Global markets have recently experienced broad-based gains, with U.S. indexes nearing record highs and smaller-cap indexes outperforming their larger counterparts. In this context, penny stocks—often seen as a niche investment area—continue to offer intriguing opportunities for growth, especially when they are backed by strong financial health. Despite being considered a somewhat outdated term, penny stocks can still represent significant potential for investors seeking hidden value in smaller or newer companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.19 | £836.42M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.275 | £417.71M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.69 | £74.76M | ★★★★☆☆ |

Click here to see the full list of 5,749 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sichuan Hebang Biotechnology (SHSE:603077)

Simply Wall St Financial Health Rating: ★★★★☆☆

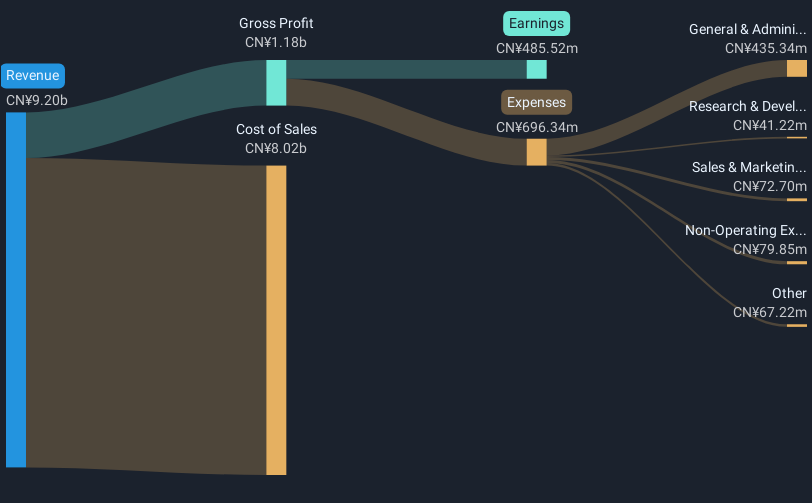

Overview: Sichuan Hebang Biotechnology Corporation Limited operates in the agricultural, chemical, and new material sectors with a market cap of CN¥16.37 billion.

Operations: Sichuan Hebang Biotechnology Corporation Limited has not reported any specific revenue segments.

Market Cap: CN¥16.37B

Sichuan Hebang Biotechnology Corporation Limited has demonstrated some financial resilience with short-term assets of CN¥10.8 billion covering both long-term and short-term liabilities, suggesting a solid liquidity position. However, the company's net profit margins have decreased to 5.3% from 15.6% last year, indicating profitability challenges despite having high-quality earnings and satisfactory debt levels with a net debt to equity ratio of 4.4%. The recent share buyback program valued at up to CN¥200 million aims to support shareholder value but comes amid negative earnings growth over the past year and an elevated price-to-earnings ratio of 33.7x relative to market norms.

- Take a closer look at Sichuan Hebang Biotechnology's potential here in our financial health report.

- Review our historical performance report to gain insights into Sichuan Hebang Biotechnology's track record.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Financial Health Rating: ★★★★☆☆

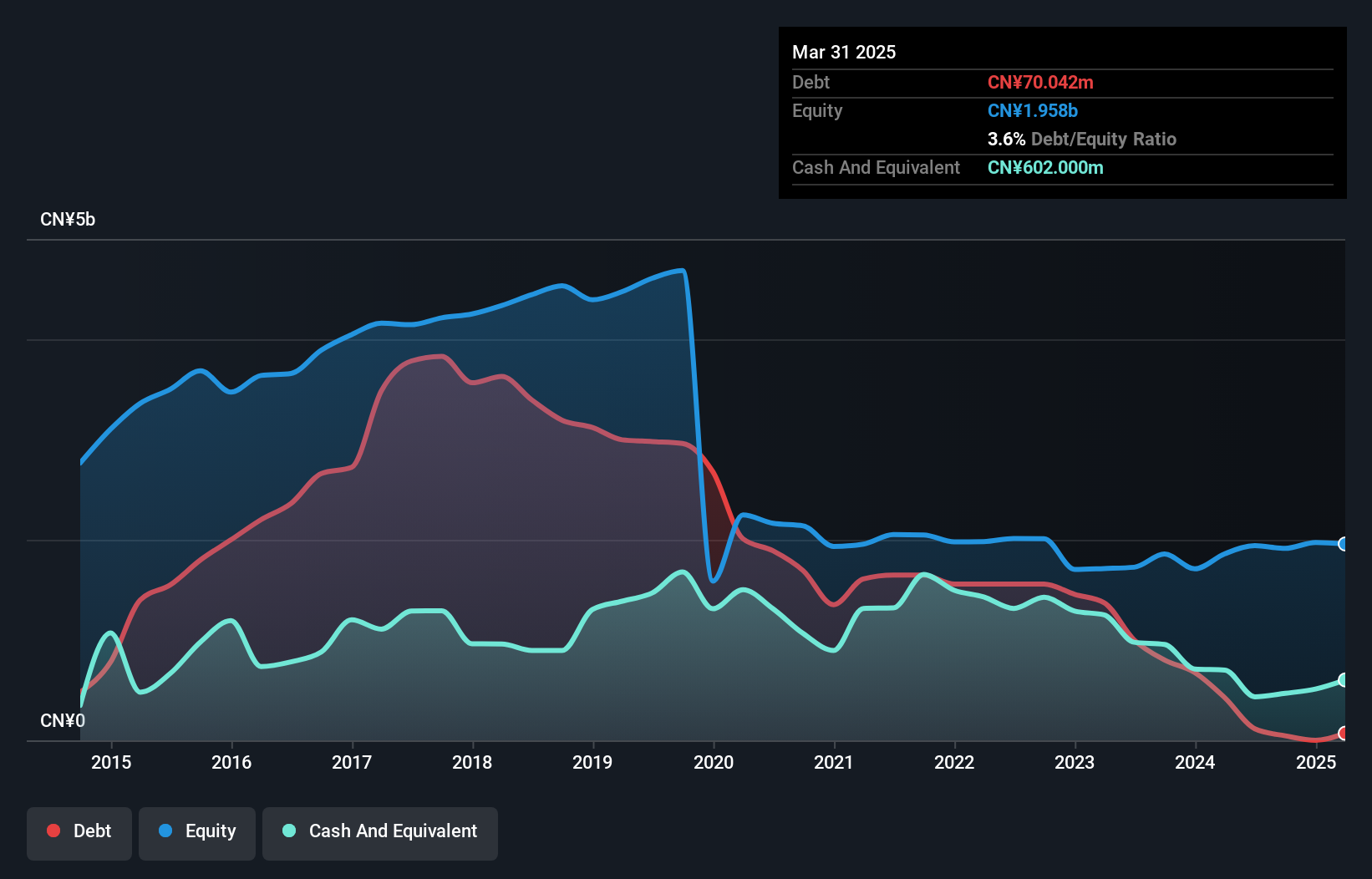

Overview: Harbin Gloria Pharmaceuticals Co., Ltd is involved in the research, development, production, and sale of pharmaceutical products mainly in China, with a market cap of CN¥5.77 billion.

Operations: Harbin Gloria Pharmaceuticals does not report specific revenue segments.

Market Cap: CN¥5.77B

Harbin Gloria Pharmaceuticals Co., Ltd. has shown financial improvement, becoming profitable with a significant reduction in its debt-to-equity ratio from 63.2% to 2.3% over five years, and maintaining more cash than total debt. Despite this, the company's short-term assets of CN¥870.4 million barely cover its short-term liabilities of CN¥871.9 million, indicating liquidity constraints. Recent earnings highlight a decline in sales and net income compared to the previous year, alongside shareholder dilution by 3.8%. Investor activism is evident with recent board nominations and approved shareholder proposals at extraordinary meetings.

- Unlock comprehensive insights into our analysis of HARBIN GLORIA PHARMACEUTICALS stock in this financial health report.

- Examine HARBIN GLORIA PHARMACEUTICALS' past performance report to understand how it has performed in prior years.

Pubang Landscape Architecture (SZSE:002663)

Simply Wall St Financial Health Rating: ★★★★★☆

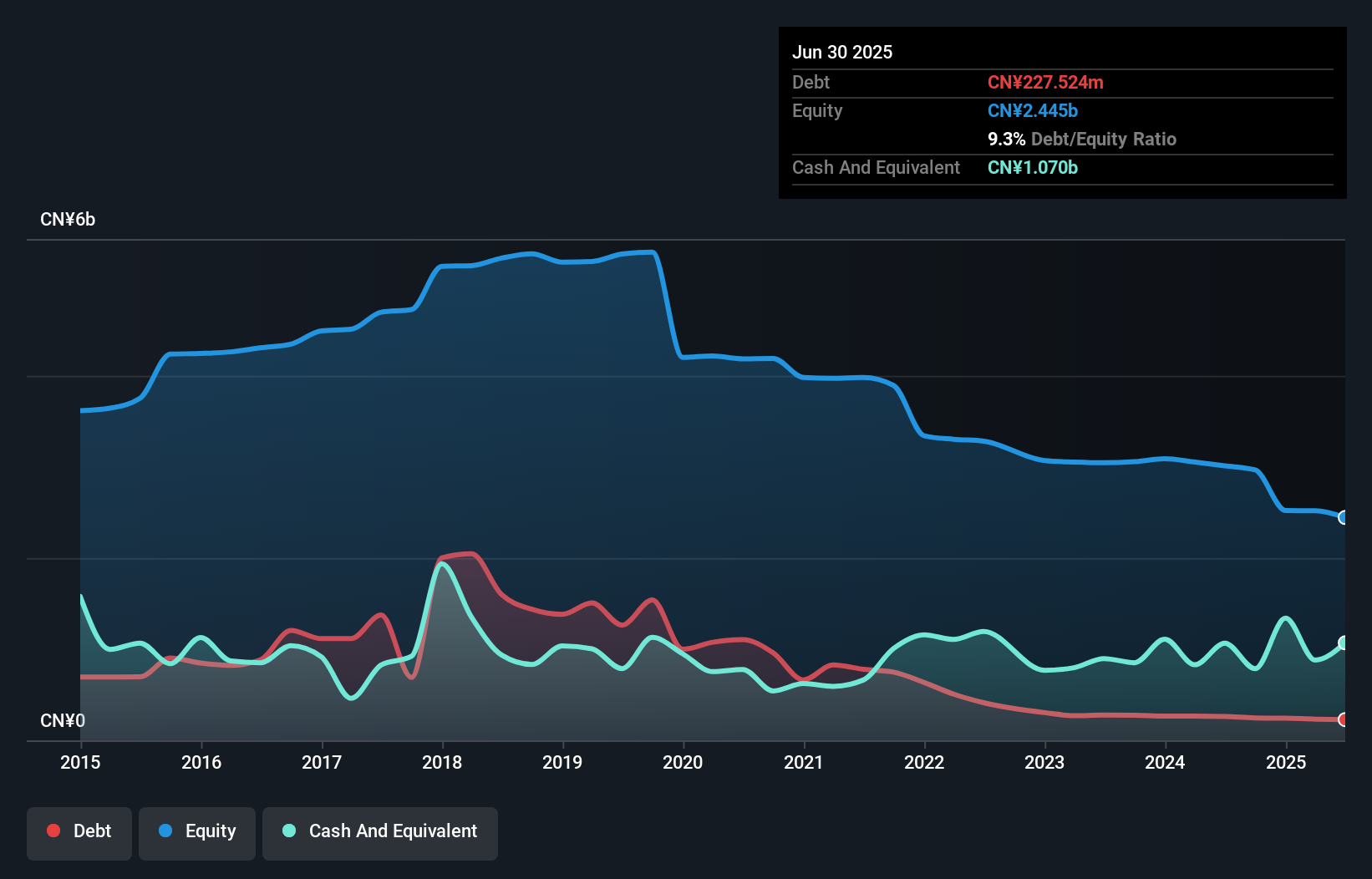

Overview: Pubang Landscape Architecture Co., Ltd operates in garden planning, design, and engineering primarily in China with a market cap of CN¥3.50 billion.

Operations: There are no specific revenue segments reported for Pubang Landscape Architecture Co., Ltd.

Market Cap: CN¥3.5B

Pubang Landscape Architecture Co., Ltd has demonstrated financial resilience, achieving profitability over the past year with a strong earnings growth rate of 38.6% annually over five years. The company's short-term assets of CN¥3.4 billion comfortably cover both its short-term and long-term liabilities, and it holds more cash than total debt, indicating robust liquidity management. Despite these strengths, Pubang reported a net loss of CN¥22.39 million for the first nine months of 2024, though this was an improvement from the previous year’s loss. No significant shareholder dilution occurred recently, reflecting stable equity management practices.

- Click here to discover the nuances of Pubang Landscape Architecture with our detailed analytical financial health report.

- Explore historical data to track Pubang Landscape Architecture's performance over time in our past results report.

Key Takeaways

- Embark on your investment journey to our 5,749 Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603077

Sichuan Hebang Biotechnology

Provides agricultural, chemical, and new material products.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives