- Japan

- /

- Trade Distributors

- /

- TSE:9906

3 Asian Dividend Stocks With Up To 9.6% Yield To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rally, with U.S. indices reaching record highs and positive developments in trade relations between the U.S. and China, investors are increasingly looking toward Asia for opportunities to diversify their portfolios. In this environment, dividend stocks can offer a reliable income stream and potential stability amidst market fluctuations, making them an attractive option for those seeking to enhance their portfolio's resilience.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.57% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.33% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.00% | ★★★★★★ |

| NCD (TSE:4783) | 4.24% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.34% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.53% | ★★★★★★ |

| ENEOS Holdings (TSE:5020) | 4.20% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.42% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.04% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.16% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

AP (Thailand) (SET:AP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: AP (Thailand) Public Company Limited, with a market cap of THB19.66 billion, operates in the real estate development sector in Thailand through its subsidiaries.

Operations: AP (Thailand) Public Company Limited generates revenue primarily from its Low-Rise Segment at THB32.46 billion and High-Rise Segment at THB2.73 billion.

Dividend Yield: 9.6%

AP (Thailand) offers a stable dividend profile, with payments consistently growing over the past decade and a current yield of 9.6%, placing it in the top 25% of Thai dividend payers. Despite recent earnings declines, dividends remain well-covered by both earnings (38.7% payout ratio) and cash flows (50.2% cash payout ratio). However, its debt coverage by operating cash flow is weak, which could be a concern for future financial flexibility.

- Click here and access our complete dividend analysis report to understand the dynamics of AP (Thailand).

- The analysis detailed in our AP (Thailand) valuation report hints at an deflated share price compared to its estimated value.

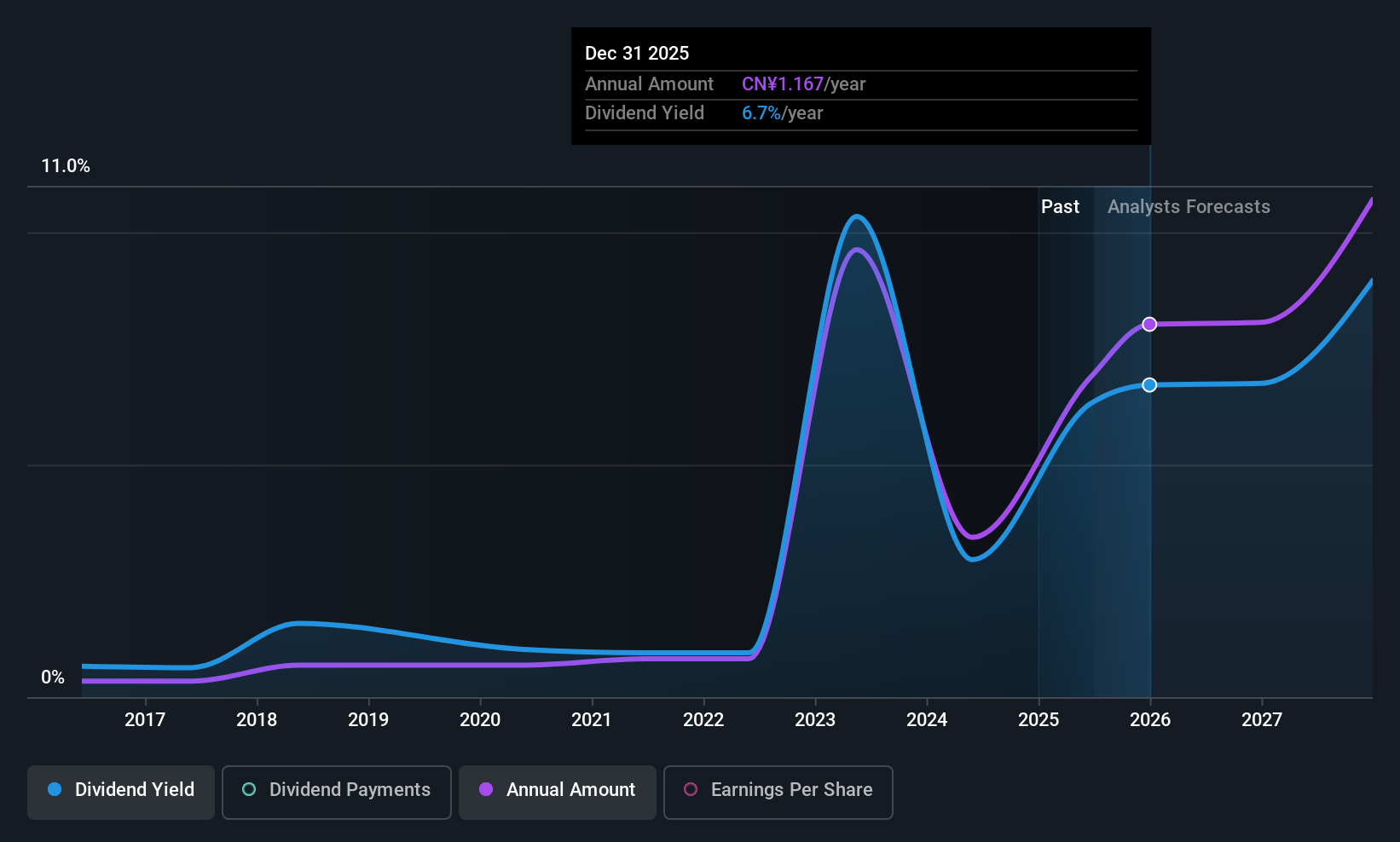

Western MiningLtd (SHSE:601168)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Western Mining Co., Ltd. operates in the mining, smelting, and trading of metals both in Mainland China and internationally, with a market capitalization of CN¥39.63 billion.

Operations: Western Mining Co., Ltd. generates revenue through its activities in mining, smelting, and metal trading across domestic and international markets.

Dividend Yield: 6%

Western Mining Ltd. presents a mixed picture for dividend investors. Its dividends, though currently yielding 6.01% and covered by earnings (79.4% payout ratio) and cash flows (35.4% cash payout ratio), have been volatile over the past decade, raising concerns about reliability. Despite recent earnings growth, the company was recently removed from an index constituent list, which may impact investor sentiment regarding its financial stability and future dividend prospects in the Asian market.

- Unlock comprehensive insights into our analysis of Western MiningLtd stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Western MiningLtd is priced lower than what may be justified by its financials.

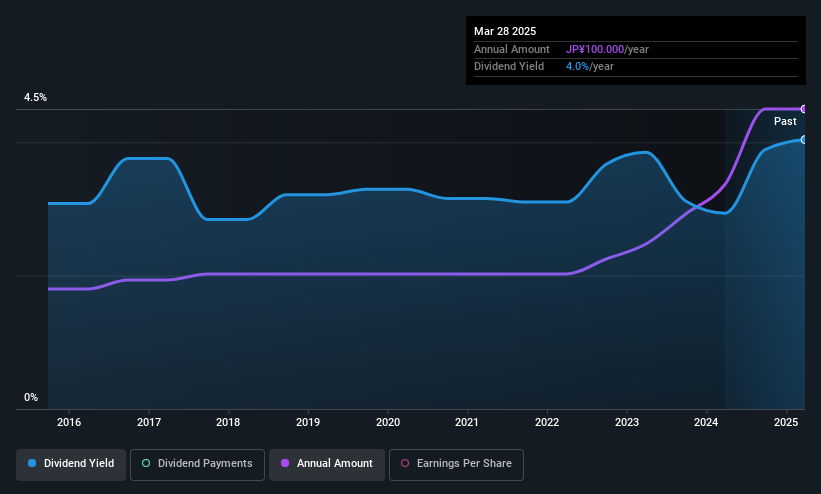

Fujii Sangyo (TSE:9906)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Fujii Sangyo Corporation operates in Japan, focusing on the sale of electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery, with a market cap of ¥26.34 billion.

Operations: Fujii Sangyo Corporation's revenue is primarily derived from its Material Innovations Company, contributing ¥53.78 billion, Infrastructure Solutions Company with ¥33.69 billion, and Komatsu Construction Equipment Sales and Service Japan, Ltd., which adds ¥7 billion.

Dividend Yield: 4.2%

Fujii Sangyo offers a compelling profile for dividend investors with its stable and growing dividends over the past decade. The company's 4.17% yield ranks it among the top 25% of dividend payers in Japan, supported by a low payout ratio of 26.7% and cash payout ratio of 38.1%, ensuring sustainability from both earnings and cash flows. Despite trading significantly below estimated fair value, recent AGM proceedings suggest continued operational focus without major disruptions to its dividend strategy.

- Dive into the specifics of Fujii Sangyo here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Fujii Sangyo is trading behind its estimated value.

Seize The Opportunity

- Explore the 1225 names from our Top Asian Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9906

Fujii Sangyo

Engages in the sale of electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives