- South Korea

- /

- Machinery

- /

- KOSE:A010140

Global's November 2025 Stock Picks For Estimated Value Opportunities

Reviewed by Simply Wall St

As global markets face a mix of challenges, including a record low in U.S. consumer sentiment and heightened scrutiny over AI spending, investors are increasingly focused on identifying undervalued stocks that may offer potential value opportunities. In this environment, a good stock is often characterized by strong fundamentals and resilience to broader market fluctuations, making it an attractive consideration for those seeking value amid current uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimicron Technology (TWSE:3037) | NT$179.00 | NT$355.74 | 49.7% |

| Truecaller (OM:TRUE B) | SEK25.44 | SEK50.66 | 49.8% |

| TESEC (TSE:6337) | ¥2077.00 | ¥4140.39 | 49.8% |

| Nichicon (TSE:6996) | ¥1290.00 | ¥2567.83 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK126.60 | 49.9% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥9.99 | CN¥19.91 | 49.8% |

| IbidenLtd (TSE:4062) | ¥13690.00 | ¥27289.49 | 49.8% |

| EROAD (NZSE:ERD) | NZ$1.59 | NZ$3.15 | 49.5% |

| Doxee (BIT:DOX) | €3.75 | €7.43 | 49.5% |

| Atea (OB:ATEA) | NOK150.60 | NOK300.13 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates globally in shipbuilding, offshore, and energy and infrastructure sectors with a market cap of ₩22.42 trillion.

Operations: The company's revenue segments include Shipbuilding & Marine Engineering at ₩9.89 trillion and Construction at ₩513.68 billion.

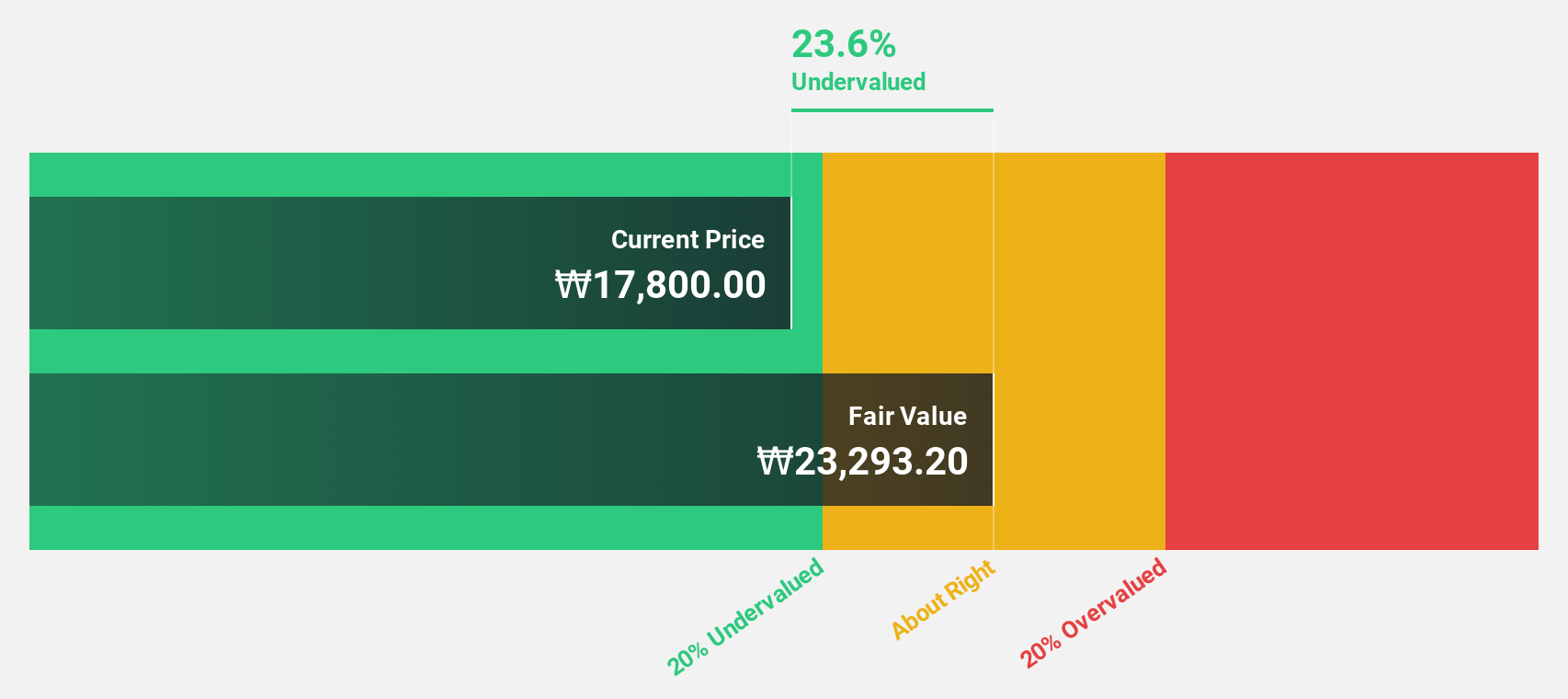

Estimated Discount To Fair Value: 29.4%

Samsung Heavy Industries is trading at ₩26,475, significantly below its estimated fair value of ₩37,489.31, indicating potential undervaluation. With earnings expected to grow substantially and faster than the Korean market's average, the company shows promising cash flow potential despite its high debt levels. Recent strategic alliances in AI data centers and shipbuilding highlight efforts to enhance technological capabilities and operational efficiency, which may positively impact future cash flows.

- In light of our recent growth report, it seems possible that Samsung Heavy Industries' financial performance will exceed current levels.

- Navigate through the intricacies of Samsung Heavy Industries with our comprehensive financial health report here.

Camurus (OM:CAMX)

Overview: Camurus AB is a biopharmaceutical company that develops and commercializes medicines for severe and chronic diseases across Europe, Africa, the Middle East, North America, and Asia, with a market cap of SEK36.42 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for Camurus AB. If you have additional information on their revenue segments, I would be happy to help summarize it for you.

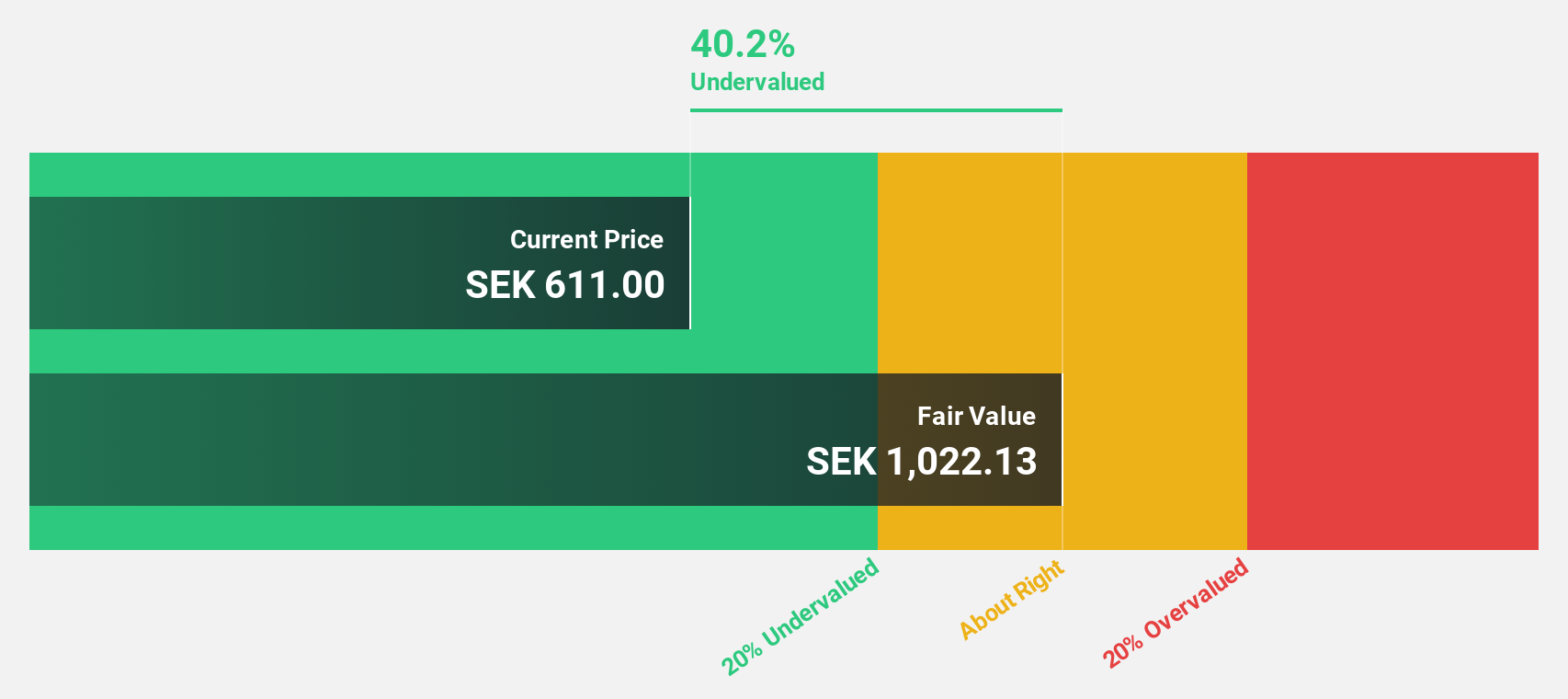

Estimated Discount To Fair Value: 39.2%

Camurus is trading at SEK611, considerably below its estimated fair value of SEK1004.32, suggesting it might be undervalued based on cash flows. The company anticipates substantial revenue growth of 28.5% annually, outpacing the Swedish market's average. Despite revised lower earnings guidance for 2025, recent positive Phase 1b study results for CAM2056 could enhance future revenue streams and profitability through innovative product offerings in the healthcare sector.

- Upon reviewing our latest growth report, Camurus' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Camurus.

Shengda ResourcesLtd (SZSE:000603)

Overview: Shengda Resources Co., Ltd. operates in China through its subsidiaries, focusing on mining development, resource trading, and investment management, with a market capitalization of CN¥16.31 billion.

Operations: Shengda Resources Co., Ltd. generates revenue through its subsidiaries by engaging in mining development, resource trading, and investment management activities within China.

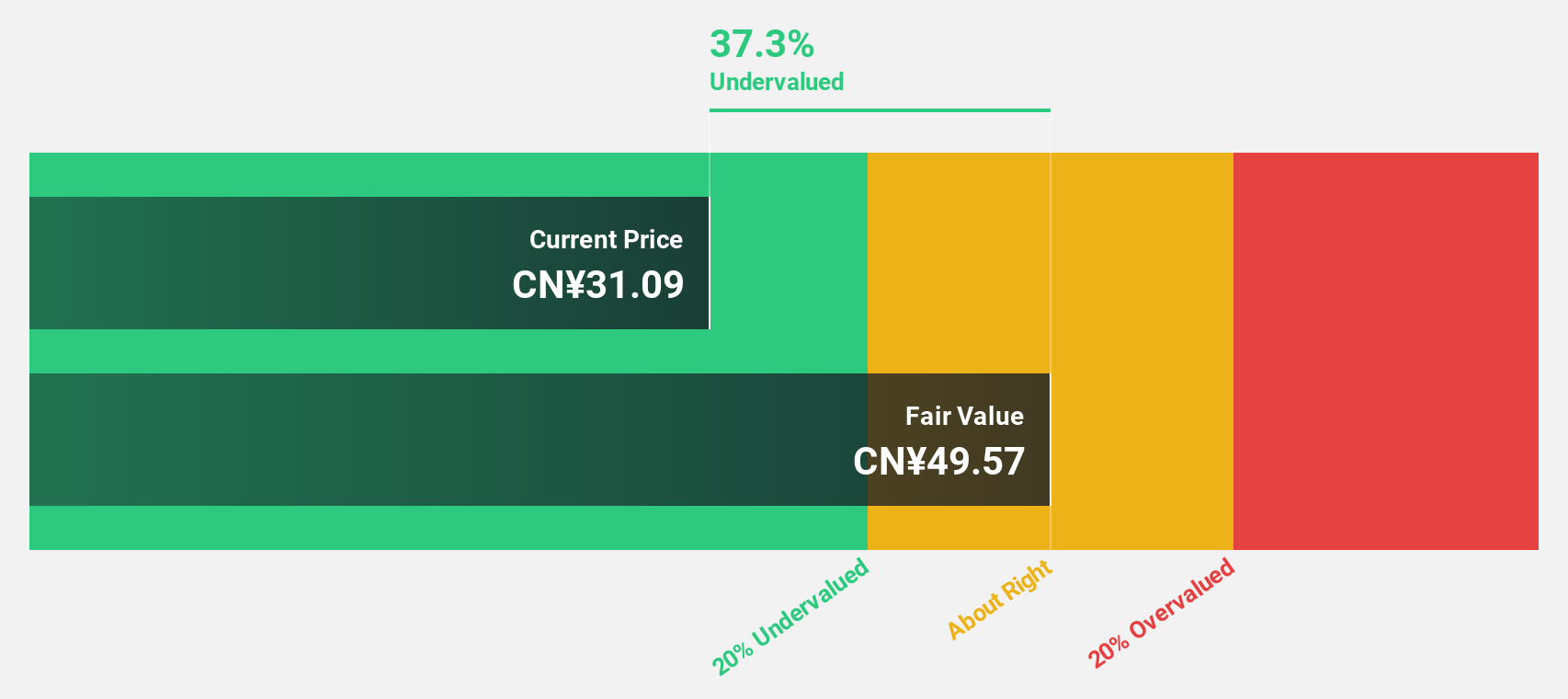

Estimated Discount To Fair Value: 48.4%

Shengda Resources is trading at CN¥25.73, significantly below its estimated fair value of CN¥49.9, highlighting its potential undervaluation based on cash flows. Recent earnings show a net income increase to CNY 322.64 million for the first nine months of 2025, reflecting robust growth despite share price volatility. Forecasts predict substantial annual revenue and profit growth exceeding market averages, reinforcing Shengda's attractive valuation for investors focusing on cash flow metrics.

- The analysis detailed in our Shengda ResourcesLtd growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Shengda ResourcesLtd.

Next Steps

- Gain an insight into the universe of 510 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A010140

Samsung Heavy Industries

Engages in the shipbuilding, offshore, and energy and infra businesses worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives