Shenyang Chemical Industry (SZSE:000698 shareholders incur further losses as stock declines 11% this week, taking three-year losses to 41%

Shenyang Chemical Industry Co., Ltd. (SZSE:000698) shareholders should be happy to see the share price up 16% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 41% in the last three years, significantly under-performing the market.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Shenyang Chemical Industry

Shenyang Chemical Industry wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

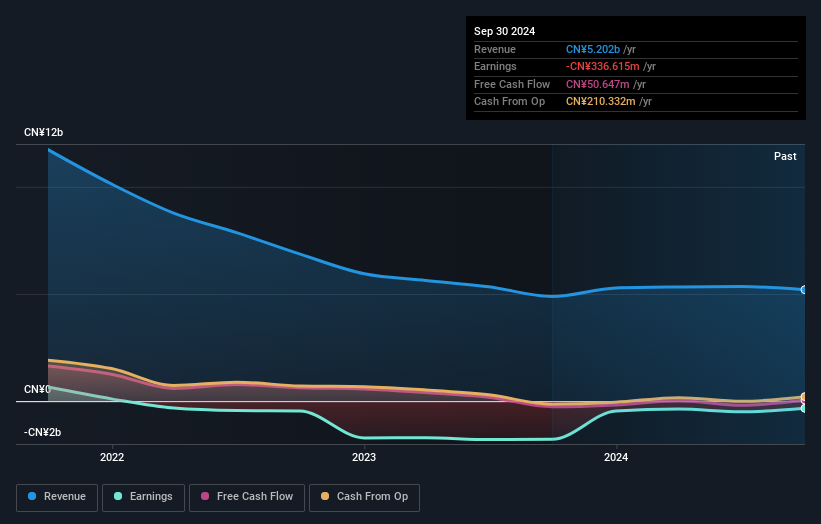

Over the last three years, Shenyang Chemical Industry's revenue dropped 29% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 12% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Shenyang Chemical Industry's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Shenyang Chemical Industry shareholders are down 18% for the year, but the market itself is up 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 0.5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Shenyang Chemical Industry you should be aware of.

But note: Shenyang Chemical Industry may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000698

Shenyang Chemical Industry

Provides chlor-alkali chemicals, petrochemicals, and chemical materials in China and internationally.

Adequate balance sheet and slightly overvalued.