Hubei Yihua Chemical Industry Co., Ltd.'s (SZSE:000422) Price Is Right But Growth Is Lacking After Shares Rocket 33%

Despite an already strong run, Hubei Yihua Chemical Industry Co., Ltd. (SZSE:000422) shares have been powering on, with a gain of 33% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 7.0% isn't as attractive.

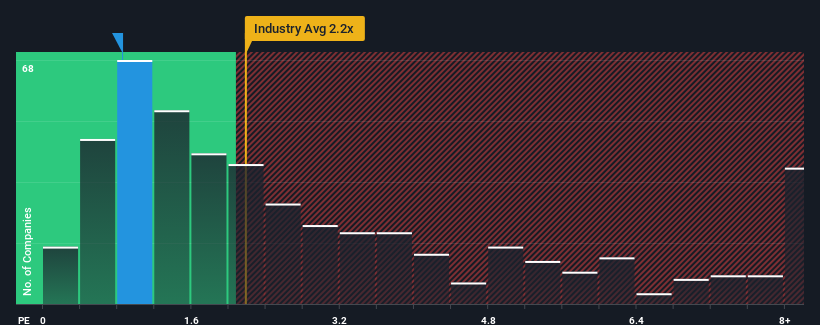

Although its price has surged higher, Hubei Yihua Chemical Industry may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2.2x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Hubei Yihua Chemical Industry

How Has Hubei Yihua Chemical Industry Performed Recently?

Recent times haven't been great for Hubei Yihua Chemical Industry as its revenue has been falling quicker than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Hubei Yihua Chemical Industry's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Hubei Yihua Chemical Industry's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 12% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 5.8% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 23%, which is noticeably more attractive.

With this information, we can see why Hubei Yihua Chemical Industry is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Hubei Yihua Chemical Industry's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Hubei Yihua Chemical Industry's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hubei Yihua Chemical Industry maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Hubei Yihua Chemical Industry (1 is a bit unpleasant!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Yihua Chemical Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000422

Hubei Yihua Chemical Industry

Manufactures and sells chemical raw materials and products in China.

Good value with moderate growth potential.

Market Insights

Community Narratives