- China

- /

- Metals and Mining

- /

- SHSE:603876

A Piece Of The Puzzle Missing From Jiangsu Dingsheng New Materials Joint-Stock Co.,Ltd's (SHSE:603876) Share Price

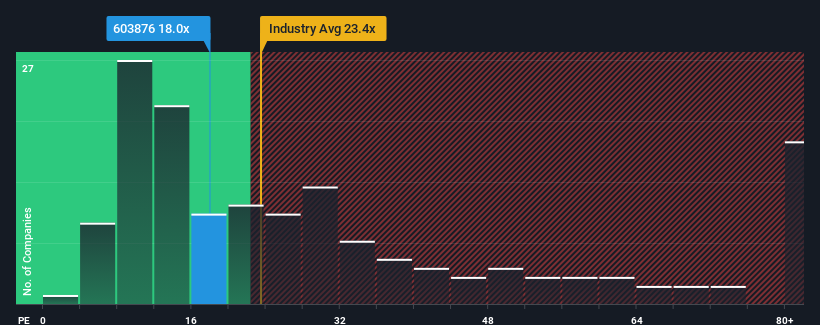

With a price-to-earnings (or "P/E") ratio of 18x Jiangsu Dingsheng New Materials Joint-Stock Co.,Ltd (SHSE:603876) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 28x and even P/E's higher than 52x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Jiangsu Dingsheng New Materials Ltd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Jiangsu Dingsheng New Materials Ltd

How Is Jiangsu Dingsheng New Materials Ltd's Growth Trending?

In order to justify its P/E ratio, Jiangsu Dingsheng New Materials Ltd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 70% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 23% per annum during the coming three years according to the five analysts following the company. With the market predicted to deliver 24% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Jiangsu Dingsheng New Materials Ltd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Jiangsu Dingsheng New Materials Ltd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jiangsu Dingsheng New Materials Ltd, and understanding them should be part of your investment process.

If you're unsure about the strength of Jiangsu Dingsheng New Materials Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603876

Jiangsu Dingsheng New Materials Ltd

Engages in research and development, production, and sales of aluminum plates and foils.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives