Investors Still Aren't Entirely Convinced By Jilin Chemical Fibre Stock Co.,Ltd's (SZSE:000420) Revenues Despite 30% Price Jump

Jilin Chemical Fibre Stock Co.,Ltd (SZSE:000420) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

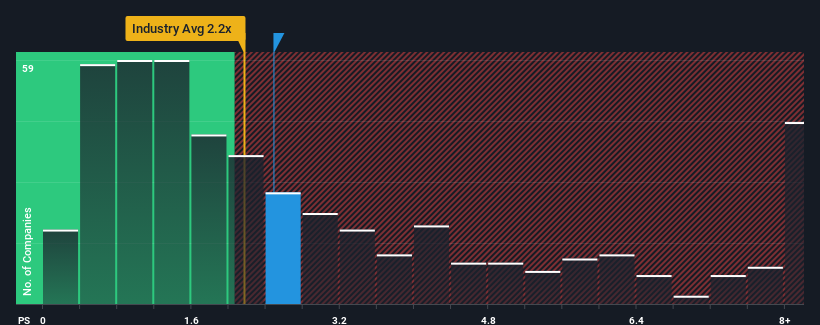

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Jilin Chemical Fibre StockLtd's P/S ratio of 2.5x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in China is also close to 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Jilin Chemical Fibre StockLtd

What Does Jilin Chemical Fibre StockLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jilin Chemical Fibre StockLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Jilin Chemical Fibre StockLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Jilin Chemical Fibre StockLtd?

In order to justify its P/S ratio, Jilin Chemical Fibre StockLtd would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 30% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Jilin Chemical Fibre StockLtd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Jilin Chemical Fibre StockLtd's P/S?

Jilin Chemical Fibre StockLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jilin Chemical Fibre StockLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Jilin Chemical Fibre StockLtd (1 makes us a bit uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on Jilin Chemical Fibre StockLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Jilin Chemical Fibre StockLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000420

Jilin Chemical Fibre StockLtd

Produces and sells chemical fiber in China.

Reasonable growth potential low.

Market Insights

Community Narratives