- China

- /

- Metals and Mining

- /

- SZSE:000758

Undiscovered Gems in Global Markets to Explore This September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and mixed economic signals, investors are keenly observing the performance of small-cap stocks, which have recently experienced declines alongside major indices like the Nasdaq Composite and Russell 2000. In such an environment, identifying undiscovered gems—a task that requires a keen eye for potential growth opportunities amidst broader market volatility—can prove rewarding for those willing to explore beyond the well-trodden paths of large-cap equities.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| Soft-World International | NA | -1.48% | 5.58% | ★★★★★★ |

| TI Cloud | NA | 12.55% | 6.36% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Banyan Tree Holdings | 42.74% | 15.33% | 72.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Lily Group (SHSE:603823)

Simply Wall St Value Rating: ★★★★★★

Overview: Lily Group Co., Ltd. is a company that manufactures and sells organic pigments in the People’s Republic of China, with a market capitalization of CN¥6.21 billion.

Operations: Lily Group generates revenue primarily from its Chemicals segment, which contributed CN¥2.29 billion. The company's financial performance is influenced by its gross profit margin trend, which has shown notable fluctuations over recent periods.

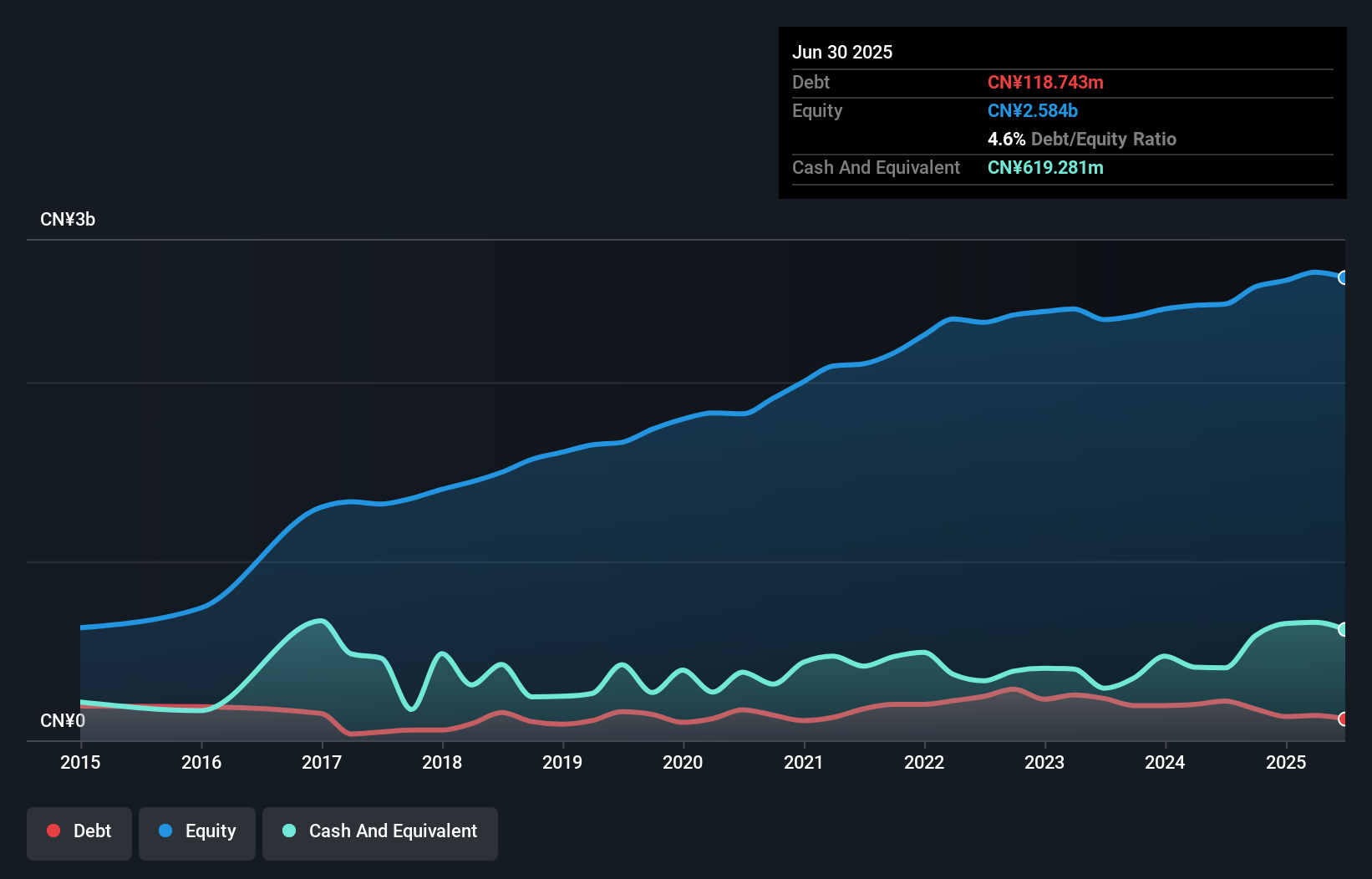

Lily Group, a smaller player in the chemicals sector, has shown earnings growth of 6% over the past year, outpacing the industry's 1.6%. The company boasts a solid financial position with its debt to equity ratio dropping from 9.4 to 4.6 over five years and more cash than total debt. Despite recent volatility in share price, Lily Group's price-to-earnings ratio stands at 37.6x compared to the CN market average of 45.3x, suggesting potential value for investors looking for quality earnings and free cash flow positivity amidst industry challenges.

- Take a closer look at Lily Group's potential here in our health report.

Understand Lily Group's track record by examining our Past report.

UCAP Cloud Information TechnologyLtd (SHSE:688228)

Simply Wall St Value Rating: ★★★★★☆

Overview: UCAP Cloud Information Technology Co., Ltd. operates in the cloud computing sector, providing information technology services, and has a market capitalization of approximately CN¥12.90 billion.

Operations: UCAP Cloud Information Technology Co., Ltd. generates revenue primarily through its cloud computing and IT service offerings. The company's financial performance is highlighted by a net profit margin of 15%, reflecting its ability to manage costs effectively while providing these services.

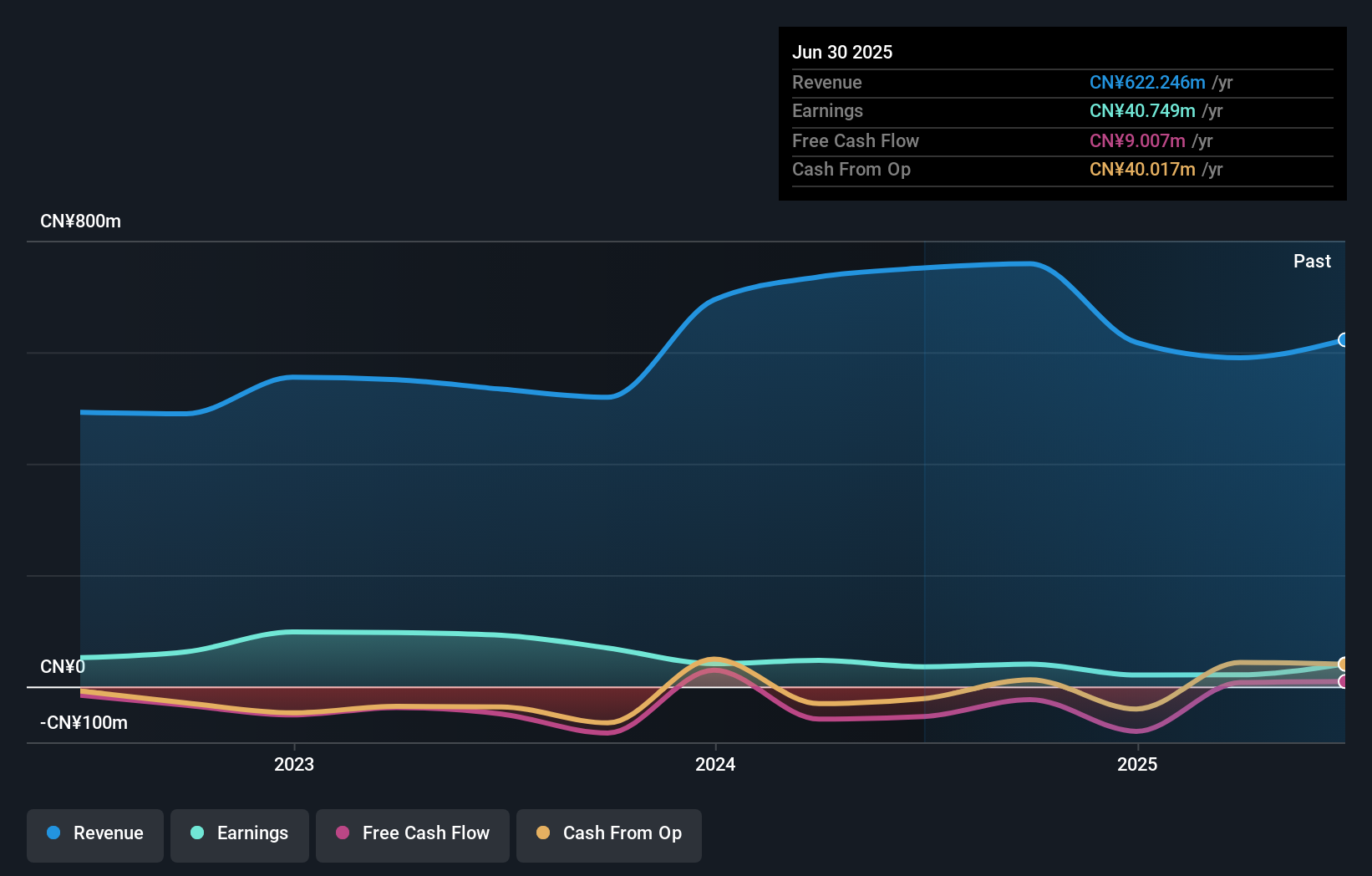

UCAP Cloud Information Technology Ltd. has shown notable progress, with earnings growing by 14.9% over the past year, outpacing the IT industry average of -8.7%. Despite a volatile share price recently, the company remains profitable and free cash flow positive. The debt to equity ratio increased to 13.5% from zero over five years, though it still holds more cash than total debt, indicating financial resilience. Recent results for H1 2025 show sales at CNY 159.46 million and net income at CNY 3.78 million compared to a loss last year, reflecting operational improvements and potential for future growth in revenue streams.

China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd (SZSE:000758)

Simply Wall St Value Rating: ★★★★★★

Overview: China Nonferrous Metal Industry's Foreign Engineering and Construction Co., Ltd. is a company engaged in engineering, construction, and manufacturing activities within the non-ferrous metal industry, with a market capitalization of approximately CN¥12.54 billion.

Operations: The primary revenue streams for the company are contracted projects and non-ferrous metal activities, contributing CN¥5.01 billion and CN¥3.90 billion, respectively. Equipment manufacturing adds another CN¥256.23 million to the total revenue mix.

