- Hong Kong

- /

- Auto Components

- /

- SEHK:2025

Global Penny Stocks: Tian Tu Capital And 2 Other Promising Picks

Reviewed by Simply Wall St

Global markets have been buoyed by favorable trade deal news, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, spurred by agreements between the U.S. and countries such as Japan and Indonesia. Though the term 'penny stock' might sound like a relic of past trading days, their potential remains relevant today. These smaller or newer companies can offer a mix of affordability and growth potential when grounded in strong financials, making them an intriguing area for investors seeking hidden value.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$933.81M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.495 | SGD200.62M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.515 | MYR304.7M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.56 | SGD10.08B | ✅ 5 ⚠️ 0 View Analysis > |

| Libertas 7 (BME:LIB) | €2.46 | €52.42M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.96 | £304.63M | ✅ 5 ⚠️ 1 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.835 | MYR6.43B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £192.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.972 | €32.78M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,830 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Tian Tu Capital (SEHK:1973)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm focusing on investments in small and medium-sized companies across various stages, with a market cap of HK$2.54 billion.

Operations: The company's revenue segment includes Asset Management, which reported CN¥662.24 million.

Market Cap: HK$2.54B

Tian Tu Capital Co., Ltd. operates with a market cap of HK$2.54 billion, focusing on private equity and venture capital investments in small to medium-sized companies. Despite having CN¥1.6 billion in short-term assets that exceed its short-term liabilities, the company remains pre-revenue with less than US$1 million in revenue, indicating it is not yet generating significant income from its operations. The firm has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, although long-term liabilities remain uncovered by current assets. Recent board changes could influence future strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Tian Tu Capital.

- Evaluate Tian Tu Capital's historical performance by accessing our past performance report.

Ruifeng Power Group (SEHK:2025)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ruifeng Power Group Company Limited is an investment holding company focused on the design, development, manufacture, and sale of cylinder blocks and heads in China with a market cap of HK$3.50 billion.

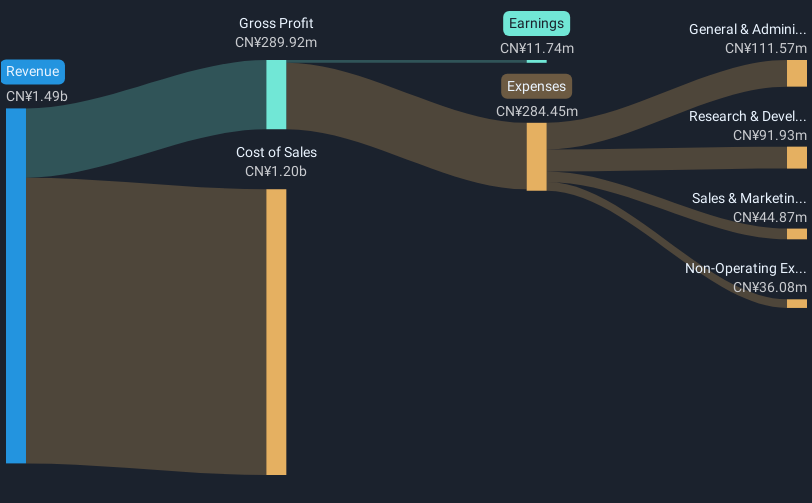

Operations: The company's revenue is primarily derived from cylinder blocks at CN¥716.83 million, followed by cylinder heads at CN¥213.16 million, and ancillary cylinder block components and others at CN¥26.86 million.

Market Cap: HK$3.5B

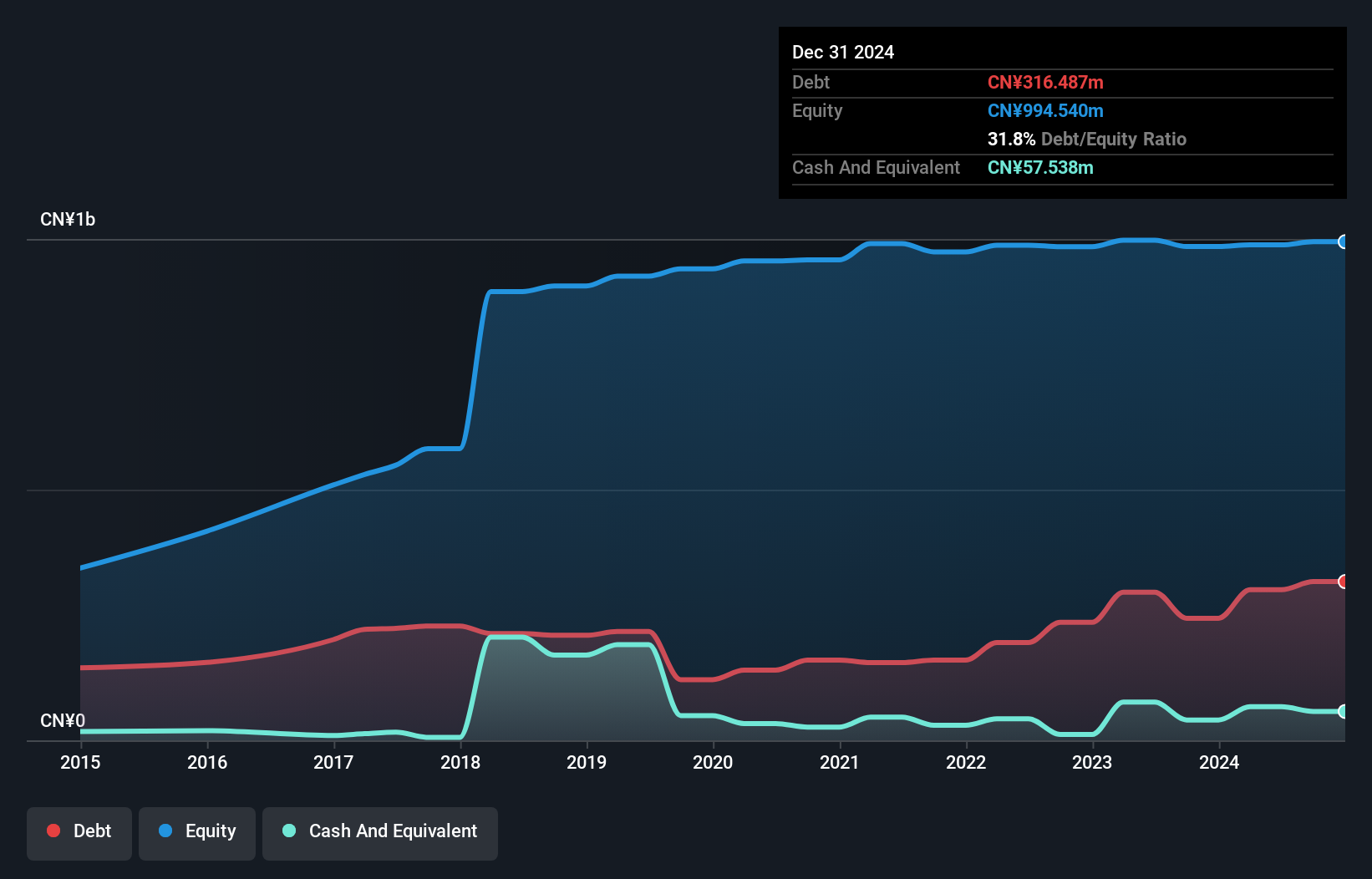

Ruifeng Power Group, with a market cap of HK$3.50 billion, primarily generates revenue from cylinder blocks and heads in China. Despite earnings growth of 71.5% over the past year, its five-year average shows a decline of 19.4% annually. The company maintains high-quality earnings and has improved profit margins to 2%. Short-term assets exceed both short- and long-term liabilities, indicating financial stability. However, the debt-to-equity ratio has increased to 31.8% over five years. Recent board changes include appointing Mr. Wong Tak Chun as an independent non-executive director, potentially impacting governance positively with his extensive experience in finance and governance.

- Jump into the full analysis health report here for a deeper understanding of Ruifeng Power Group.

- Assess Ruifeng Power Group's previous results with our detailed historical performance reports.

Chongqing Zaisheng Technology (SHSE:603601)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chongqing Zaisheng Technology Co., Ltd. is involved in the research, manufacturing, and marketing of glass microfiber products for purification and energy-saving markets in China, with a market cap of CN¥4.89 billion.

Operations: Chongqing Zaisheng Technology Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥4.89B

Chongqing Zaisheng Technology, with a market cap of CN¥4.89 billion, has seen its net profit margins improve to 6.3% from 2.3% last year, reflecting stronger financial performance despite a large one-off gain impacting results. The company's short-term assets exceed both short- and long-term liabilities, suggesting solid liquidity management. Although earnings grew by 147% over the past year, they have declined by an average of 34.7% annually over five years. Trading below estimated fair value and maintaining more cash than debt indicates potential undervaluation but comes with high share price volatility recently observed in the market.

- Get an in-depth perspective on Chongqing Zaisheng Technology's performance by reading our balance sheet health report here.

- Assess Chongqing Zaisheng Technology's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Dive into all 3,830 of the Global Penny Stocks we have identified here.

- Want To Explore Some Alternatives? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2025

Ruifeng Power Group

An investment holding company, engages in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives