- China

- /

- Metals and Mining

- /

- SHSE:603113

Even With A 37% Surge, Cautious Investors Are Not Rewarding Jinneng Science&Technology Co.,Ltd's (SHSE:603113) Performance Completely

Jinneng Science&Technology Co.,Ltd (SHSE:603113) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

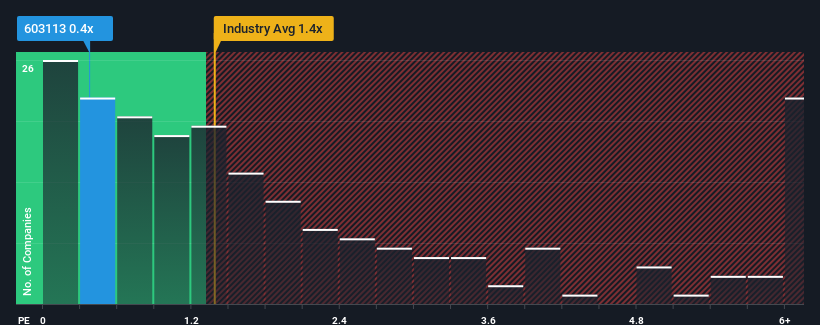

Even after such a large jump in price, considering around half the companies operating in China's Metals and Mining industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Jinneng Science&TechnologyLtd as an solid investment opportunity with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Jinneng Science&TechnologyLtd

How Has Jinneng Science&TechnologyLtd Performed Recently?

While the industry has experienced revenue growth lately, Jinneng Science&TechnologyLtd's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Jinneng Science&TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Jinneng Science&TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 58% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 21% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

In light of this, it's peculiar that Jinneng Science&TechnologyLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Jinneng Science&TechnologyLtd's P/S?

Jinneng Science&TechnologyLtd's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Jinneng Science&TechnologyLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Jinneng Science&TechnologyLtd.

If you're unsure about the strength of Jinneng Science&TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603113

Jinneng Science&TechnologyLtd

An energy-focused industrial company, produces and distributes fine chemical and coal chemical products in China and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives