Spotlight On Undiscovered Gems With Strong Fundamentals February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and fluctuating interest rates, major U.S. stock indexes are approaching record highs, with growth stocks outpacing their value counterparts. Despite small-cap stocks lagging behind larger indices like the S&P 500, the current economic climate presents unique opportunities for discerning investors to identify stocks with robust fundamentals that may have been overlooked in broader market movements. In such an environment, focusing on companies with strong financial health and potential for growth can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Sun | 32.74% | 8.77% | 65.36% | ★★★★☆☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Longyan Kaolin Clay (SHSE:605086)

Simply Wall St Value Rating: ★★★★★★

Overview: Longyan Kaolin Clay Co., Ltd. focuses on the production and supply of kaolin for ceramic raw materials in China, with a market capitalization of CN¥5.67 billion.

Operations: Longyan Kaolin Clay generates revenue primarily from its specialty chemicals segment, amounting to CN¥314.38 million. The company's market capitalization stands at CN¥5.67 billion.

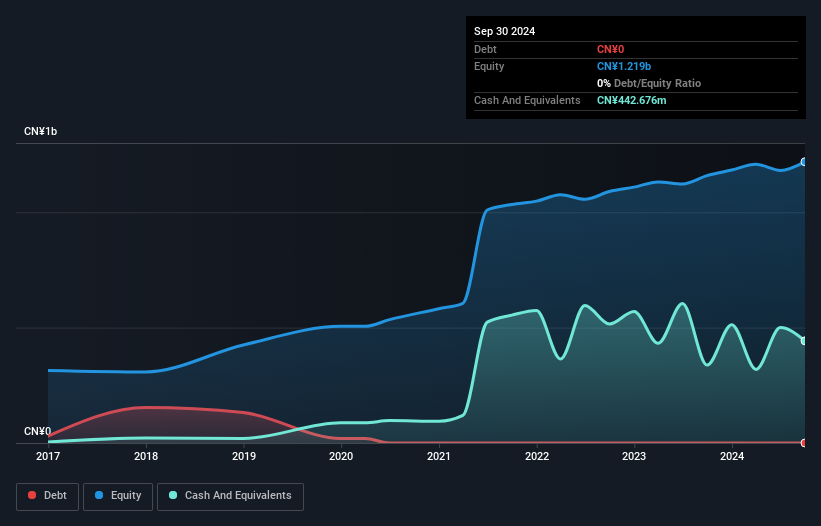

Longyan Kaolin Clay, a small player in the market, has shown resilience with an 8% earnings growth over the past year, outpacing the Basic Materials industry's -22.9%. The company is debt-free, having reduced its debt from a 9.9% debt-to-equity ratio five years ago. With high-quality earnings and positive free cash flow reaching CNY 122.77 million recently, Longyan Kaolin seems to be on solid financial footing despite recent share price volatility. A notable event includes Longyan Hongtong Investment's acquisition of a 3.35% stake for approximately CNY 100 million at CNY 17.26 per share, indicating investor confidence in its prospects.

Jiangnan Yifan MotorLtd (SZSE:301023)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangnan Yifan Motor Co., Ltd specializes in the design, development, manufacture, and sale of gear energy storage motors and operating mechanisms for medium and high voltage switch circuit breaker equipment both in China and internationally, with a market cap of CN¥2.97 billion.

Operations: Jiangnan Yifan Motor Co., Ltd generates revenue primarily from the sale of gear energy storage motors and operating mechanisms for medium and high voltage switch circuit breaker equipment. The company's market cap is CN¥2.97 billion, reflecting its position within the industry.

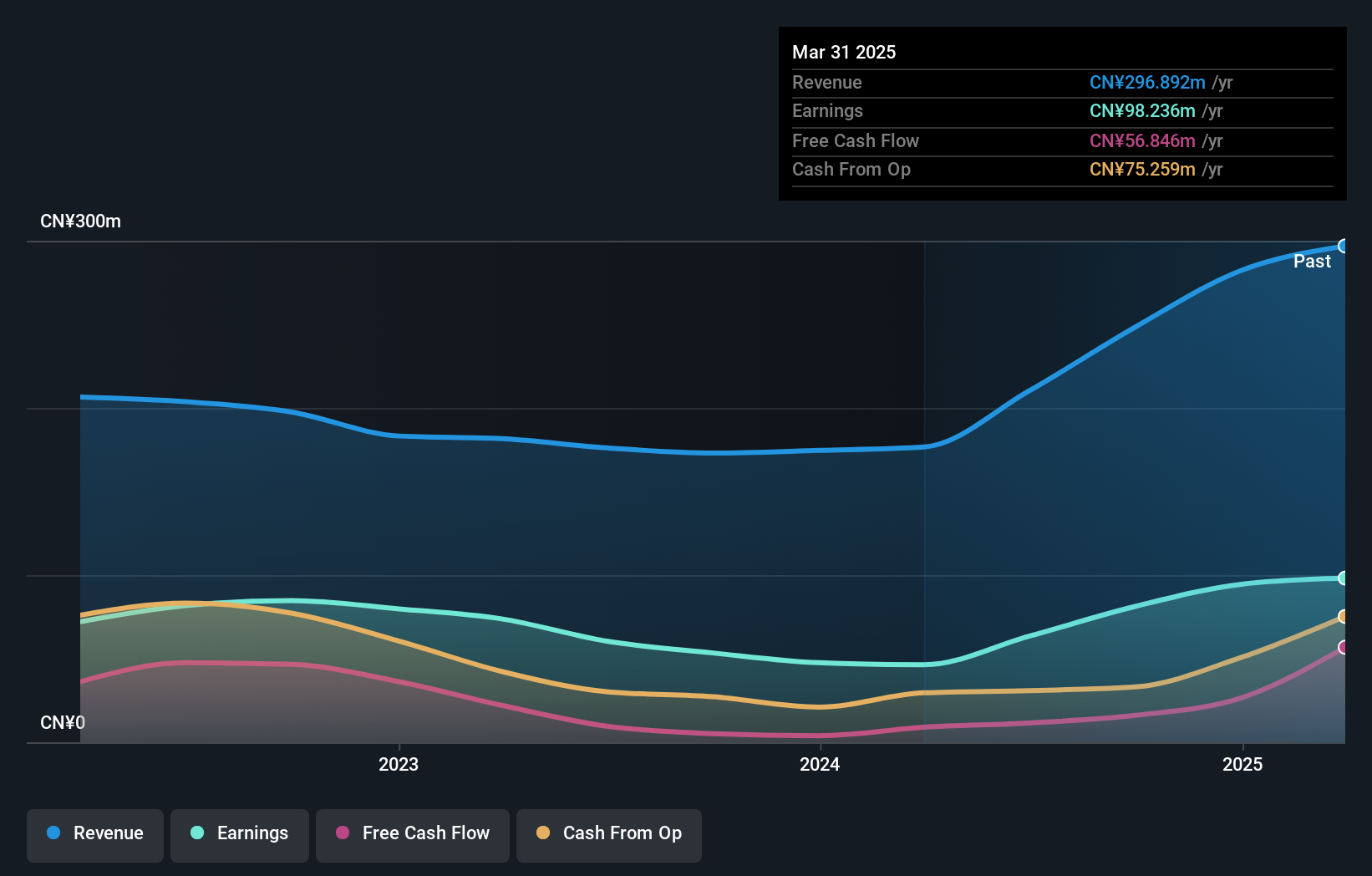

Jiangnan Yifan Motor Ltd, a small player in the electrical industry, has shown impressive growth with earnings surging by 52% over the past year, outpacing the industry's modest 1.1% rise. The company operates debt-free, which eliminates concerns about interest payments and highlights its robust financial health. Despite this strong recent performance, earnings have declined by 2.3% annually over five years. A notable feature is its high level of non-cash earnings, suggesting quality in reported profits. Recently, it announced a cash dividend of CNY 5 per ten shares for Q3 2024, reflecting shareholder-friendly policies and potential value prospects ahead.

- Take a closer look at Jiangnan Yifan MotorLtd's potential here in our health report.

Understand Jiangnan Yifan MotorLtd's track record by examining our Past report.

Taiwan Speciality Chemicals (TPEX:4772)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Speciality Chemicals Corporation focuses on the production and sale of specialty electronic-graded gases and chemicals in Taiwan, with a market capitalization of NT$34.34 billion.

Operations: The primary revenue stream for Taiwan Speciality Chemicals comes from the research, development, and sales of precision chemical materials, amounting to NT$808.72 million.

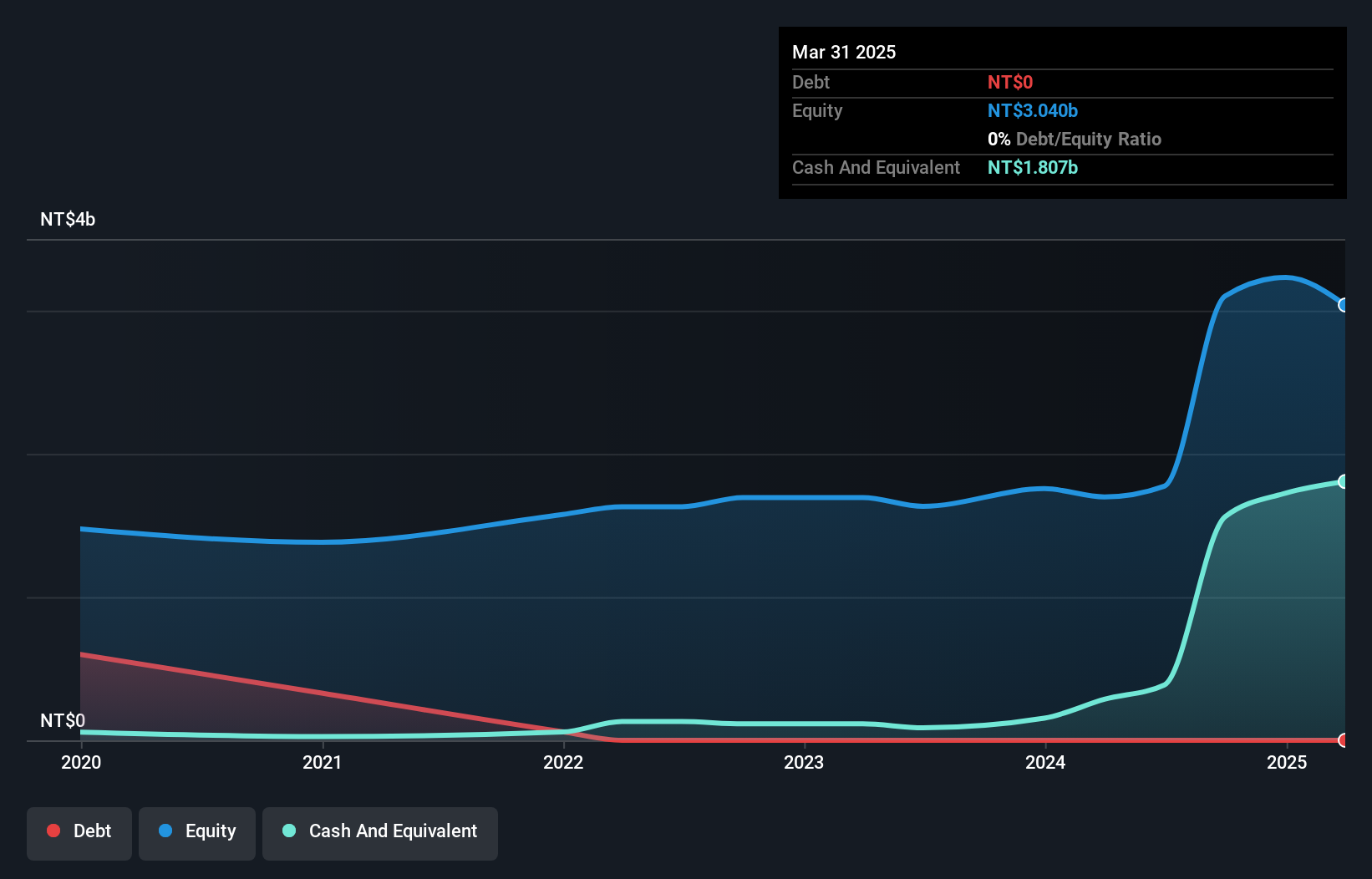

Taiwan Speciality Chemicals, a nimble player in the industry, boasts impressive financial health with earnings growth of 209% last year, outpacing the sector's 13.7%. The company is debt-free, having reduced its obligations over five years and demonstrating high-quality earnings. Recently, it announced a dividend of TWD 2 per share for 2024, totaling TWD 295 million. Despite a volatile share price recently, its free cash flow has shown positive trends with US$429.89 million reported at the latest count. Changes in leadership include Cheng-Chien Chen joining the nomination committee as Tang-Liang Yao steps down.

- Click to explore a detailed breakdown of our findings in Taiwan Speciality Chemicals' health report.

Summing It All Up

- Unlock our comprehensive list of 4721 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Speciality Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4772

Taiwan Speciality Chemicals

Manufactures and sells specialty electronic-graded gases and chemicals in Taiwan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives