After Leaping 29% Rayitek Hi-Tech Film Company Ltd., Shenzhen (SHSE:688323) Shares Are Not Flying Under The Radar

Those holding Rayitek Hi-Tech Film Company Ltd., Shenzhen (SHSE:688323) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

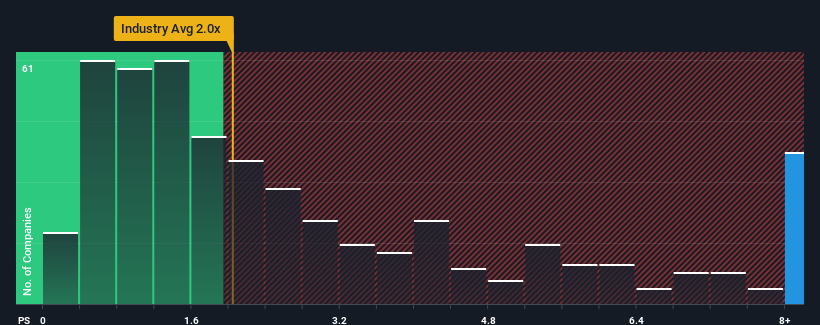

Following the firm bounce in price, you could be forgiven for thinking Rayitek Hi-Tech Film Company Shenzhen is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.5x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Rayitek Hi-Tech Film Company Shenzhen

How Has Rayitek Hi-Tech Film Company Shenzhen Performed Recently?

While the industry has experienced revenue growth lately, Rayitek Hi-Tech Film Company Shenzhen's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Rayitek Hi-Tech Film Company Shenzhen will help you uncover what's on the horizon.How Is Rayitek Hi-Tech Film Company Shenzhen's Revenue Growth Trending?

In order to justify its P/S ratio, Rayitek Hi-Tech Film Company Shenzhen would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 8.5% decrease to the company's top line. As a result, revenue from three years ago have also fallen 21% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 114% over the next year. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Rayitek Hi-Tech Film Company Shenzhen's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Rayitek Hi-Tech Film Company Shenzhen's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Rayitek Hi-Tech Film Company Shenzhen shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Rayitek Hi-Tech Film Company Shenzhen that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688323

Rayitek Hi-Tech Film Company Shenzhen

Engages in the research and development, manufacture, service, and sale of PI films in China.

High growth potential with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026