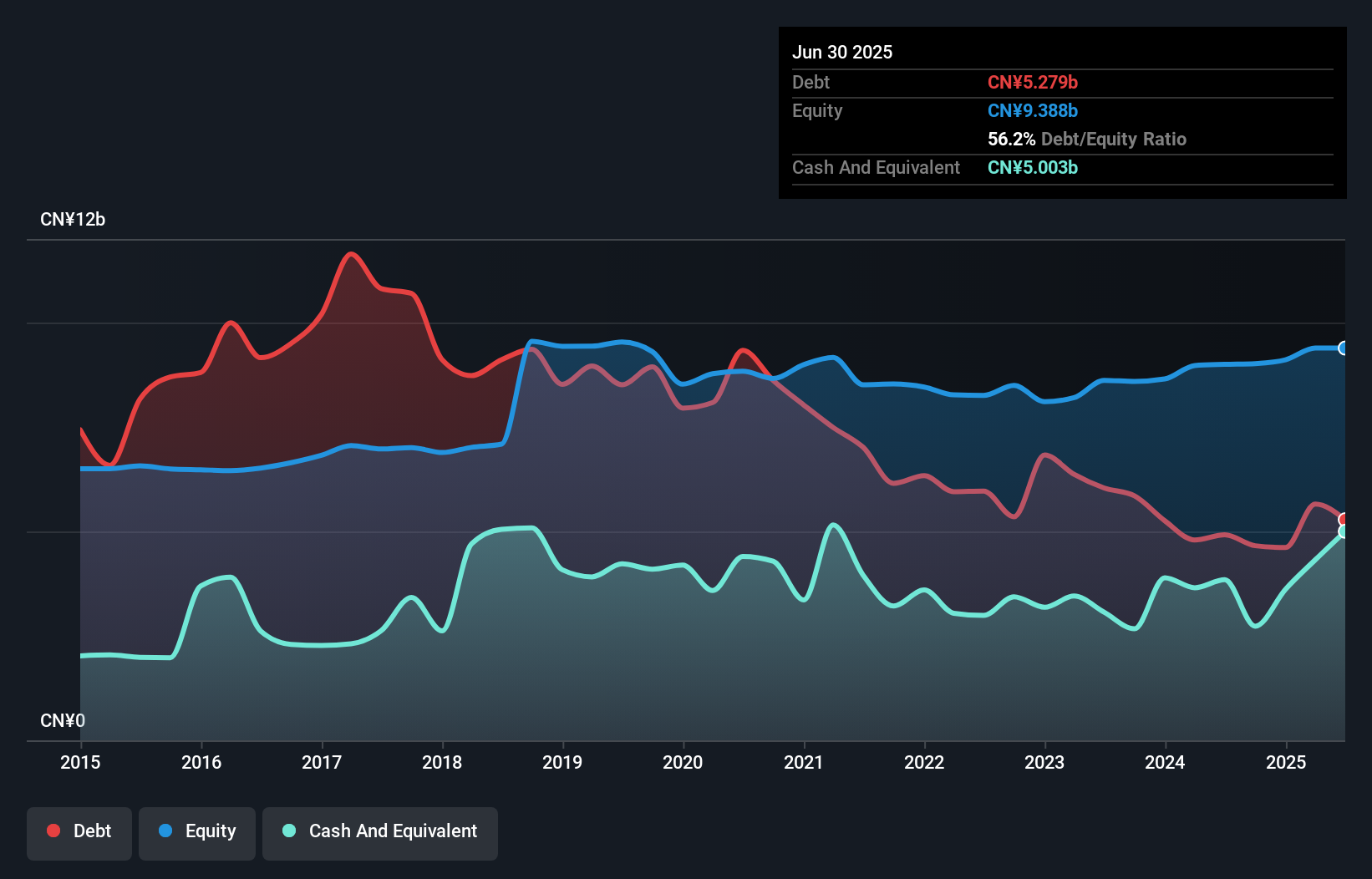

China Nonferrous Metal Industry's Foreign Engineering and Construction Ltd. showcases a robust financial profile, with its net income rising to CNY 440.53 million from CNY 314.66 million last year, indicating strong earnings growth of 34.6% that outpaces the broader Metals and Mining industry. The company's price-to-earnings ratio of 25x suggests good value compared to the CN market average of 45.3x, while its net debt to equity ratio has impressively decreased from 105.7% to a satisfactory level of 56.2% over five years, reflecting prudent debt management strategies in this small-cap space.

Where To Now?

- Navigate through the entire inventory of 2933 Global Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000758

China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd

China Nonferrous Metal Industry's Foreign Engineering and Construction Co.,Ltd.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives