- Hong Kong

- /

- Capital Markets

- /

- SEHK:6066

3 Asian Stocks Estimated To Be Trading At Discounts Of 20.6% To 47.5%

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and inflationary pressures, Asian equities present a unique landscape marked by cautious optimism and strategic opportunities. In this environment, identifying undervalued stocks becomes crucial for investors seeking to capitalize on potential market inefficiencies, particularly those estimated to be trading at significant discounts.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Livero (TSE:9245) | ¥1701.00 | ¥3374.76 | 49.6% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥43.52 | CN¥85.48 | 49.1% |

| Fuji (TSE:6134) | ¥2268.50 | ¥4455.15 | 49.1% |

| StemCell Institute (TSE:7096) | ¥1060.00 | ¥2118.09 | 50% |

| cottaLTD (TSE:3359) | ¥431.00 | ¥858.54 | 49.8% |

| Kanto Denka Kogyo (TSE:4047) | ¥843.00 | ¥1679.86 | 49.8% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.44 | CN¥26.41 | 49.1% |

| GEM (SZSE:002340) | CN¥6.14 | CN¥12.27 | 49.9% |

| Dive (TSE:151A) | ¥921.00 | ¥1817.84 | 49.3% |

| BalnibarbiLtd (TSE:3418) | ¥1166.00 | ¥2297.01 | 49.2% |

Let's explore several standout options from the results in the screener.

CSC Financial (SEHK:6066)

Overview: CSC Financial Co., Ltd. operates as an investment banking service provider in Mainland China and internationally, with a market cap of HK$177.25 billion.

Operations: CSC Financial Co., Ltd. generates revenue through its investment banking services in Mainland China and internationally.

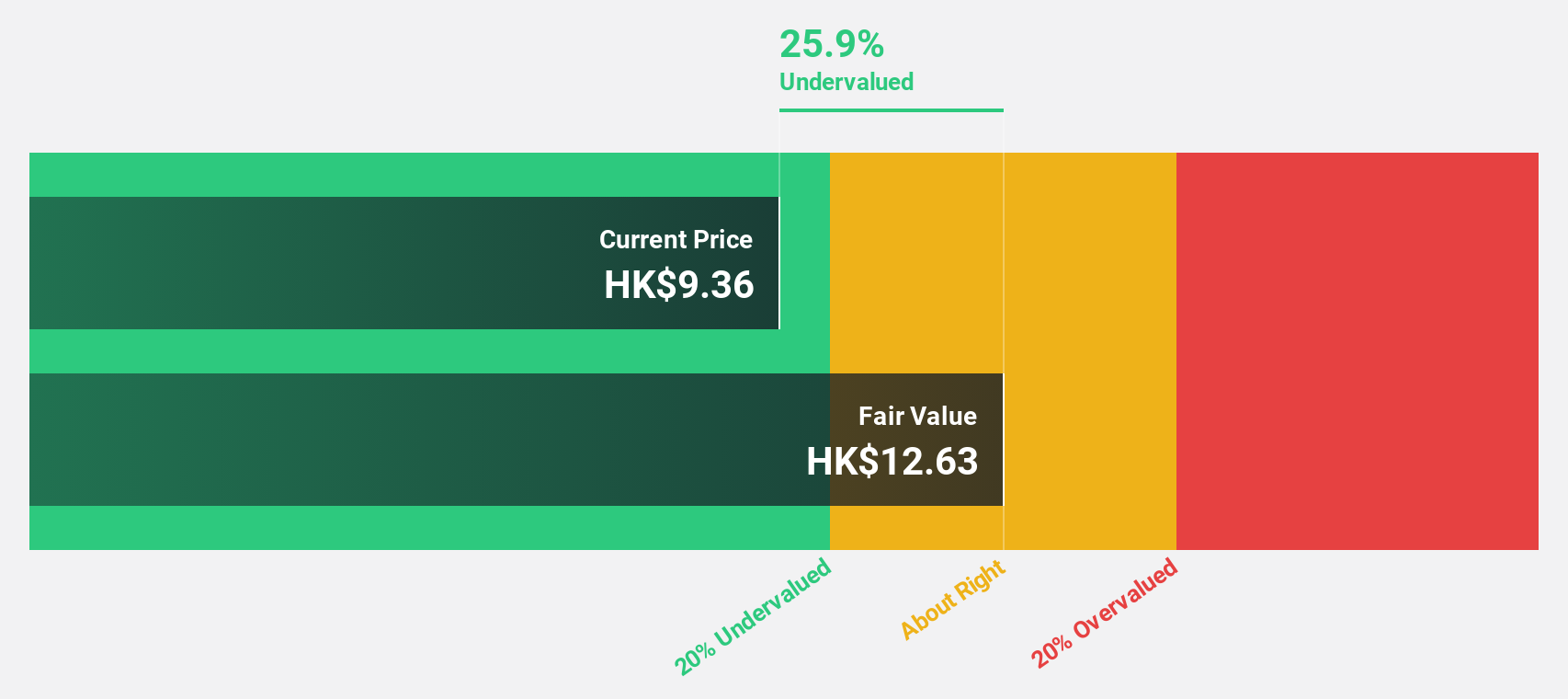

Estimated Discount To Fair Value: 26.1%

CSC Financial's recent earnings report shows a strong increase in net income, rising to CNY 1.84 billion for Q1 2025 from CNY 1.23 billion a year earlier, driven by significant growth in brokerage and proprietary trading revenues. The stock is trading at HK$9.34, below its estimated fair value of HK$12.64, representing over 20% undervaluation based on discounted cash flow analysis. However, the dividend track record remains unstable despite the company's robust financial performance and growth prospects in earnings and revenue exceeding market averages.

- Our comprehensive growth report raises the possibility that CSC Financial is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of CSC Financial.

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. operates in China, producing and selling paints, coatings, and building materials under the 3trees brand with a market capitalization of CN¥25.97 billion.

Operations: SKSHU Paint Co., Ltd. generates revenue through its production and sale of paints, coatings, and building materials under the 3trees brand in China.

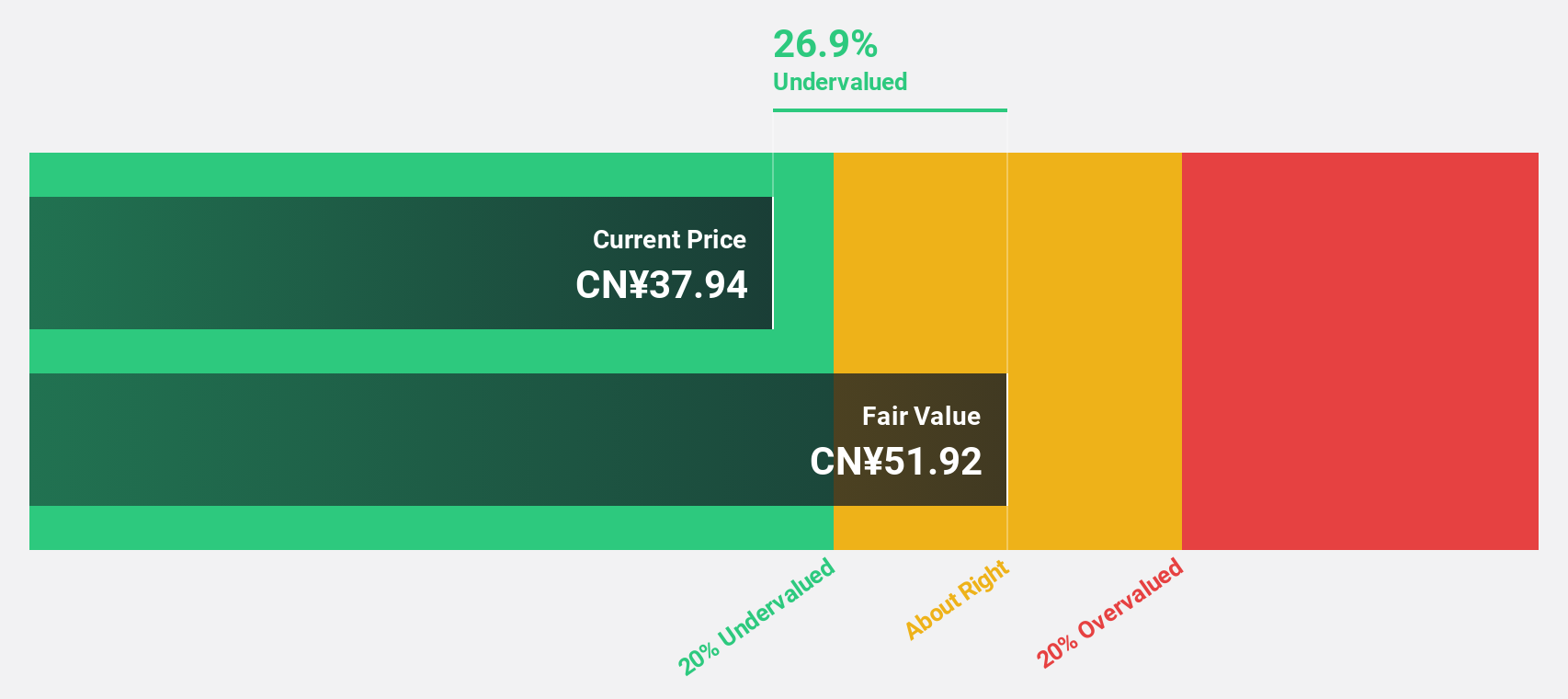

Estimated Discount To Fair Value: 20.6%

SKSHU Paint Co., Ltd. is trading at CN¥35.2, which is 20.6% below its estimated fair value of CN¥44.34, suggesting it may be undervalued based on cash flow analysis. Despite a high level of debt and an unstable dividend track record, the company has shown significant earnings growth and forecasts indicate continued robust profit increases outpacing market averages. Recent Q1 2025 results reflect net income growth to CN¥105.15 million from CN¥47.08 million year-over-year, indicating strong operational performance amidst slower revenue growth projections compared to the market average.

- Upon reviewing our latest growth report, SKSHU PaintLtd's projected financial performance appears quite optimistic.

- Dive into the specifics of SKSHU PaintLtd here with our thorough financial health report.

Loncin Motor (SHSE:603766)

Overview: Loncin Motor Co., Ltd. manufactures and sells generating sets, agricultural machinery equipment, light-duty power units, and two-wheeled motorcycles in Japan and internationally, with a market cap of CN¥29.20 billion.

Operations: Revenue segments for Loncin Motor Co., Ltd. include generating sets, agricultural machinery equipment, light-duty power units, and two-wheeled motorcycles.

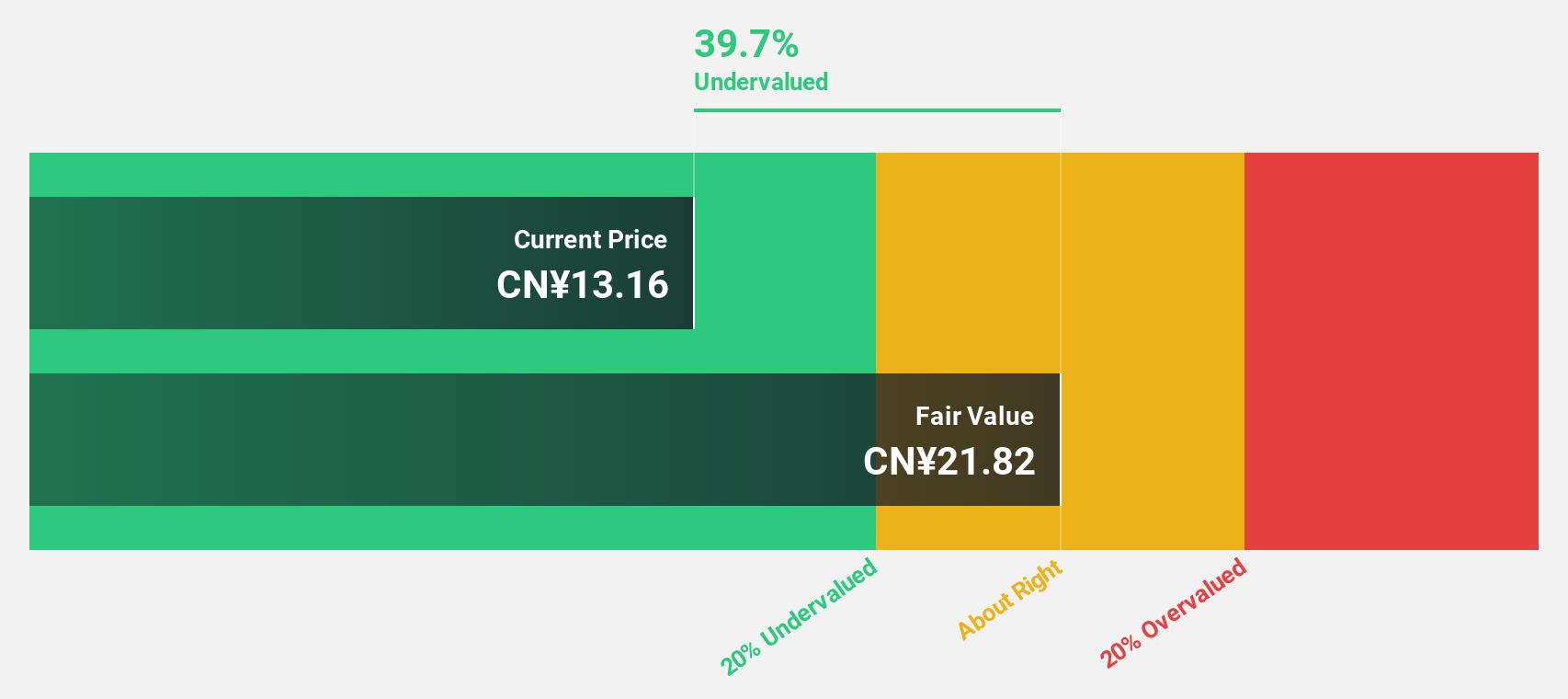

Estimated Discount To Fair Value: 47.5%

Loncin Motor, trading at CN¥14.22, is significantly undervalued as it sits 47.5% below its fair value estimate of CN¥27.08 based on cash flow analysis. Despite an unstable dividend history, recent performance shows strong earnings growth with Q1 2025 net income rising to CN¥506.88 million from CN¥257.57 million a year ago and revenue increasing to CN¥4,646.32 million from CN¥3,295.77 million year-over-year, highlighting robust operational results amidst slower revenue growth forecasts than the market average.

- According our earnings growth report, there's an indication that Loncin Motor might be ready to expand.

- Click here to discover the nuances of Loncin Motor with our detailed financial health report.

Where To Now?

- Dive into all 302 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6066

CSC Financial

Provides investment banking services in Mainland China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives