Sino-Agri Leading BiosciencesLtd's (SHSE:603970) Shareholders May Want To Dig Deeper Than Statutory Profit

Sino-Agri Leading Biosciences Co.,Ltd's (SHSE:603970) robust recent earnings didn't do much to move the stock. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

See our latest analysis for Sino-Agri Leading BiosciencesLtd

Examining Cashflow Against Sino-Agri Leading BiosciencesLtd's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

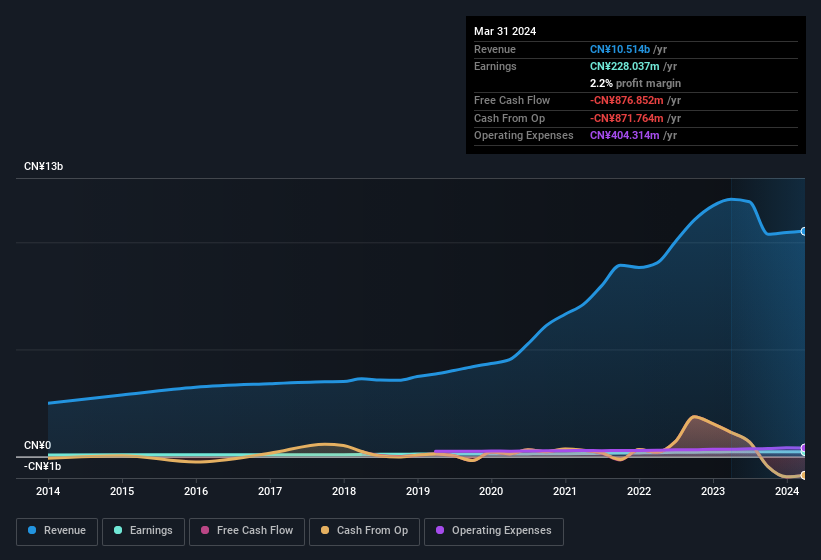

Over the twelve months to March 2024, Sino-Agri Leading BiosciencesLtd recorded an accrual ratio of 1.05. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of CN¥877m, in contrast to the aforementioned profit of CN¥228.0m. It's worth noting that Sino-Agri Leading BiosciencesLtd generated positive FCF of CN¥1.1b a year ago, so at least they've done it in the past. One positive for Sino-Agri Leading BiosciencesLtd shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Sino-Agri Leading BiosciencesLtd's Profit Performance

As we discussed above, we think Sino-Agri Leading BiosciencesLtd's earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that Sino-Agri Leading BiosciencesLtd's underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 65% per annum growth in EPS for the last three. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Sino-Agri Leading BiosciencesLtd, you'd also look into what risks it is currently facing. For instance, we've identified 2 warning signs for Sino-Agri Leading BiosciencesLtd (1 is concerning) you should be familiar with.

Today we've zoomed in on a single data point to better understand the nature of Sino-Agri Leading BiosciencesLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Sino-Agri Leading BiosciencesLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603970

Sino-Agri Leading BiosciencesLtd

Researches, develops, produces, and distributes agrochemicals in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives