After Leaping 37% Sanxiang Advanced Materials Co., Ltd. (SHSE:603663) Shares Are Not Flying Under The Radar

The Sanxiang Advanced Materials Co., Ltd. (SHSE:603663) share price has done very well over the last month, posting an excellent gain of 37%. The last month tops off a massive increase of 130% in the last year.

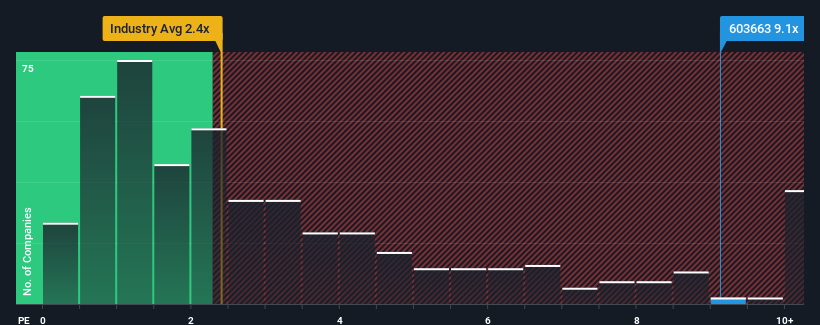

After such a large jump in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Sanxiang Advanced Materials as a stock to avoid entirely with its 9.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Sanxiang Advanced Materials

How Has Sanxiang Advanced Materials Performed Recently?

Recent revenue growth for Sanxiang Advanced Materials has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sanxiang Advanced Materials.How Is Sanxiang Advanced Materials' Revenue Growth Trending?

Sanxiang Advanced Materials' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 52% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 24%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Sanxiang Advanced Materials' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Sanxiang Advanced Materials' P/S?

The strong share price surge has lead to Sanxiang Advanced Materials' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Sanxiang Advanced Materials' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Sanxiang Advanced Materials with six simple checks.

If these risks are making you reconsider your opinion on Sanxiang Advanced Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603663

Sanxiang Advanced Materials

Engages in the manufacture and sale of fused zirconia, cast modified materials, and single crystal fused aluminum materials.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026