Zhejiang Fulai New Material Co.,Ltd.'s (SHSE:605488) 28% Share Price Surge Not Quite Adding Up

Those holding Zhejiang Fulai New Material Co.,Ltd. (SHSE:605488) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 25% is also fairly reasonable.

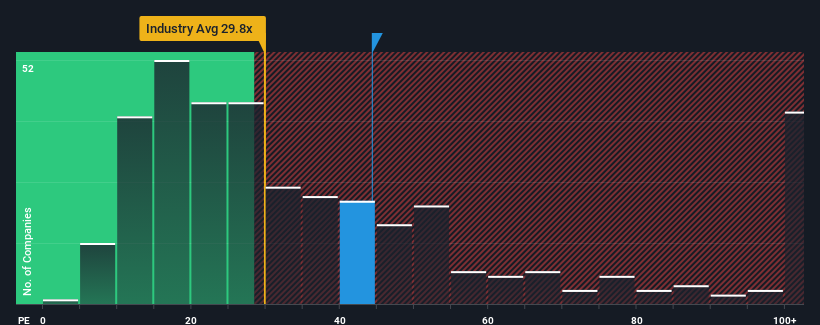

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 31x, you may consider Zhejiang Fulai New MaterialLtd as a stock to potentially avoid with its 44.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

As an illustration, earnings have deteriorated at Zhejiang Fulai New MaterialLtd over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Zhejiang Fulai New MaterialLtd

How Is Zhejiang Fulai New MaterialLtd's Growth Trending?

Zhejiang Fulai New MaterialLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.8%. This means it has also seen a slide in earnings over the longer-term as EPS is down 60% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's an unpleasant look.

In light of this, it's alarming that Zhejiang Fulai New MaterialLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Zhejiang Fulai New MaterialLtd's P/E

The large bounce in Zhejiang Fulai New MaterialLtd's shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Zhejiang Fulai New MaterialLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Zhejiang Fulai New MaterialLtd (at least 2 which are a bit concerning), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Zhejiang Fulai New MaterialLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Fulai New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605488

Zhejiang Fulai New MaterialLtd

Researches, develops, produces, and sells functional coating composite products in China and internationally.

Slight risk with acceptable track record.

Market Insights

Community Narratives