- China

- /

- Paper and Forestry Products

- /

- SHSE:603607

Risks To Shareholder Returns Are Elevated At These Prices For Zhejiang Jinghua Laser Technology Co.,Ltd (SHSE:603607)

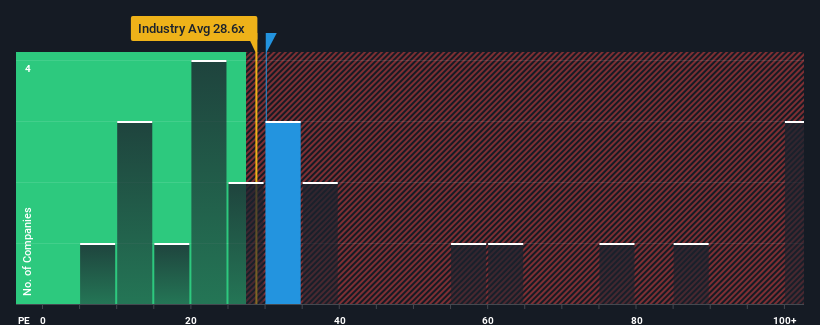

There wouldn't be many who think Zhejiang Jinghua Laser Technology Co.,Ltd's (SHSE:603607) price-to-earnings (or "P/E") ratio of 30x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Zhejiang Jinghua Laser TechnologyLtd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Zhejiang Jinghua Laser TechnologyLtd

Is There Some Growth For Zhejiang Jinghua Laser TechnologyLtd?

There's an inherent assumption that a company should be matching the market for P/E ratios like Zhejiang Jinghua Laser TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 18% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Zhejiang Jinghua Laser TechnologyLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Zhejiang Jinghua Laser TechnologyLtd's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Zhejiang Jinghua Laser TechnologyLtd revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zhejiang Jinghua Laser TechnologyLtd (1 is a bit unpleasant!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jinghua Laser TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603607

Zhejiang Jinghua Laser TechnologyLtd

Develops, manufactures, and sells laser holographic molded products.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives