Optimistic Investors Push Wuxi Acryl Technology Co., Ltd. (SHSE:603722) Shares Up 32% But Growth Is Lacking

Those holding Wuxi Acryl Technology Co., Ltd. (SHSE:603722) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

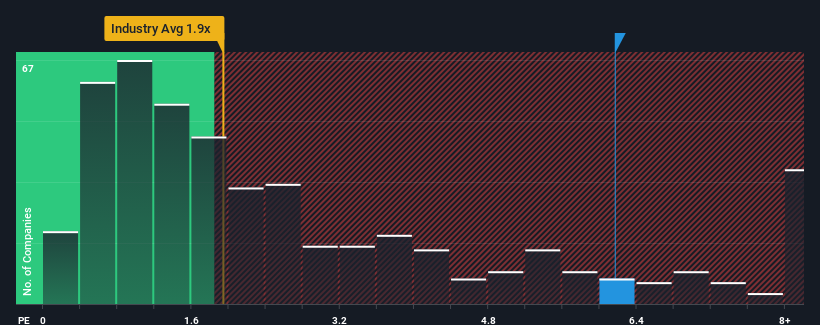

After such a large jump in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Wuxi Acryl Technology as a stock to avoid entirely with its 6.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Wuxi Acryl Technology

How Has Wuxi Acryl Technology Performed Recently?

While the industry has experienced revenue growth lately, Wuxi Acryl Technology's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wuxi Acryl Technology.Is There Enough Revenue Growth Forecasted For Wuxi Acryl Technology?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Wuxi Acryl Technology's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 33%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.0% during the coming year according to the only analyst following the company. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

With this information, we find it concerning that Wuxi Acryl Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has lead to Wuxi Acryl Technology's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Wuxi Acryl Technology, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Wuxi Acryl Technology you should know about.

If you're unsure about the strength of Wuxi Acryl Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Acryl Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603722

Wuxi Acryl Technology

Produces and sells polyester, acrylic, polyurethane, high-performance epoxy, and special application resins in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives