Subdued Growth No Barrier To Guangdong DFP New Material Group Co., Ltd. (SHSE:601515) With Shares Advancing 33%

Guangdong DFP New Material Group Co., Ltd. (SHSE:601515) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

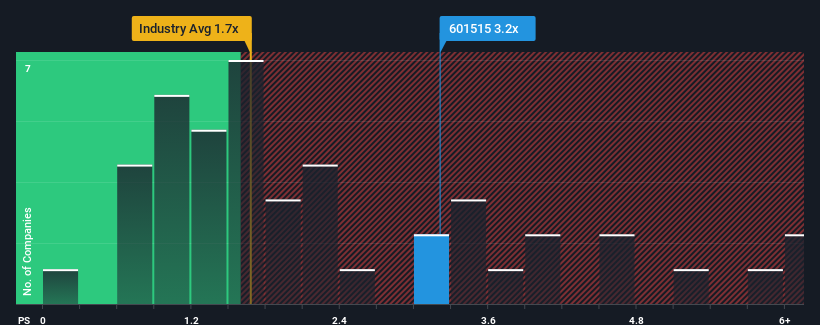

Following the firm bounce in price, when almost half of the companies in China's Packaging industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider Guangdong DFP New Material Group as a stock probably not worth researching with its 3.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Guangdong DFP New Material Group

How Guangdong DFP New Material Group Has Been Performing

Guangdong DFP New Material Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Guangdong DFP New Material Group will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Guangdong DFP New Material Group?

The only time you'd be truly comfortable seeing a P/S as high as Guangdong DFP New Material Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 47% decrease to the company's top line. As a result, revenue from three years ago have also fallen 48% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 19% over the next year. That's not great when the rest of the industry is expected to grow by 17%.

In light of this, it's alarming that Guangdong DFP New Material Group's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From Guangdong DFP New Material Group's P/S?

Guangdong DFP New Material Group's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Guangdong DFP New Material Group's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Before you take the next step, you should know about the 2 warning signs for Guangdong DFP New Material Group that we have uncovered.

If you're unsure about the strength of Guangdong DFP New Material Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Quzhou DFP New Material Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601515

Quzhou DFP New Material Group

Engages in the research, development, design, manufacture, and sale of printing and paper packaging products in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion