- China

- /

- Basic Materials

- /

- SHSE:605086

Subdued Growth No Barrier To Longyan Kaolin Clay Co., Ltd. (SHSE:605086) With Shares Advancing 26%

Despite an already strong run, Longyan Kaolin Clay Co., Ltd. (SHSE:605086) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 54%.

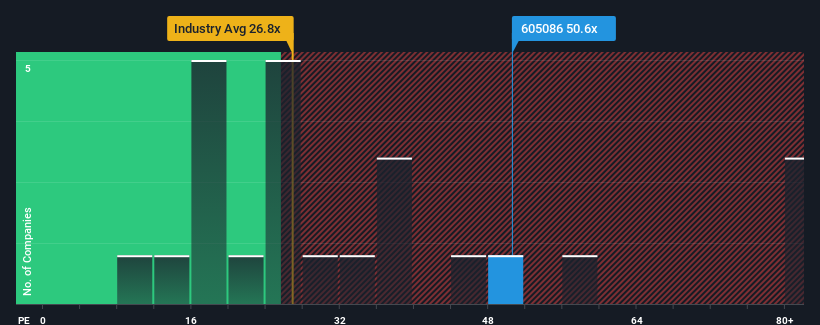

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 36x, you may consider Longyan Kaolin Clay as a stock to potentially avoid with its 50.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Longyan Kaolin Clay has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Longyan Kaolin Clay

Does Growth Match The High P/E?

In order to justify its P/E ratio, Longyan Kaolin Clay would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a decent 9.0% gain to the company's bottom line. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 38% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Longyan Kaolin Clay's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Longyan Kaolin Clay's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Longyan Kaolin Clay currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Longyan Kaolin Clay with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605086

Longyan Kaolin Clay

Engages in production and supply of kaolin for ceramic raw materials in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026