Apple Flavor & Fragrance GroupLtd's (SHSE:603020) Profits Appear To Have Quality Issues

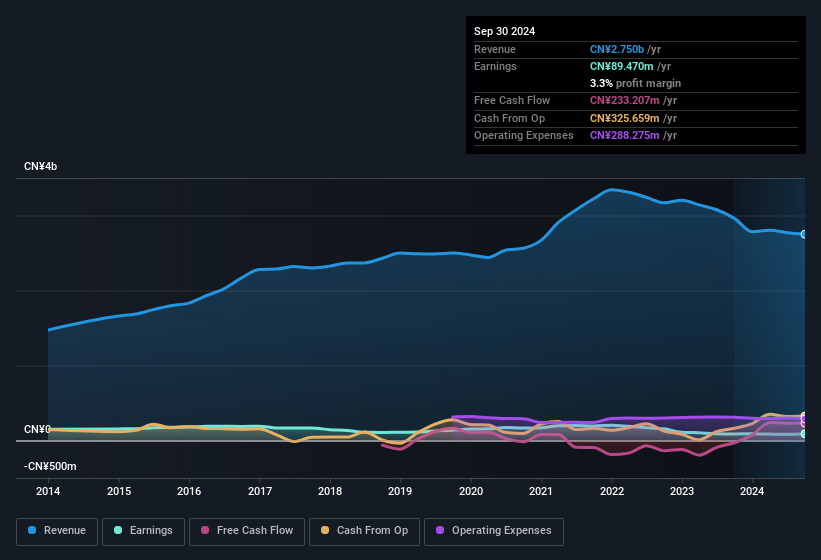

Apple Flavor & Fragrance Group Co.,Ltd.'s (SHSE:603020) healthy profit numbers didn't contain any surprises for investors. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

Check out our latest analysis for Apple Flavor & Fragrance GroupLtd

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Apple Flavor & Fragrance GroupLtd's profit received a boost of CN¥41m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. We can see that Apple Flavor & Fragrance GroupLtd's positive unusual items were quite significant relative to its profit in the year to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Apple Flavor & Fragrance GroupLtd.

Our Take On Apple Flavor & Fragrance GroupLtd's Profit Performance

As previously mentioned, Apple Flavor & Fragrance GroupLtd's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. As a result, we think it may well be the case that Apple Flavor & Fragrance GroupLtd's underlying earnings power is lower than its statutory profit. And we are pleased to note that EPS is at least heading in the right direction in the alst twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 3 warning signs for Apple Flavor & Fragrance GroupLtd (of which 1 doesn't sit too well with us!) you should know about.

This note has only looked at a single factor that sheds light on the nature of Apple Flavor & Fragrance GroupLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603020

Apple Flavor & Fragrance GroupLtd

Engages in the manufacture and sale of flavors, fragrances, and food ingredients in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives