- China

- /

- Paper and Forestry Products

- /

- SHSE:603733

A Piece Of The Puzzle Missing From Xianhe Co.,Ltd.'s (SHSE:603733) 39% Share Price Climb

Xianhe Co.,Ltd. (SHSE:603733) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

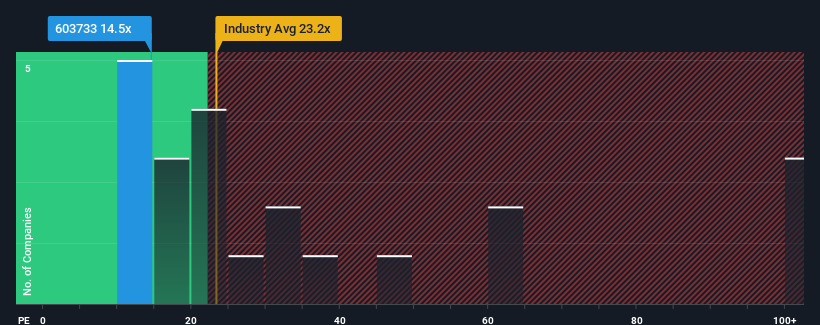

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider XianheLtd as a highly attractive investment with its 14.5x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for XianheLtd as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for XianheLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as XianheLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 88%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 4.4% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the seven analysts watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it odd that XianheLtd is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Even after such a strong price move, XianheLtd's P/E still trails the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that XianheLtd currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for XianheLtd (of which 2 are a bit concerning!) you should know about.

If you're unsure about the strength of XianheLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603733

XianheLtd

Develops and produces specialty papers, pulps, paper products, and related chemical additives in China and internationally.

Proven track record and fair value.

Market Insights

Community Narratives