLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Hefei Fengle SeedLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 21% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 9.2% over the next year. With the industry predicted to deliver 24% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Hefei Fengle SeedLtd's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Hefei Fengle SeedLtd's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hefei Fengle SeedLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Hefei Fengle SeedLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Fengle SeedLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000713

Hefei Fengle SeedLtd

Engages in the research, development, production, and sale of seeds, agrochemicals, and spices in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives