Is Guangzhou Guanggang Gases & EnergyLtd (SHSE:688548) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Guangzhou Guanggang Gases & Energy Co.,Ltd. (SHSE:688548) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Guangzhou Guanggang Gases & EnergyLtd

How Much Debt Does Guangzhou Guanggang Gases & EnergyLtd Carry?

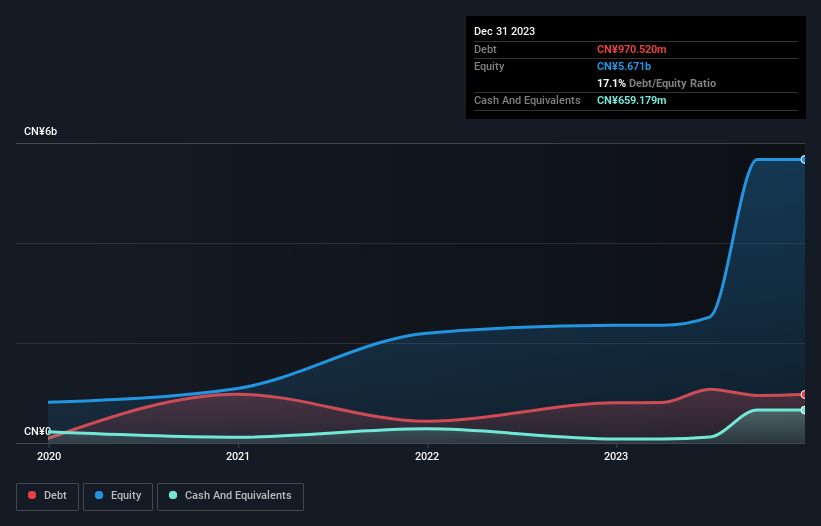

The image below, which you can click on for greater detail, shows that at September 2023 Guangzhou Guanggang Gases & EnergyLtd had debt of CN¥970.5m, up from CN¥805.5m in one year. On the flip side, it has CN¥659.2m in cash leading to net debt of about CN¥311.3m.

How Healthy Is Guangzhou Guanggang Gases & EnergyLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Guangzhou Guanggang Gases & EnergyLtd had liabilities of CN¥758.7m due within 12 months and liabilities of CN¥803.8m due beyond that. On the other hand, it had cash of CN¥659.2m and CN¥348.2m worth of receivables due within a year. So its liabilities total CN¥555.0m more than the combination of its cash and short-term receivables.

Since publicly traded Guangzhou Guanggang Gases & EnergyLtd shares are worth a total of CN¥14.3b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Guangzhou Guanggang Gases & EnergyLtd's net debt is only 0.63 times its EBITDA. And its EBIT covers its interest expense a whopping 15.3 times over. So we're pretty relaxed about its super-conservative use of debt. Fortunately, Guangzhou Guanggang Gases & EnergyLtd grew its EBIT by 6.3% in the last year, making that debt load look even more manageable. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Guangzhou Guanggang Gases & EnergyLtd's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Guangzhou Guanggang Gases & EnergyLtd saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Based on what we've seen Guangzhou Guanggang Gases & EnergyLtd is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. Considering this range of data points, we think Guangzhou Guanggang Gases & EnergyLtd is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Guangzhou Guanggang Gases & EnergyLtd's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Guangzhou Guanggang Gases & EnergyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688548

Guangzhou Guanggang Gases & EnergyLtd

Guangzhou Guanggang Gases & Energy Co.,Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives