- China

- /

- Metals and Mining

- /

- SHSE:605158

Further Upside For Zhejiang Huada New Materials Co., Ltd. (SHSE:605158) Shares Could Introduce Price Risks After 30% Bounce

Despite an already strong run, Zhejiang Huada New Materials Co., Ltd. (SHSE:605158) shares have been powering on, with a gain of 30% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

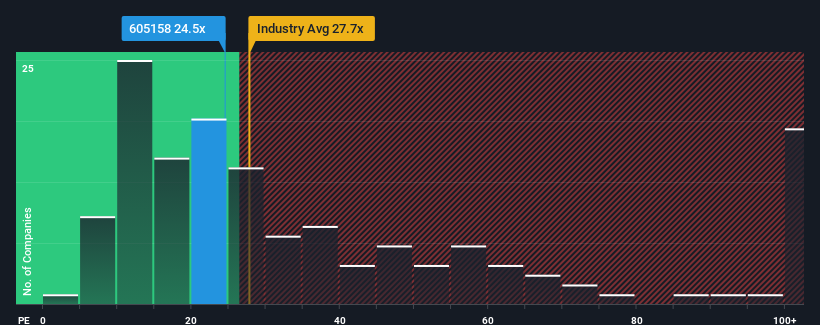

Although its price has surged higher, Zhejiang Huada New Materials' price-to-earnings (or "P/E") ratio of 24.5x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 71x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

The recently shrinking earnings for Zhejiang Huada New Materials have been in line with the market. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for Zhejiang Huada New Materials

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang Huada New Materials' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.3%. This means it has also seen a slide in earnings over the longer-term as EPS is down 13% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 72% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's peculiar that Zhejiang Huada New Materials' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Zhejiang Huada New Materials' P/E

The latest share price surge wasn't enough to lift Zhejiang Huada New Materials' P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhejiang Huada New Materials currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for Zhejiang Huada New Materials that we have uncovered.

If these risks are making you reconsider your opinion on Zhejiang Huada New Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huada New Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605158

Zhejiang Huada New Materials

Engages in the research, development, production, and sale of multifunctional color coated sheets, hot-dip galvanized aluminum sheets, and related substrates in China and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives