Little Excitement Around Orinko Advanced Plastics Co.,LTD's (SHSE:688219) Earnings

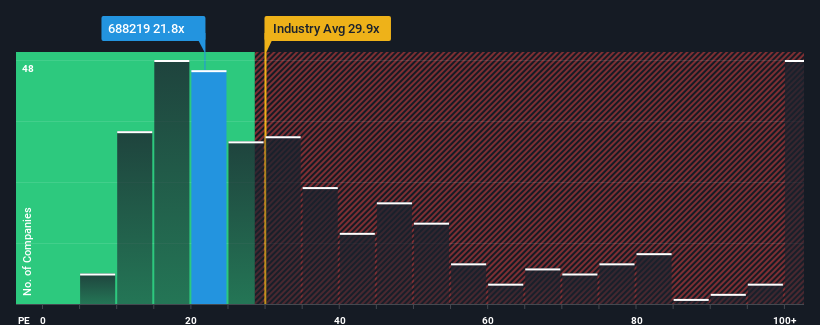

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Orinko Advanced Plastics Co.,LTD (SHSE:688219) as an attractive investment with its 21.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Orinko Advanced PlasticsLTD has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Orinko Advanced PlasticsLTD

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Orinko Advanced PlasticsLTD would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 87% gain to the company's bottom line. The latest three year period has also seen a 30% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Orinko Advanced PlasticsLTD's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Orinko Advanced PlasticsLTD maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Orinko Advanced PlasticsLTD (2 don't sit too well with us!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688219

Orinko Advanced PlasticsLTD

Researches, develops, produces, and sells polymer modified materials in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026