- China

- /

- Semiconductors

- /

- SHSE:600732

Global Growth Stocks Insiders Favor With Up To 123% Earnings Growth

Reviewed by Simply Wall St

As global markets show signs of optimism with easing trade tensions and positive corporate earnings, investors are keenly observing the landscape for potential growth opportunities. In this environment, companies with high insider ownership can be particularly appealing, as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

Let's review some notable picks from our screened stocks.

Shanghai Aiko Solar EnergyLtd (SHSE:600732)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Aiko Solar Energy Co., Ltd. is involved in the research, manufacture, and sale of crystalline silicon solar cells and has a market capitalization of CN¥18.97 billion.

Operations: Shanghai Aiko Solar Energy Co., Ltd. generates revenue primarily through its operations in the research, manufacture, and sale of crystalline silicon solar cells.

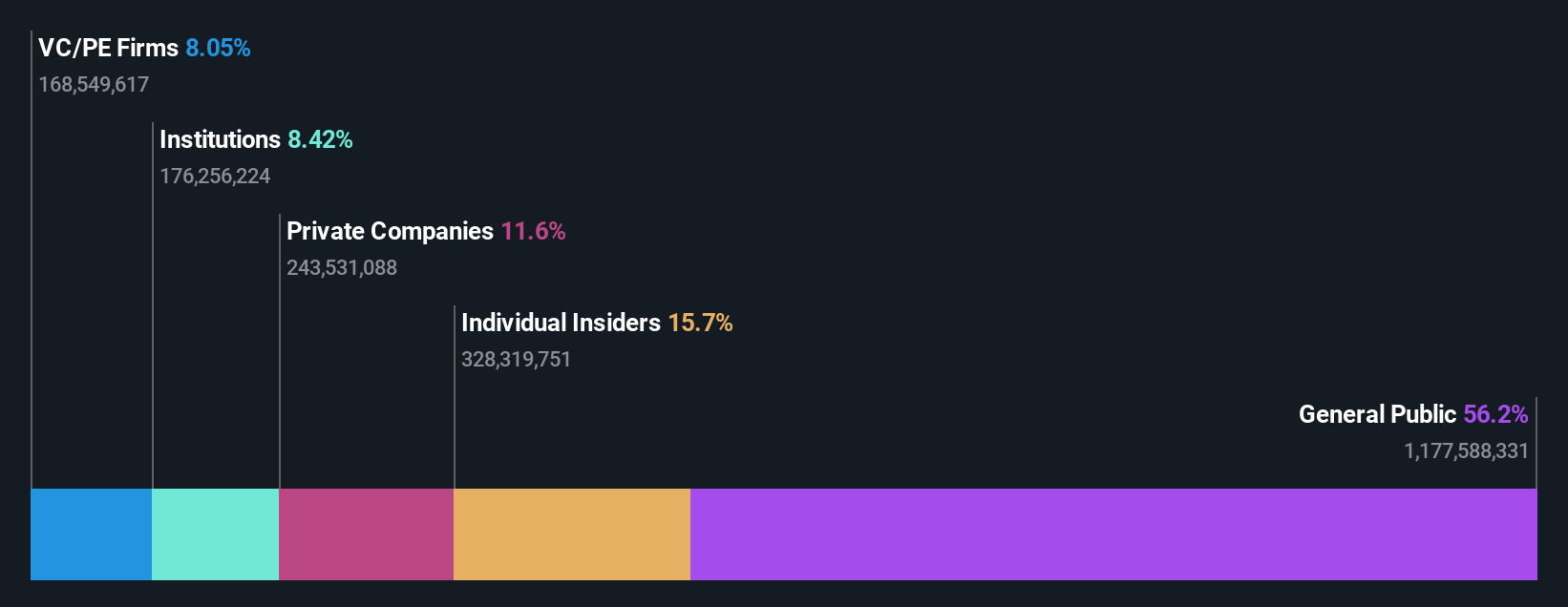

Insider Ownership: 18.2%

Earnings Growth Forecast: 123.3% p.a.

Shanghai Aiko Solar Energy Ltd. is forecasted to experience significant revenue growth of 54.4% annually, outpacing the Chinese market's average. Despite trading at a substantial discount to its estimated fair value and expected profitability within three years, the company faces challenges with a net loss of CNY 300.42 million in Q1 2025 and declining annual sales from CNY 27.17 billion to CNY 11.16 billion in 2024, highlighting financial instability concerns amidst high insider ownership potential benefits.

- Navigate through the intricacies of Shanghai Aiko Solar EnergyLtd with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Shanghai Aiko Solar EnergyLtd's current price could be quite moderate.

Jiangsu Cnano Technology (SHSE:688116)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Cnano Technology Co., Ltd. is engaged in the research, development, production, and sale of carbon nanotube materials and related products in China, with a market capitalization of approximately CN¥15.11 billion.

Operations: Jiangsu Cnano Technology Co., Ltd. generates revenue primarily through the research, development, production, and sale of carbon nanotube materials and related products in China.

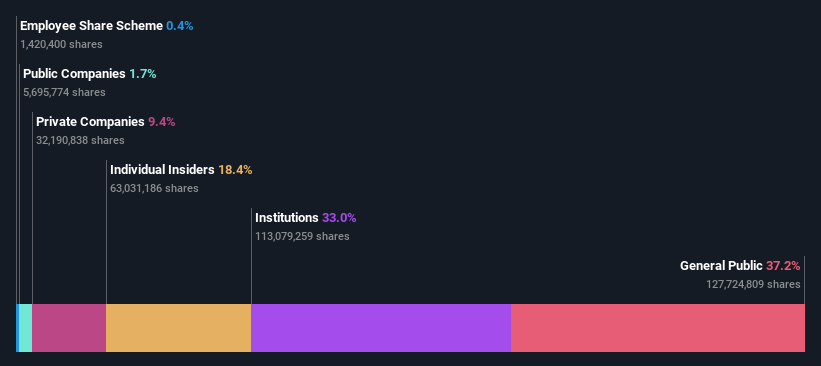

Insider Ownership: 12.6%

Earnings Growth Forecast: 34% p.a.

Jiangsu Cnano Technology is poised for robust growth, with earnings and revenue expected to increase by 34% and 30.2% annually, respectively, surpassing the Chinese market averages. Despite a slight decline in net income from CNY 297.16 million to CNY 253.31 million in 2024, the company's insider ownership remains strong, potentially aligning management interests with shareholders'. However, its return on equity is projected to remain modest at 19.9%, and dividend sustainability appears weak due to insufficient free cash flow coverage.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangsu Cnano Technology.

- Insights from our recent valuation report point to the potential overvaluation of Jiangsu Cnano Technology shares in the market.

Estun Automation (SZSE:002747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estun Automation Co., Ltd. focuses on the R&D, production, and sale of intelligent equipment and its control components in China, with a market cap of CN¥17.34 billion.

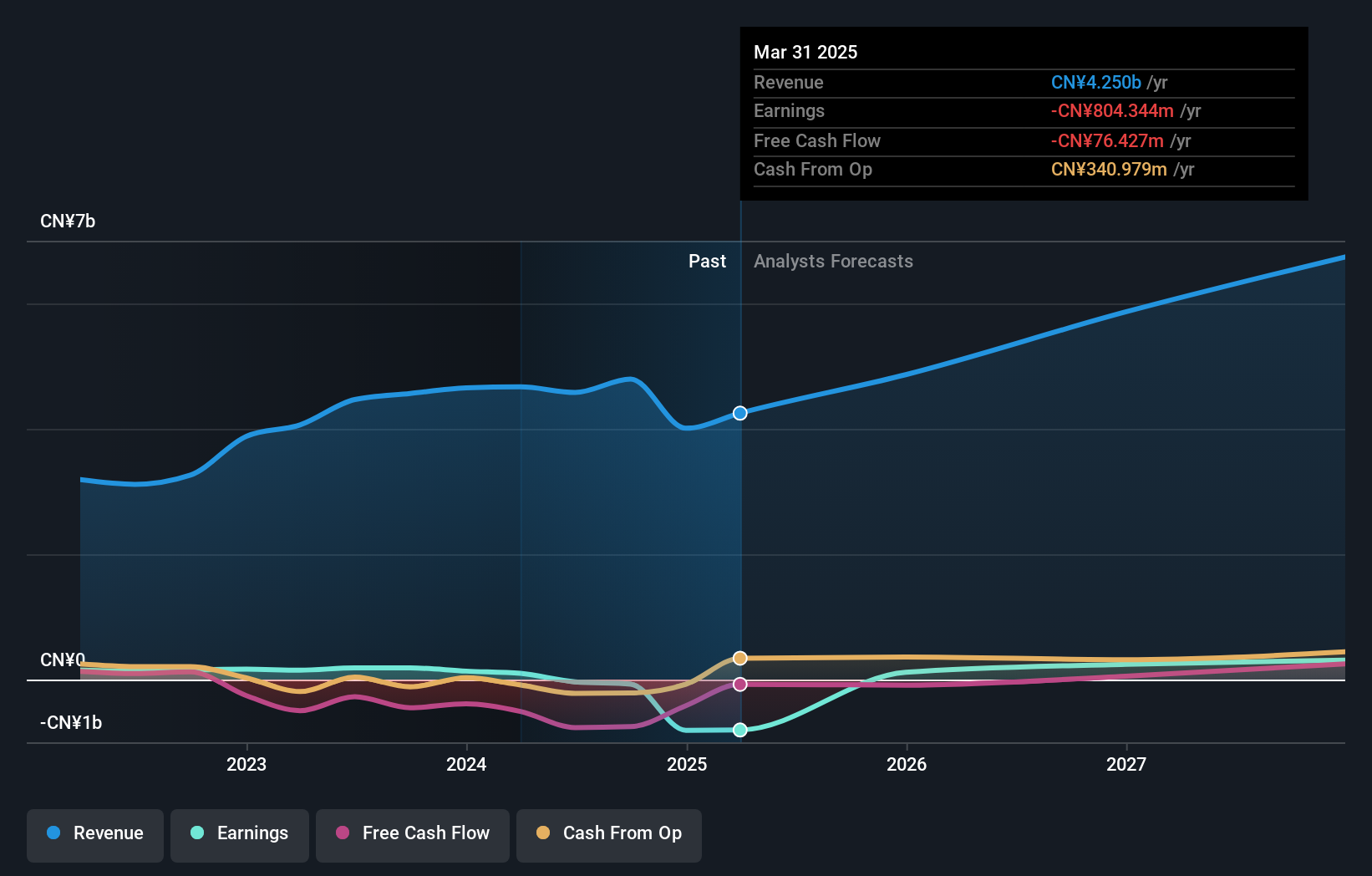

Operations: Estun Automation generates revenue of CN¥4.25 billion from its Instrument and Meter Manufacturing segment.

Insider Ownership: 13%

Earnings Growth Forecast: 89.5% p.a.

Estun Automation's recent earnings show a rise in Q1 2025 sales to CNY 1.24 billion from CNY 1 billion year-over-year, with net income doubling to CNY 12.63 million. Despite this, the company faced a full-year net loss of CNY 810.44 million in 2024 due to higher expenses and lower annual sales of CNY 4 billion. Forecasts suggest profitability within three years and revenue growth outpacing the Chinese market, though debt coverage remains weak.

- Dive into the specifics of Estun Automation here with our thorough growth forecast report.

- According our valuation report, there's an indication that Estun Automation's share price might be on the expensive side.

Summing It All Up

- Discover the full array of 838 Fast Growing Global Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600732

Shanghai Aiko Solar EnergyLtd

Engages in the research, manufacture, and sale of crystalline silicon solar cells.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives