Ningbo Solartron Technology Co.,Ltd.'s (SHSE:688299) Popularity With Investors Under Threat As Stock Sinks 25%

Ningbo Solartron Technology Co.,Ltd. (SHSE:688299) shares have had a horrible month, losing 25% after a relatively good period beforehand. The last month has meant the stock is now only up 3.4% during the last year.

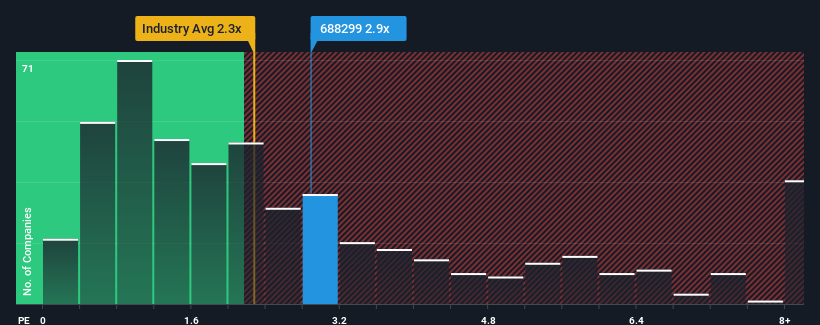

Even after such a large drop in price, you could still be forgiven for thinking Ningbo Solartron TechnologyLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.9x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Ningbo Solartron TechnologyLtd

What Does Ningbo Solartron TechnologyLtd's Recent Performance Look Like?

Ningbo Solartron TechnologyLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ningbo Solartron TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Ningbo Solartron TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.8% last year. The solid recent performance means it was also able to grow revenue by 5.4% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 13% over the next year. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

In light of this, it's alarming that Ningbo Solartron TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Ningbo Solartron TechnologyLtd's P/S Mean For Investors?

Despite the recent share price weakness, Ningbo Solartron TechnologyLtd's P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Ningbo Solartron TechnologyLtd trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Ningbo Solartron TechnologyLtd that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Solartron TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688299

Ningbo Solartron TechnologyLtd

Researches, develops, produces, and sells functional films in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives