Undiscovered Gems With Strong Fundamentals For November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, small-cap stocks have experienced notable fluctuations, with indices like the S&P MidCap 400 and Russell 2000 reflecting these shifts. Amidst this backdrop of economic and political developments, identifying stocks with strong fundamentals becomes crucial for uncovering potential opportunities in a volatile environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Shree Digvijay Cement | 21.42% | 13.22% | 13.00% | ★★★★★☆ |

| Interarch Building Products | 2.55% | 10.02% | 28.21% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Smith Adhesive New MaterialLtd (SHSE:603683)

Simply Wall St Value Rating: ★★★★★☆

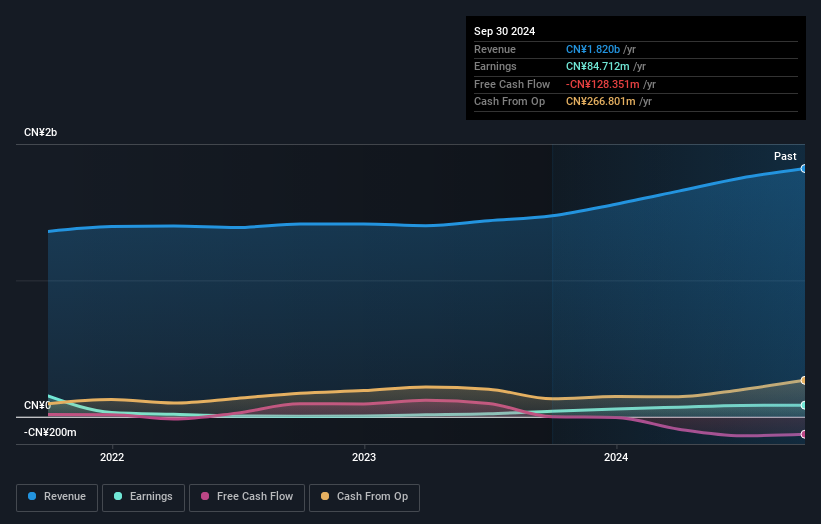

Overview: Shanghai Smith Adhesive New Material Co., Ltd specializes in the manufacture and sale of adhesive tapes and adhesives in China, with a market cap of CN¥2.37 billion.

Operations: Shanghai Smith Adhesive New Material Co., Ltd generates revenue primarily through the sale of adhesive tapes and adhesives. The company's financial performance is influenced by its cost structure, where fluctuations in raw material prices can impact profitability.

Shanghai Smith Adhesive New Material Ltd, a nimble player in the adhesive industry, has shown impressive growth with earnings surging 106% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 34.9%, reflecting prudent financial management despite an increase from 43.7% to 51.5% over five years. Recent results highlight robust sales of CNY1.36 billion for nine months ending September 2024, up from CNY1.10 billion previously, alongside net income rising to CNY66 million from CNY39 million last year, showcasing strong operational performance and potential for future value creation.

Guangdong AVCiT Technology Holding (SZSE:001229)

Simply Wall St Value Rating: ★★★★★★

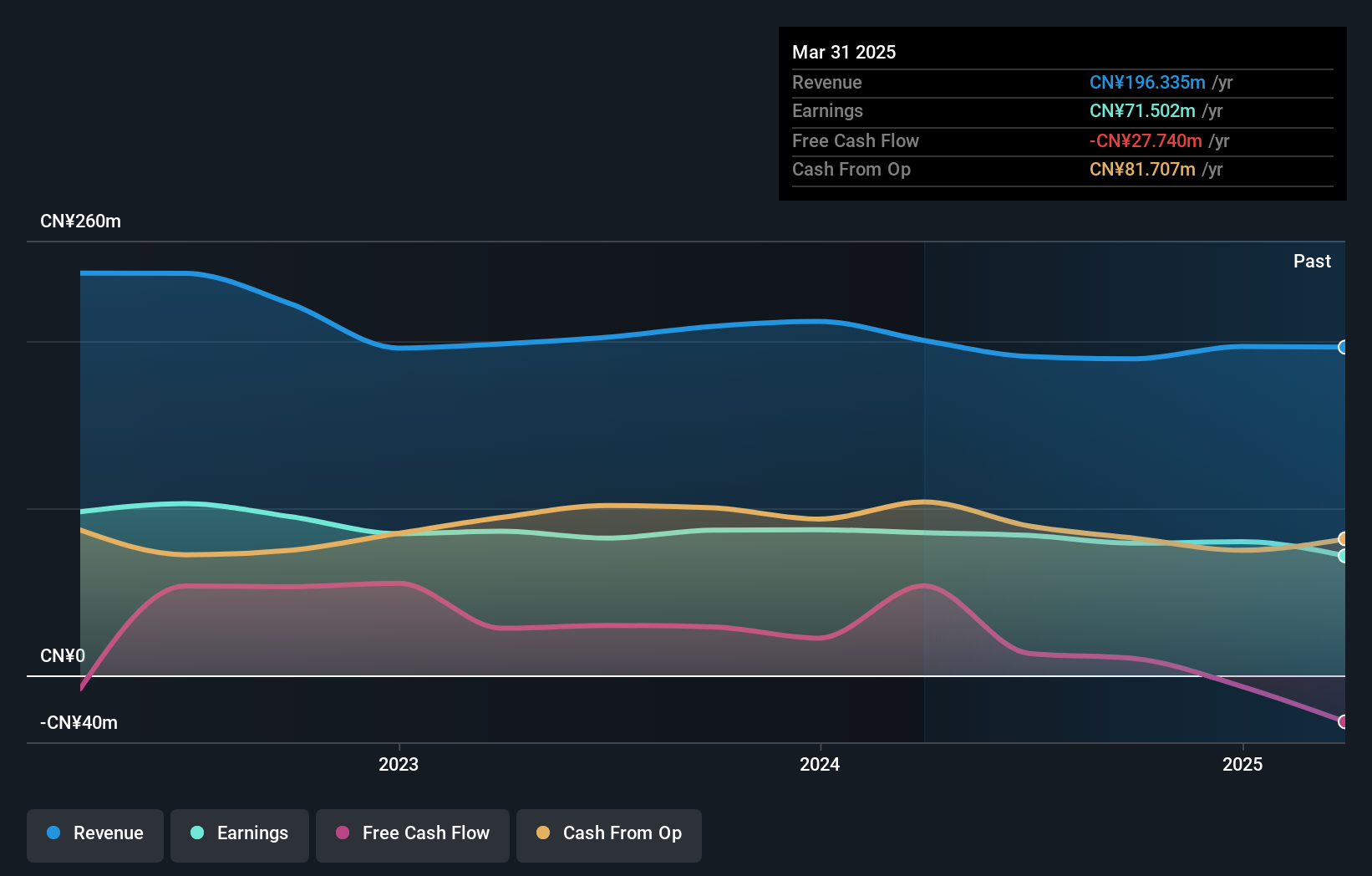

Overview: Guangdong AVCiT Technology Holding Co., Ltd. operates in the technology sector and has a market capitalization of CN¥2.68 billion.

Operations: Guangdong AVCiT Technology Holding generates revenue primarily from its technology-related operations. The company's financial performance is reflected in its market capitalization of CN¥2.68 billion.

Guangdong AVCiT Technology Holding, a smaller player in the tech scene, shows mixed financials with a Price-To-Earnings ratio of 37.2x, favorably below the industry average of 65.3x. Despite reporting high-quality earnings and remaining debt-free, its recent performance reveals challenges; sales for the nine months ended September 2024 were CNY 117.4 million compared to CNY 139.74 million last year, and net income stood at CNY 52.13 million against CNY 60.15 million previously. The company is free cash flow positive but experienced negative earnings growth of -9%, contrasting with an industry decline of -3%.

Union Bank of Taiwan (TWSE:2838)

Simply Wall St Value Rating: ★★★★★★

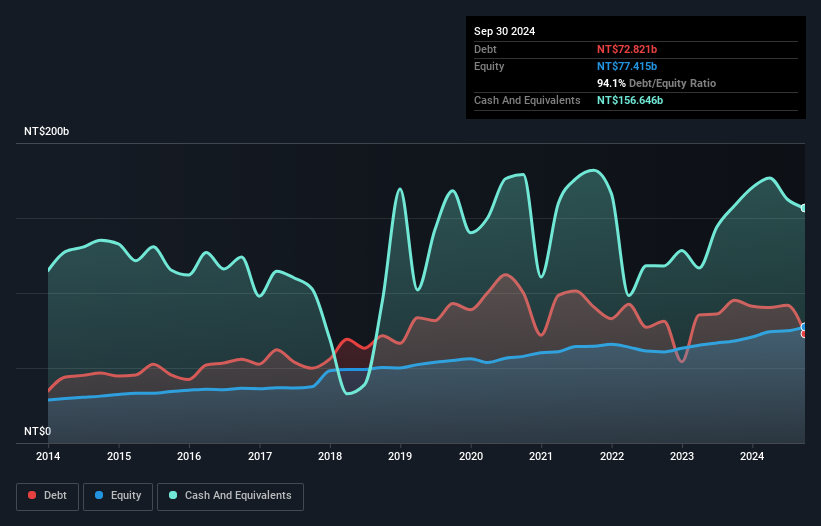

Overview: Union Bank of Taiwan offers a range of banking products and services and has a market capitalization of NT$65.03 billion.

Operations: Union Bank of Taiwan generates revenue through its diverse banking products and services. The bank's net profit margin is a key financial metric to consider when evaluating its profitability.

Union Bank of Taiwan, a relatively small player in the financial sector, has demonstrated notable earnings growth of 14.2% over the past year, outpacing the industry average of 1.5%. With total assets standing at NT$981 billion and equity at NT$77.4 billion, it holds a robust position in terms of asset management. The bank's allowance for bad loans is more than adequate at 389%, ensuring strong risk management practices. Furthermore, its liabilities are predominantly low-risk with customer deposits making up 88%, which is less risky compared to external borrowing sources. Despite these strengths, shareholders experienced dilution recently.

- Dive into the specifics of Union Bank of Taiwan here with our thorough health report.

Assess Union Bank of Taiwan's past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4643 more companies for you to explore.Click here to unveil our expertly curated list of 4646 Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2838

Flawless balance sheet with solid track record.