- China

- /

- Metals and Mining

- /

- SHSE:605376

Jiangsu Boqian New Materials Stock Co., Ltd.'s (SHSE:605376) 26% Jump Shows Its Popularity With Investors

Jiangsu Boqian New Materials Stock Co., Ltd. (SHSE:605376) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 101% in the last year.

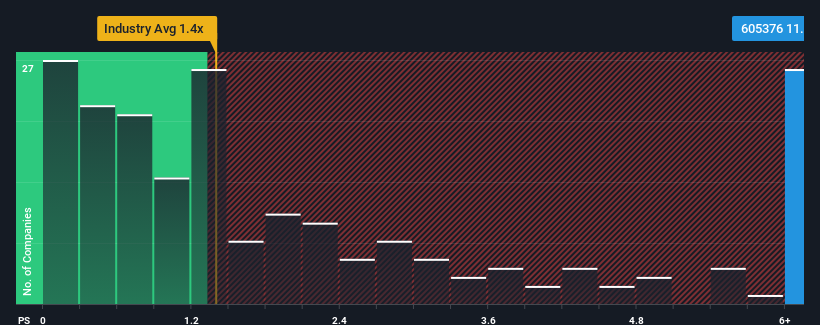

After such a large jump in price, when almost half of the companies in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Jiangsu Boqian New Materials Stock as a stock not worth researching with its 11x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Jiangsu Boqian New Materials Stock

What Does Jiangsu Boqian New Materials Stock's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Jiangsu Boqian New Materials Stock has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Jiangsu Boqian New Materials Stock's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Jiangsu Boqian New Materials Stock would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Jiangsu Boqian New Materials Stock's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Jiangsu Boqian New Materials Stock's P/S?

Jiangsu Boqian New Materials Stock's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jiangsu Boqian New Materials Stock maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Metals and Mining industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Jiangsu Boqian New Materials Stock that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605376

Jiangsu Boqian New Materials Stock

Jiangsu Boqian New Materials Stock Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives