February 2025's Leading Growth Stocks With Insider Ownership

Reviewed by Simply Wall St

In February 2025, global markets are navigating a complex landscape marked by U.S. tariff uncertainties and mixed economic signals, with major indices like the S&P 500 experiencing slight declines amid these challenges. Despite this volatility, growth companies with high insider ownership can present compelling opportunities as they often demonstrate strong alignment between management and shareholder interests, which can be particularly advantageous in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Brightstar Resources (ASX:BTR) | 10.1% | 86% |

Let's take a closer look at a couple of our picks from the screened companies.

Jiangsu Cnano Technology (SHSE:688116)

Simply Wall St Growth Rating: ★★★★★☆

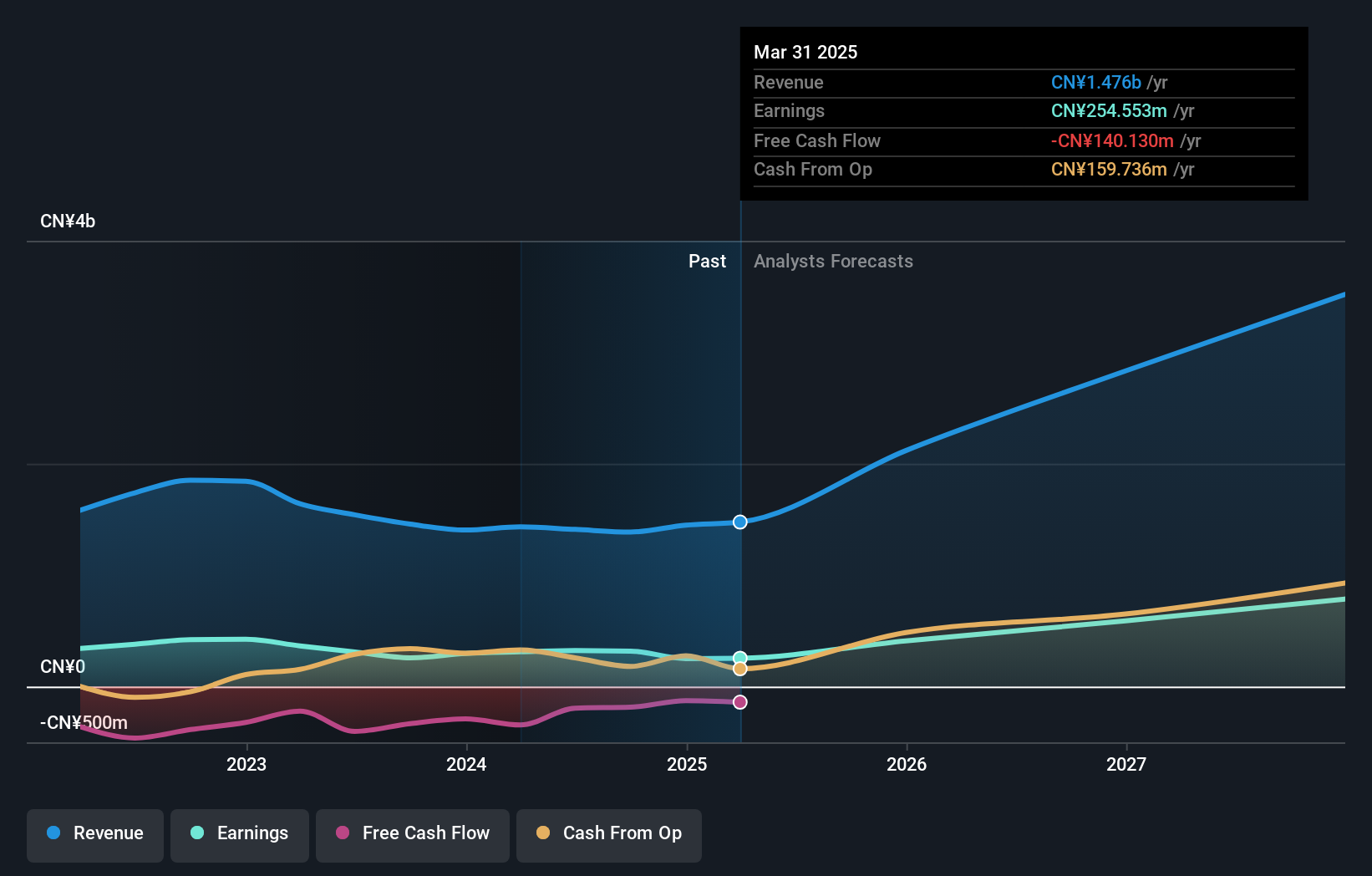

Overview: Jiangsu Cnano Technology Co., Ltd. focuses on the research, development, production, and sale of carbon nanotube materials and related products in China, with a market cap of approximately CN¥14.50 billion.

Operations: Jiangsu Cnano Technology generates revenue through its activities in researching, developing, producing, and selling carbon nanotube materials and related products within China.

Insider Ownership: 12.1%

Earnings Growth Forecast: 38.8% p.a.

Jiangsu Cnano Technology is positioned for substantial growth, with earnings expected to increase by 38.8% annually, outpacing the broader Chinese market. Revenue forecasts also indicate robust growth at 37.8% per year. Despite a volatile share price recently and a low return on equity forecast of 16.1%, the company has initiated a CNY 100 million share repurchase program to enhance shareholder value through equity incentive plans and employee stock ownership plans.

- Take a closer look at Jiangsu Cnano Technology's potential here in our earnings growth report.

- Our expertly prepared valuation report Jiangsu Cnano Technology implies its share price may be too high.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

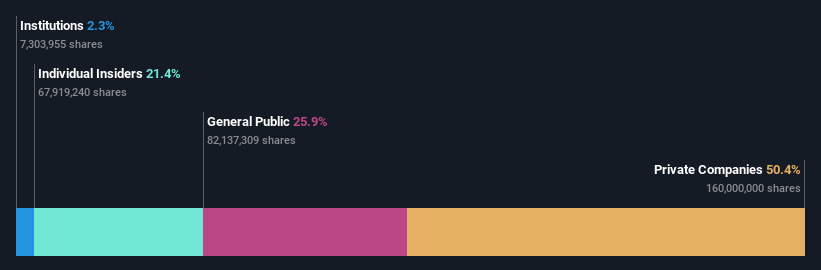

Overview: Aoshikang Technology Co., Ltd. specializes in the research, development, production, and sale of printed circuit boards with a market capitalization of CN¥9.11 billion.

Operations: The company generates revenue primarily from the printed circuit boards segment, amounting to CN¥4.41 billion.

Insider Ownership: 21.4%

Earnings Growth Forecast: 30.7% p.a.

Aoshikang Technology is poised for growth, with earnings projected to rise by 30.7% annually, surpassing the broader Chinese market's expectations. The company's revenue is also set to grow at 19% per year. Despite trading at a significant discount to its estimated fair value and offering good relative value compared to peers, its return on equity forecast remains modest at 16.3%. Recent board changes include new non-independent and independent directors' elections.

- Click here and access our complete growth analysis report to understand the dynamics of Aoshikang Technology.

- According our valuation report, there's an indication that Aoshikang Technology's share price might be on the cheaper side.

Hubei Century Network Technology (SZSE:300494)

Simply Wall St Growth Rating: ★★★★★☆

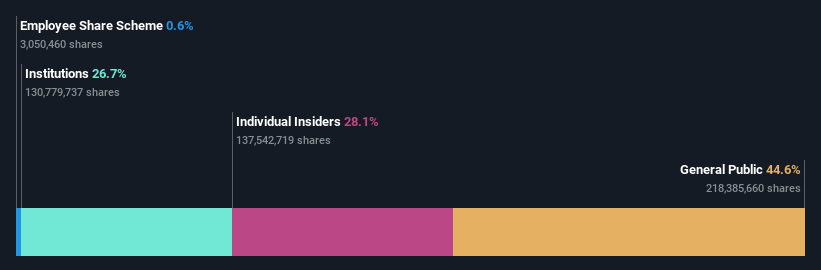

Overview: Hubei Century Network Technology Inc. operates an online entertainment platform in China and internationally, with a market cap of CN¥6.62 billion.

Operations: The company's revenue segments include online entertainment services, generating CN¥6.62 billion.

Insider Ownership: 25.5%

Earnings Growth Forecast: 56.7% p.a.

Hubei Century Network Technology is set for significant growth, with revenue expected to increase by 22.7% annually, outpacing the Chinese market's 13.5% growth rate. Earnings are forecasted to grow at a robust 56.69% per year, and the company is anticipated to achieve profitability within three years, surpassing average market expectations. However, its return on equity is projected to be modest at 11.5%, and recent share price volatility may concern investors seeking stability.

- Navigate through the intricacies of Hubei Century Network Technology with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Hubei Century Network Technology's current price could be inflated.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1438 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Jiangsu Cnano Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688116

Jiangsu Cnano Technology

Researches, develops, produces, and sells carbon nanotube materials and related products in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives