Darbond Technology Co., Ltd (SHSE:688035) Stock Rockets 35% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Darbond Technology Co., Ltd (SHSE:688035) shares have been powering on, with a gain of 35% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

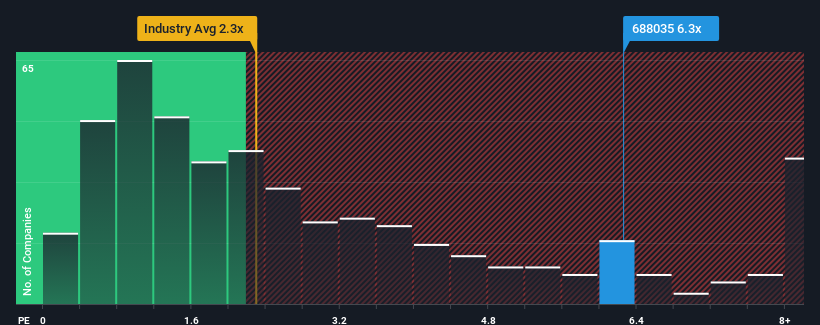

Following the firm bounce in price, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Darbond Technology as a stock not worth researching with its 6.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Darbond Technology

How Darbond Technology Has Been Performing

Darbond Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Darbond Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Darbond Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The latest three year period has also seen an excellent 82% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.2% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 24%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Darbond Technology's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Darbond Technology's P/S

The strong share price surge has lead to Darbond Technology's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Darbond Technology currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Darbond Technology is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688035

Darbond Technology

Engages in the research and development, production, and sale of polymer engineering and interface materials in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives