Beijing Haohua Energy Resource And 2 More Undiscovered Gems In Global Markets

Reviewed by Simply Wall St

As global markets grapple with tariff fears, inflation concerns, and fluctuating growth indicators, small-cap stocks have faced heightened volatility. With the S&P 600 and other indices experiencing significant declines due to trade policy uncertainties, investors are increasingly on the lookout for undiscovered gems that offer potential resilience and opportunity amidst broader market challenges. In this environment, a good stock might be characterized by strong fundamentals and strategic positioning that can weather economic fluctuations while capitalizing on emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Soft-World International | NA | -0.79% | 6.29% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Haohua Energy Resource Co., Ltd. is involved in the mining, washing, manufacturing, processing, export, and sale of coal in China with a market capitalization of approximately CN¥10.47 billion.

Operations: The company's revenue primarily stems from coal mining, washing, manufacturing, processing, export, and sales activities. It operates with a market capitalization of approximately CN¥10.47 billion.

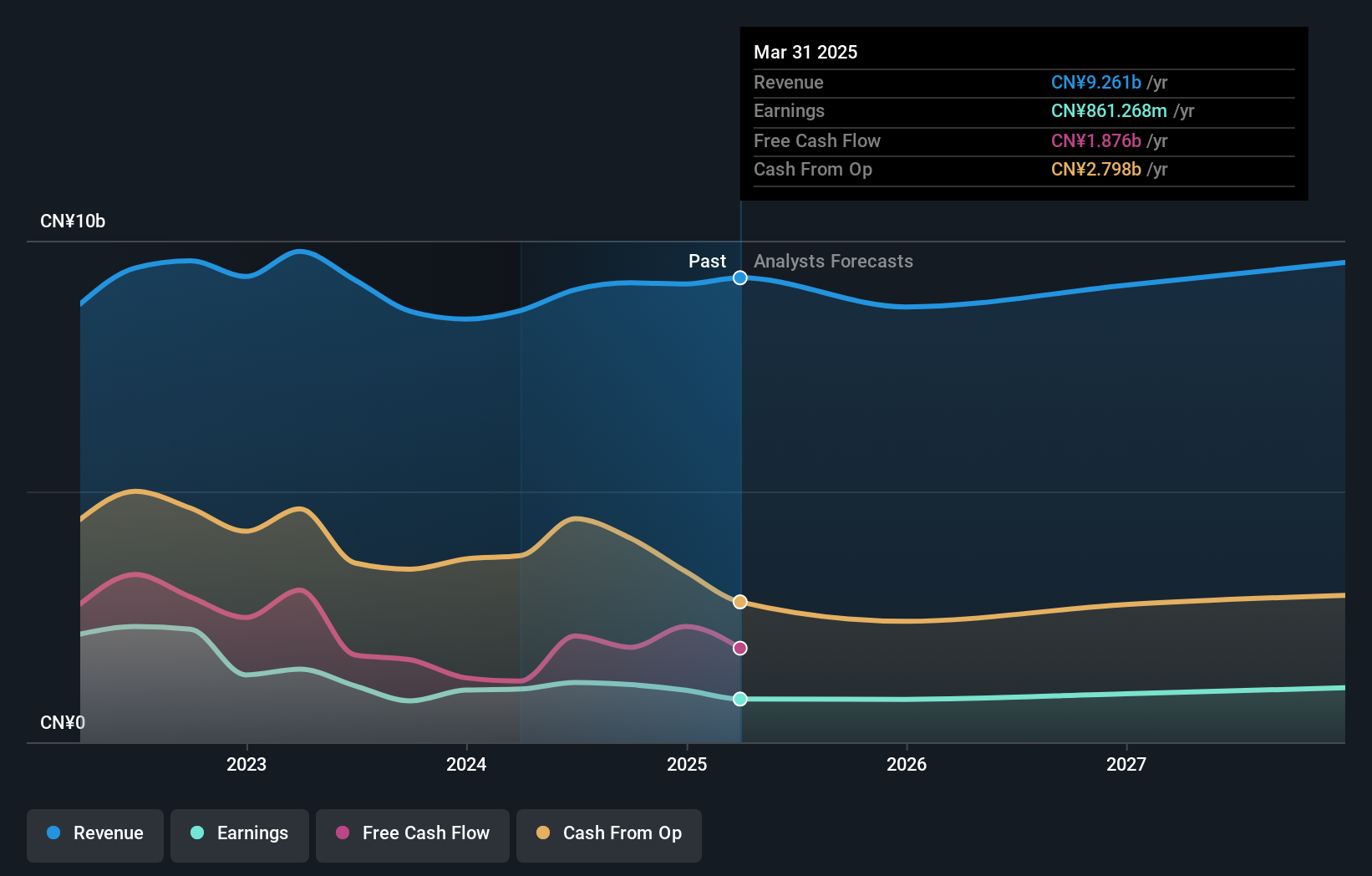

Beijing Haohua Energy Resource, a smaller player in the energy sector, is trading at 51.9% below its estimated fair value, offering a compelling proposition for investors. The company has demonstrated high-quality earnings and robust growth with earnings increasing by 39.1% over the past year, significantly outpacing the oil and gas industry's -12.3%. Its net debt to equity ratio stands at a satisfactory 13.5%, indicating prudent financial management as it reduced from 61.2% to 47.5% over five years. With interest payments well-covered by EBIT at 25 times coverage, Haohua seems well-positioned for continued stability and potential growth in profitability forecasted at an annual rate of 14%.

Hunan Xiangtou Goldsky Titanium Industry Technology (SHSE:688750)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hunan Xiangtou Goldsky Titanium Industry Technology Co., Ltd. is a company engaged in the titanium industry, focusing on metal processing and fabrication, with a market capitalization of approximately CN¥10.55 billion.

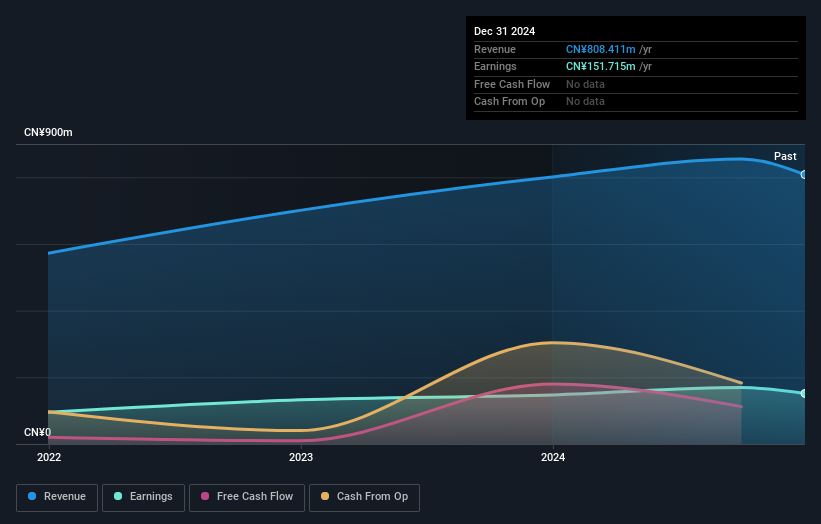

Operations: Goldsky Titanium generates revenue primarily from its metal processing and fabrication segment, amounting to CN¥808.41 million.

Hunan Xiangtou Goldsky Titanium Industry Technology, a smaller player in the metals and mining sector, showcases solid financial health. With earnings growth of 3% outpacing the industry's 0.4%, it demonstrates resilience. The company reported CNY 808.41 million in sales for 2024, slightly up from CNY 801.13 million a year earlier, while net income increased to CNY 151.71 million from CNY 147.24 million. Despite insufficient data on debt reduction over five years, it maintains more cash than total debt and generates high-quality earnings with basic EPS rising to CNY 0.4017 from CNY 0.3979 last year, reflecting steady performance amidst industry challenges.

Shinkong Insurance (TWSE:2850)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shinkong Insurance Co., Ltd. operates in Taiwan, offering property insurance services to both individuals and corporate clients, with a market capitalization of approximately NT$36.18 billion.

Operations: The primary revenue stream for Shinkong Insurance comes from its property insurance segment, generating NT$20.59 billion.

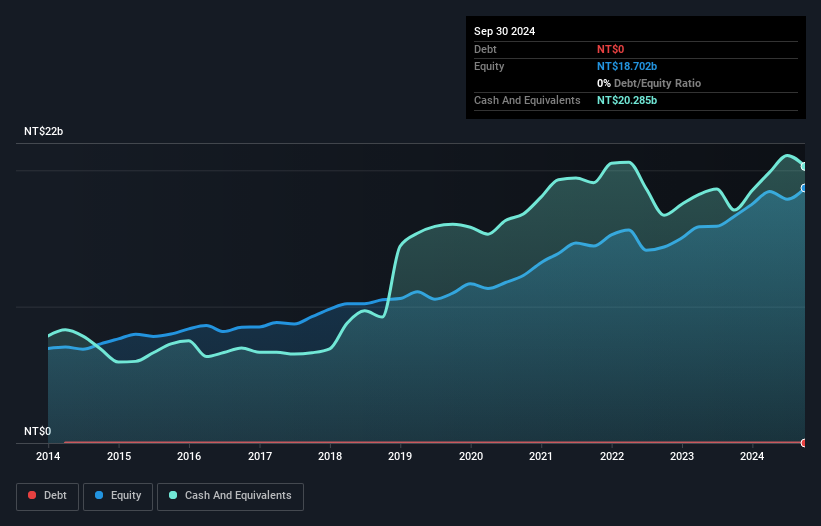

Shinkong Insurance, with its debt-free status for the past five years, stands out in the insurance sector. Despite a 22% earnings growth last year, it lagged behind the industry's impressive 79%. However, it trades at a notable discount of 29% below estimated fair value. Over five years, earnings have consistently climbed at an annual rate of nearly 16%, showcasing high-quality results. The company is set to release its Q4 2024 financials soon after their recent board meeting on March 7th. With positive free cash flow and profitability secured, Shinkong seems well-positioned in its niche market space.

- Take a closer look at Shinkong Insurance's potential here in our health report.

Understand Shinkong Insurance's track record by examining our Past report.

Turning Ideas Into Actions

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3205 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shinkong Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2850

Shinkong Insurance

Provides property insurance to individuals and corporates in Taiwan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives