- China

- /

- Semiconductors

- /

- SHSE:688662

Undiscovered Gems in Global Markets for December 2025

Reviewed by Simply Wall St

As global markets navigate the anticipation of potential interest rate cuts and mixed economic signals, small-cap stocks have shown resilience, with indices like the Russell 2000 rising amidst broader market gains. In this environment, identifying undiscovered gems requires a keen eye for companies that not only weather current economic challenges but also demonstrate potential for growth through innovative strategies or niche market positions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 47.86% | 17.97% | 41.71% | ★★★★★★ |

| Shandong Sinoglory Health Food | NA | 4.47% | 5.27% | ★★★★★★ |

| Anapass | 8.99% | 20.82% | 58.41% | ★★★★★★ |

| Savior Lifetec | NA | -11.98% | 25.39% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 44.30% | -13.35% | 24.08% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Solomon Data International | NA | 20.28% | 14.76% | ★★★★★★ |

| AblePrint Technology | 7.13% | 15.97% | 15.61% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiangsu Longda Superalloy (SHSE:688231)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Longda Superalloy Co., Ltd. focuses on the research, development, production, and sale of alloy and superalloy materials both in China and internationally, with a market cap of CN¥6.32 billion.

Operations: Jiangsu Longda Superalloy generates revenue primarily from the sale of alloy and superalloy materials. The company has a market cap of CN¥6.32 billion, indicating its significant presence in the industry.

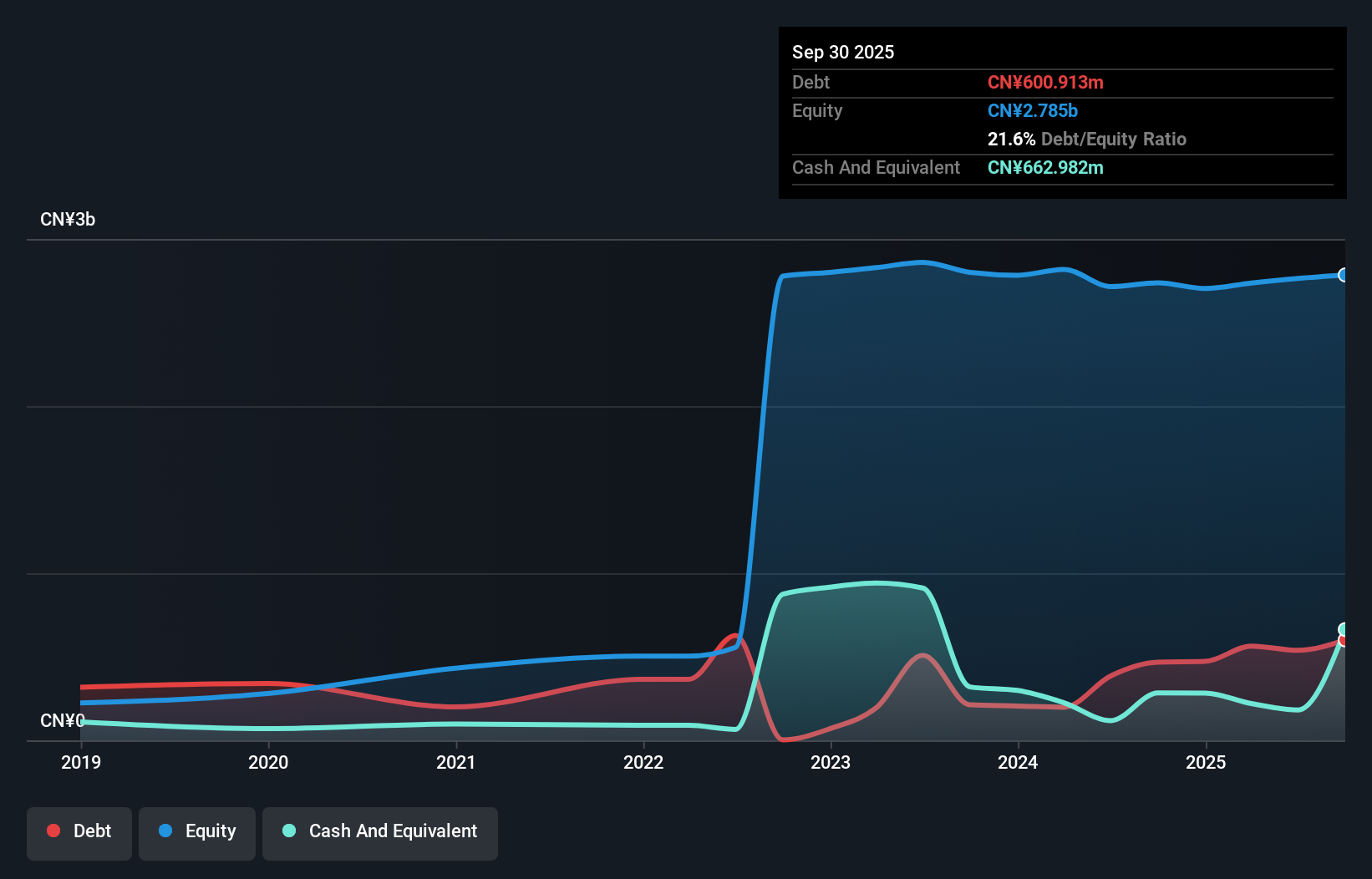

Jiangsu Longda Superalloy, a nimble player in the metals and mining sector, has been making waves with its impressive earnings growth of 119% over the past year, outpacing the industry average of 8.4%. The company's debt to equity ratio has improved significantly from 59.8% to 21.6% over five years, indicating prudent financial management. Despite a volatile share price recently, Jiangsu Longda's EBIT covers interest payments by an impressive margin of 147 times. Recent reports show sales reaching CN¥1.31 billion for nine months ending September 2025, with net income increasing to CN¥70.95 million from CN¥59.79 million last year.

- Click here to discover the nuances of Jiangsu Longda Superalloy with our detailed analytical health report.

Understand Jiangsu Longda Superalloy's track record by examining our Past report.

Guangdong Fuxin Technology (SHSE:688662)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Fuxin Technology Co., Ltd. focuses on the research, development, production, and sale of semiconductor thermoelectric materials with a market cap of CN¥4.06 billion.

Operations: Guangdong Fuxin derives its revenue primarily from the sale of semiconductor thermoelectric materials. The company's financial performance is highlighted by a market cap of approximately CN¥4.06 billion, indicating its scale in the industry.

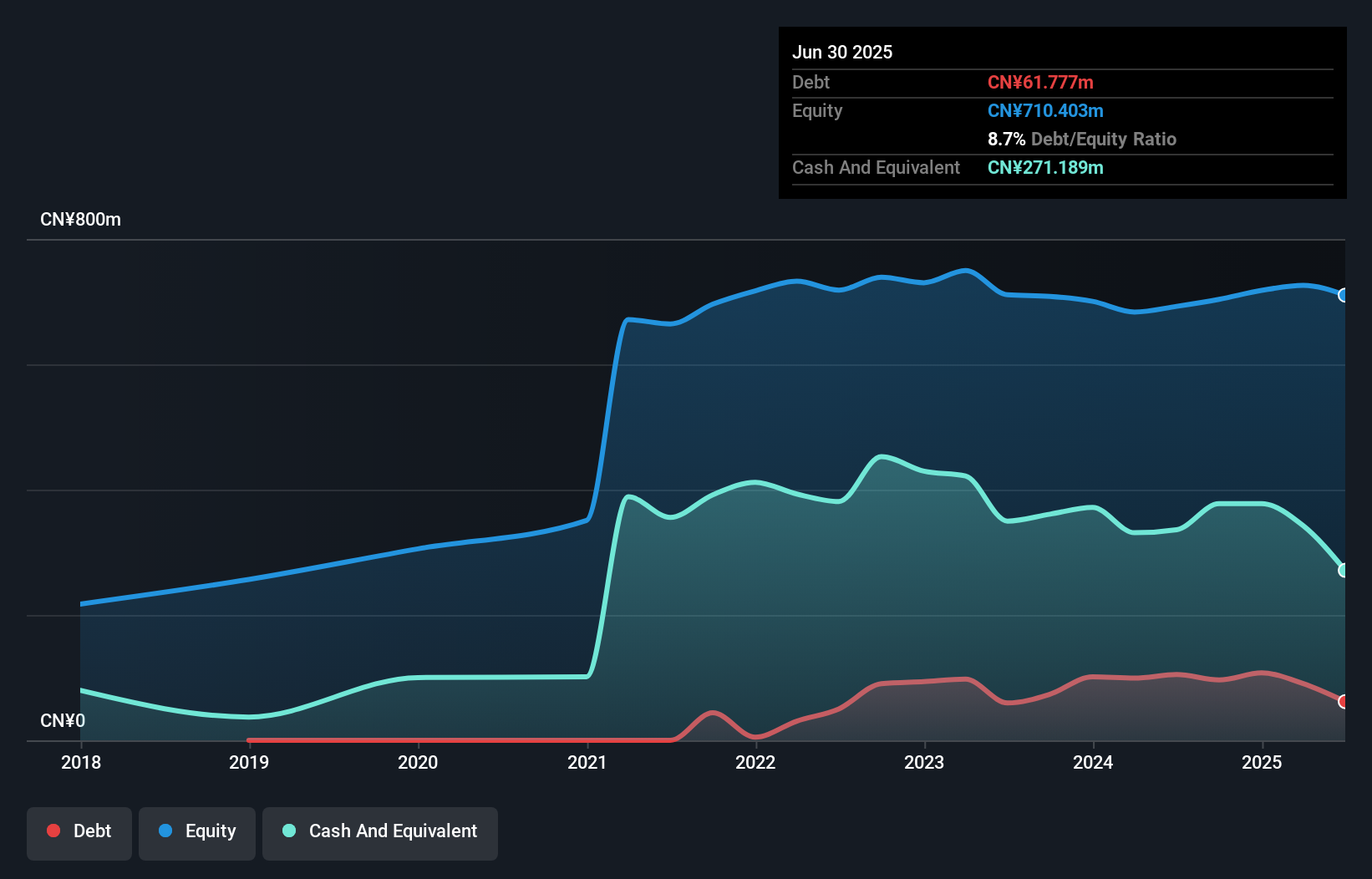

Guangdong Fuxin Technology, a player in the semiconductor sector, has seen its earnings grow by 37% over the past year, outpacing the industry's 11.4%. However, over five years, earnings have decreased annually by 28.3%, with recent results impacted by a CN¥10.1 million one-off gain. The company's debt to equity ratio rose from 0% to 6.7% in five years but maintains more cash than total debt, reducing financial strain concerns. Recently acquired stakes worth CN¥61.8 million indicate investor confidence despite volatile share prices and fluctuating free cash flow figures throughout this period.

- Click to explore a detailed breakdown of our findings in Guangdong Fuxin Technology's health report.

Sigurd Microelectronics (TWSE:6257)

Simply Wall St Value Rating: ★★★★★★

Overview: Sigurd Microelectronics Corporation operates in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits across Taiwan and international markets with a market cap of NT$47.21 billion.

Operations: Sigurd Microelectronics generates revenue primarily from its Packaging and Testing Business, which contributes NT$19.17 billion, alongside its Trading segment at NT$67.92 million.

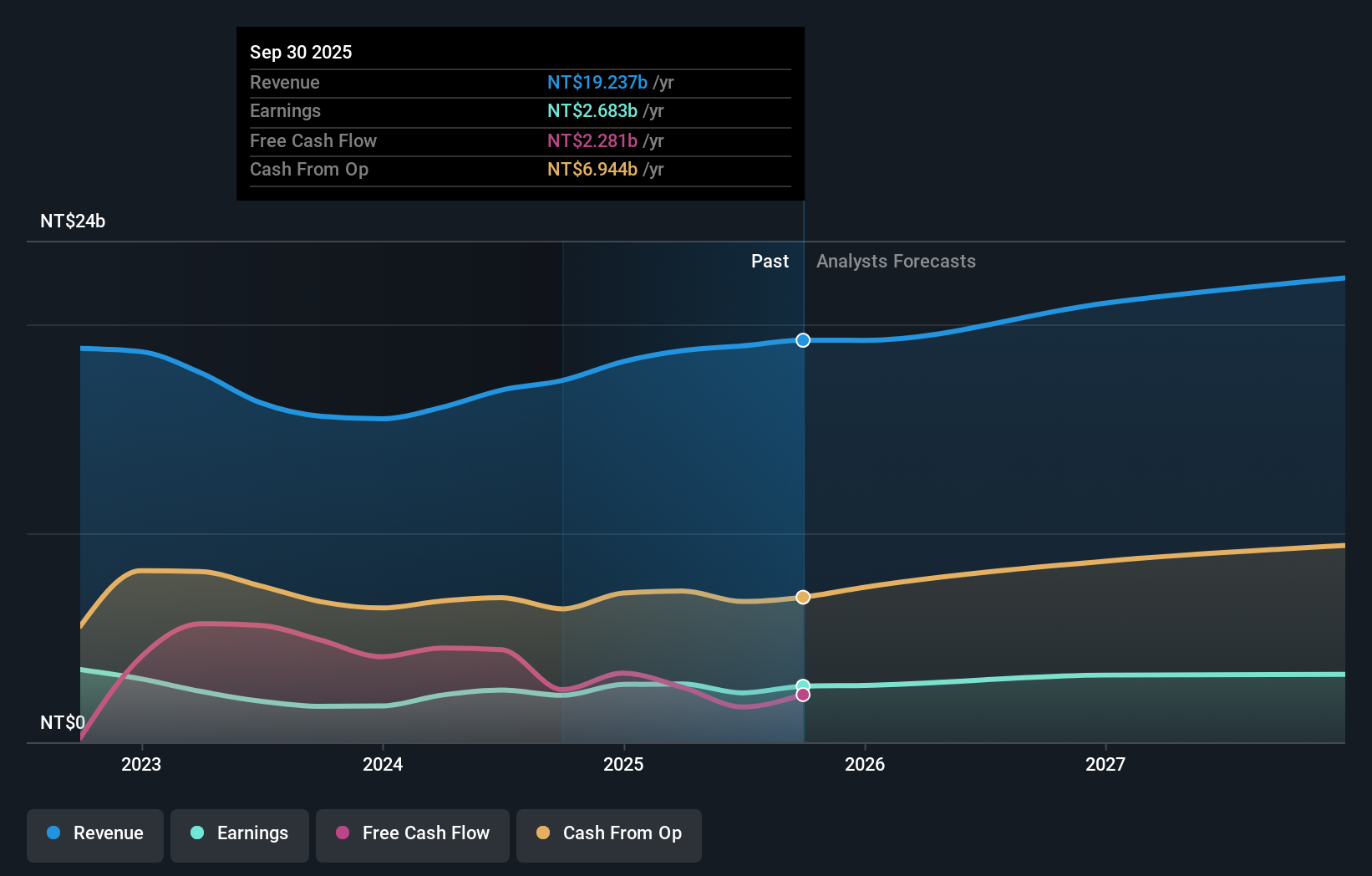

Sigurd Microelectronics, a player in the semiconductor industry, has shown robust performance with earnings growth of 19.5% over the past year, outpacing the industry's 2.5%. The company's debt-to-equity ratio has improved from 74.5% to 52.8% over five years, indicating better financial health. In recent results for Q3 2025, sales reached TWD 4,854 million compared to TWD 4,588 million last year, while net income rose significantly to TWD 803.62 million from TWD 482.93 million previously reported. With a price-to-earnings ratio of 18.5x below the market average and high-quality past earnings, Sigurd seems well-positioned for future growth prospects in its sector.

- Navigate through the intricacies of Sigurd Microelectronics with our comprehensive health report here.

Gain insights into Sigurd Microelectronics' past trends and performance with our Past report.

Turning Ideas Into Actions

- Click here to access our complete index of 2996 Global Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688662

Guangdong Fuxin Technology

Researches, develops, produces, and sells semiconductor thermoelectric materials.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion