As of May 2024, the Chinese market has shown resilience with modest gains in major indices despite ongoing challenges in the real estate sector and mixed signals from economic indicators. This backdrop sets an interesting stage for investors looking at dividend stocks, which can offer potential income stability amidst market fluctuations. In considering dividend stocks, it's important to focus on companies with robust financial health and a history of consistent dividend payments, especially in a market environment where economic recovery is uneven.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.04% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.59% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.01% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.22% | ★★★★★★ |

| Jiangsu Yanghe Brewery (SZSE:002304) | 4.83% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.11% | ★★★★★★ |

| Changchun High-Tech Industry (Group) (SZSE:000661) | 3.90% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.20% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.30% | ★★★★★★ |

Click here to see the full list of 178 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Industrial Bank (SHSE:601166)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial Bank Co., Ltd. offers a range of banking services across the People's Republic of China, with a market capitalization of approximately CN¥377.68 billion.

Operations: Industrial Bank Co., Ltd. generates revenue primarily through its commercial banking segment, which amounted to CN¥146.34 billion.

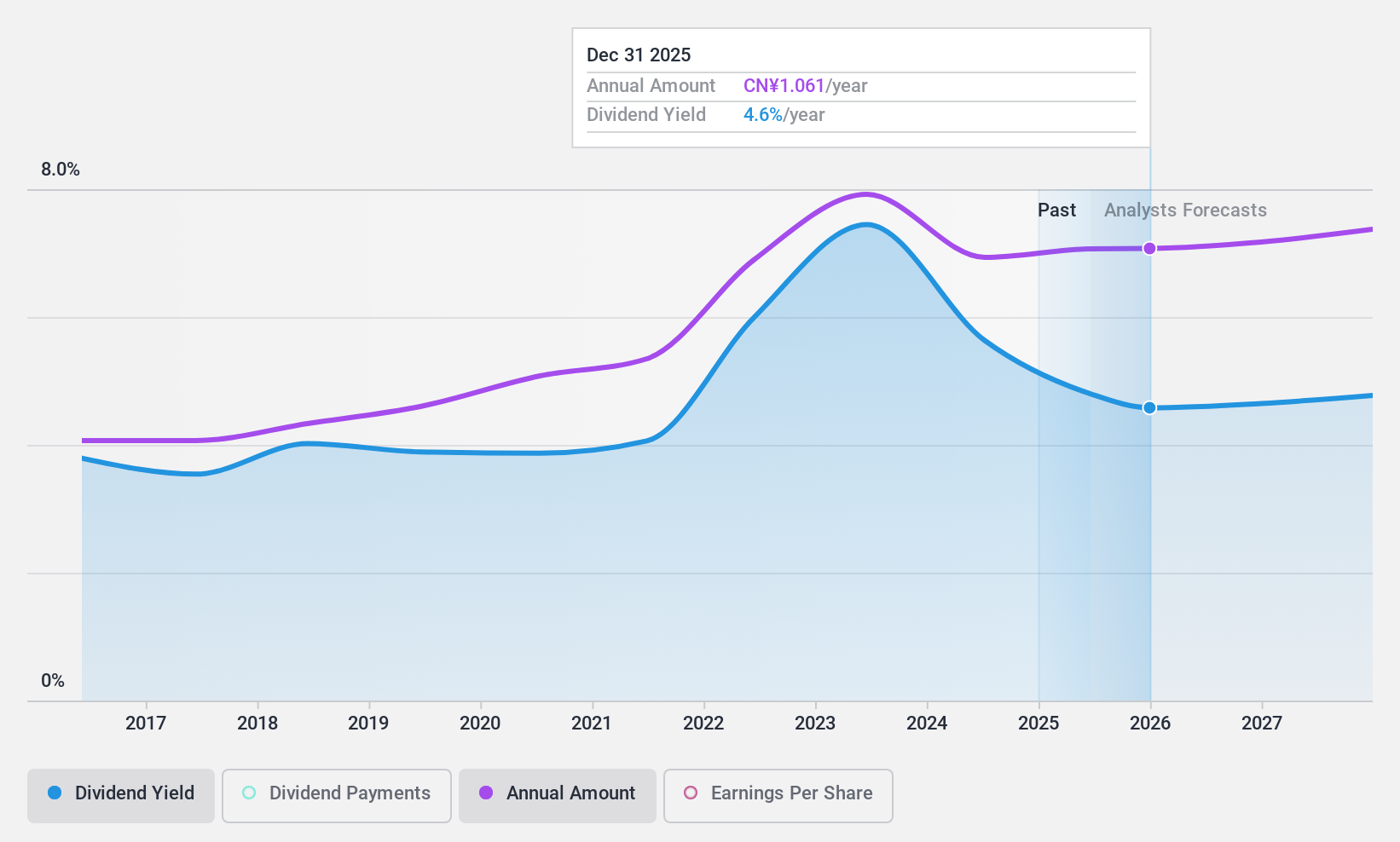

Dividend Yield: 5.7%

Industrial Bank Co., Ltd. offers a dividend yield of 5.72%, placing it in the top 25% of dividend payers in the Chinese market. Despite this, its dividends have shown volatility over the past decade, reflecting an unstable track record. However, its current and forecasted payout ratios (30% and 29.8%, respectively) suggest that dividends are well covered by earnings. Recent financials indicate a slight decline with net income dropping from CNY 91,377 million in 2023 to CNY 77,116 million by year-end and further to CNY 24,336 million in Q1 2024.

- Click here to discover the nuances of Industrial Bank with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Industrial Bank is priced lower than what may be justified by its financials.

Shanxi Lu'an Environmental Energy Development (SHSE:601699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanxi Lu'an Environmental Energy Development Co., Ltd. is a company engaged in coal production and electric power generation, with a market capitalization of approximately CN¥70.60 billion.

Operations: Shanxi Lu'an Environmental Energy Development Co., Ltd. generates its revenue primarily from coal production and electric power generation.

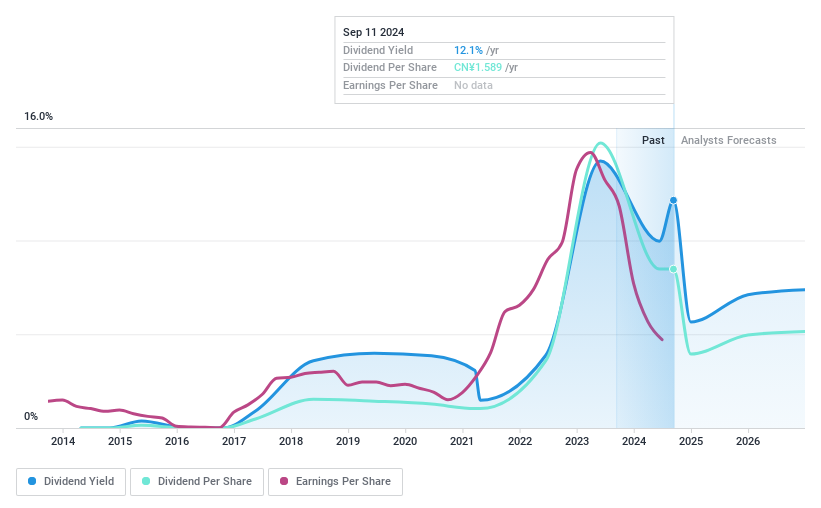

Dividend Yield: 6.7%

Shanxi Lu'an Environmental Energy Development's dividend yield of 6.73% ranks well in China, but its history of dividend payments is marked by inconsistency over the past nine years. The company's dividends are currently supported by earnings and cash flows, with payout ratios at 81.5% and 72.7%, respectively. Recent financial reports show a significant drop in revenue and net income for Q1 2024, with sales falling to CNY 8.66 billion from CNY 11.89 billion year-over-year, and net income decreasing to CNY 1.29 billion from CNY 3.38 billion, impacting its financial stability.

- Click to explore a detailed breakdown of our findings in Shanxi Lu'an Environmental Energy Development's dividend report.

- Our expertly prepared valuation report Shanxi Lu'an Environmental Energy Development implies its share price may be lower than expected.

Inner Mongolia Yuan Xing Energy (SZSE:000683)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia Yuan Xing Energy Company Limited operates in various sectors including soda ash, methanol, fertilizer, and agricultural production materials across China, with a market capitalization of approximately CN¥29.22 billion.

Operations: Inner Mongolia Yuan Xing Energy Company Limited generates its revenue primarily from the production and sale of soda ash, methanol, and fertilizers in China.

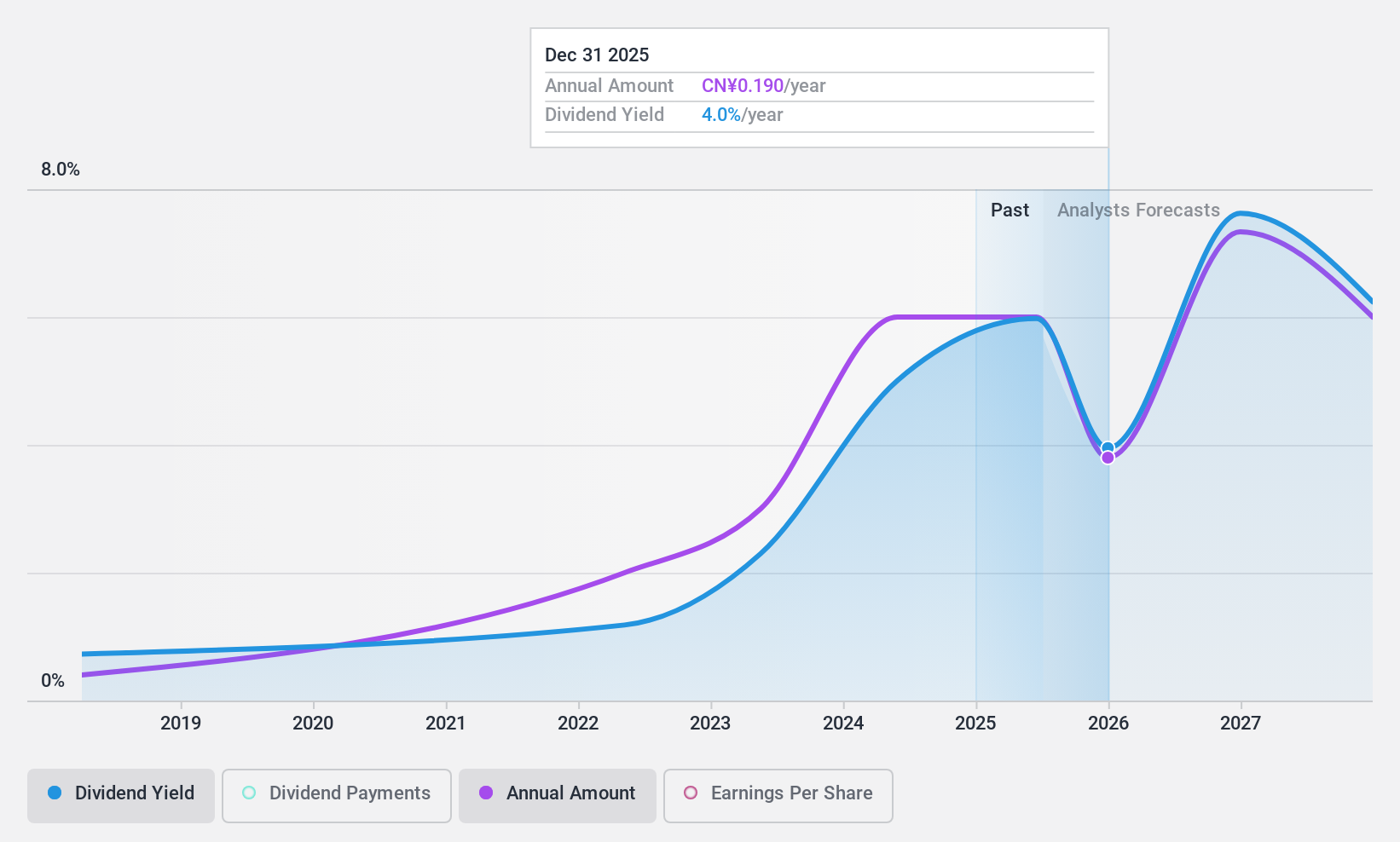

Dividend Yield: 3.7%

Inner Mongolia Yuan Xing Energy reported a Q1 2024 revenue increase to CNY 3.28 billion from CNY 2.50 billion year-over-year, although net income decreased to CNY 569.08 million from CNY 651.89 million. The company offers a dividend yield of 3.71%, among the top quartile in China, yet its dividends have been inconsistent and not well-supported by cash flows or earnings, with a payout ratio of 82.8%. The stock's price-to-earnings ratio at 22x is below the market average, suggesting relative value despite concerns over dividend sustainability and financial impacts from one-off items.

- Dive into the specifics of Inner Mongolia Yuan Xing Energy here with our thorough dividend report.

- Our valuation report unveils the possibility Inner Mongolia Yuan Xing Energy's shares may be trading at a discount.

Key Takeaways

- Click through to start exploring the rest of the 175 Top Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601166

Industrial Bank

Provides banking services in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.