Zhuhai Zhongfu Enterprise Co.,Ltd's (SZSE:000659) Shares Climb 28% But Its Business Is Yet to Catch Up

Zhuhai Zhongfu Enterprise Co.,Ltd (SZSE:000659) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 46% over that time.

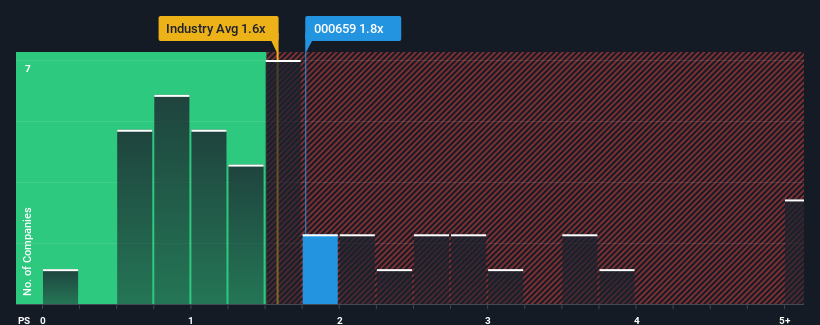

Even after such a large jump in price, it's still not a stretch to say that Zhuhai Zhongfu EnterpriseLtd's price-to-sales (or "P/S") ratio of 1.8x right now seems quite "middle-of-the-road" compared to the Packaging industry in China, where the median P/S ratio is around 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Zhuhai Zhongfu EnterpriseLtd

How Zhuhai Zhongfu EnterpriseLtd Has Been Performing

As an illustration, revenue has deteriorated at Zhuhai Zhongfu EnterpriseLtd over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhuhai Zhongfu EnterpriseLtd will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Zhuhai Zhongfu EnterpriseLtd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Zhuhai Zhongfu EnterpriseLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.0%. As a result, revenue from three years ago have also fallen 7.9% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's somewhat alarming that Zhuhai Zhongfu EnterpriseLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Key Takeaway

Zhuhai Zhongfu EnterpriseLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Zhuhai Zhongfu EnterpriseLtd revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Zhuhai Zhongfu EnterpriseLtd, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai Zhongfu EnterpriseLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000659

Zhuhai Zhongfu EnterpriseLtd

Researches, develops, manufactures, and sells PET beverage packaging materials in China.

Imperfect balance sheet and overvalued.

Market Insights

Community Narratives