Benign Growth For Sino-Agri Leading Biosciences Co.,Ltd (SHSE:603970) Underpins Stock's 25% Plummet

Sino-Agri Leading Biosciences Co.,Ltd (SHSE:603970) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

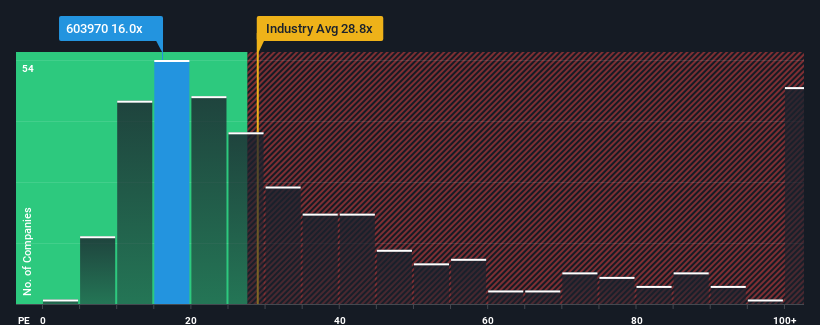

After such a large drop in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 29x, you may consider Sino-Agri Leading BiosciencesLtd as an attractive investment with its 16x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Sino-Agri Leading BiosciencesLtd has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Sino-Agri Leading BiosciencesLtd

How Is Sino-Agri Leading BiosciencesLtd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Sino-Agri Leading BiosciencesLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 3.9% gain to the company's bottom line. The latest three year period has also seen an excellent 65% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 24% per annum growth forecast for the broader market.

With this information, we can see why Sino-Agri Leading BiosciencesLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Sino-Agri Leading BiosciencesLtd's P/E?

The softening of Sino-Agri Leading BiosciencesLtd's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sino-Agri Leading BiosciencesLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Sino-Agri Leading BiosciencesLtd (1 can't be ignored!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Sino-Agri Leading BiosciencesLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603970

Sino-Agri Leading BiosciencesLtd

Researches, develops, produces, and distributes agrochemicals in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives