Unveiling 3 Stocks Including Kempower Oyj That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets react to policy changes and economic indicators, with U.S. stocks reaching record highs amid AI enthusiasm and potential trade negotiations, investors are keenly observing the landscape for opportunities. In such an environment, identifying stocks that may be trading below their estimated value can offer potential advantages, especially when considering factors like growth prospects and market positioning.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.73 | 49.8% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥18.32 | CN¥37.54 | 51.2% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.32 | US$56.60 | 50% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| Vertiseit (OM:VERT B) | SEK50.20 | SEK99.93 | 49.8% |

| Fudo Tetra (TSE:1813) | ¥2183.00 | ¥4301.33 | 49.2% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.83 | CN¥27.81 | 50.3% |

| Shinko Electric Industries (TSE:6967) | ¥5862.00 | ¥11678.51 | 49.8% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.19 | CN¥18.19 | 55.0% |

| Tenable Holdings (NasdaqGS:TENB) | US$43.39 | US$86.65 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

Kempower Oyj (HLSE:KEMPOWR)

Overview: Kempower Oyj manufactures and sells electric vehicle charging equipment and solutions under the Kempower brand name across the Nordics, Europe, North America, and internationally, with a market cap of €605.80 million.

Operations: The company's revenue is primarily derived from its electric equipment segment, which generated €234.81 million.

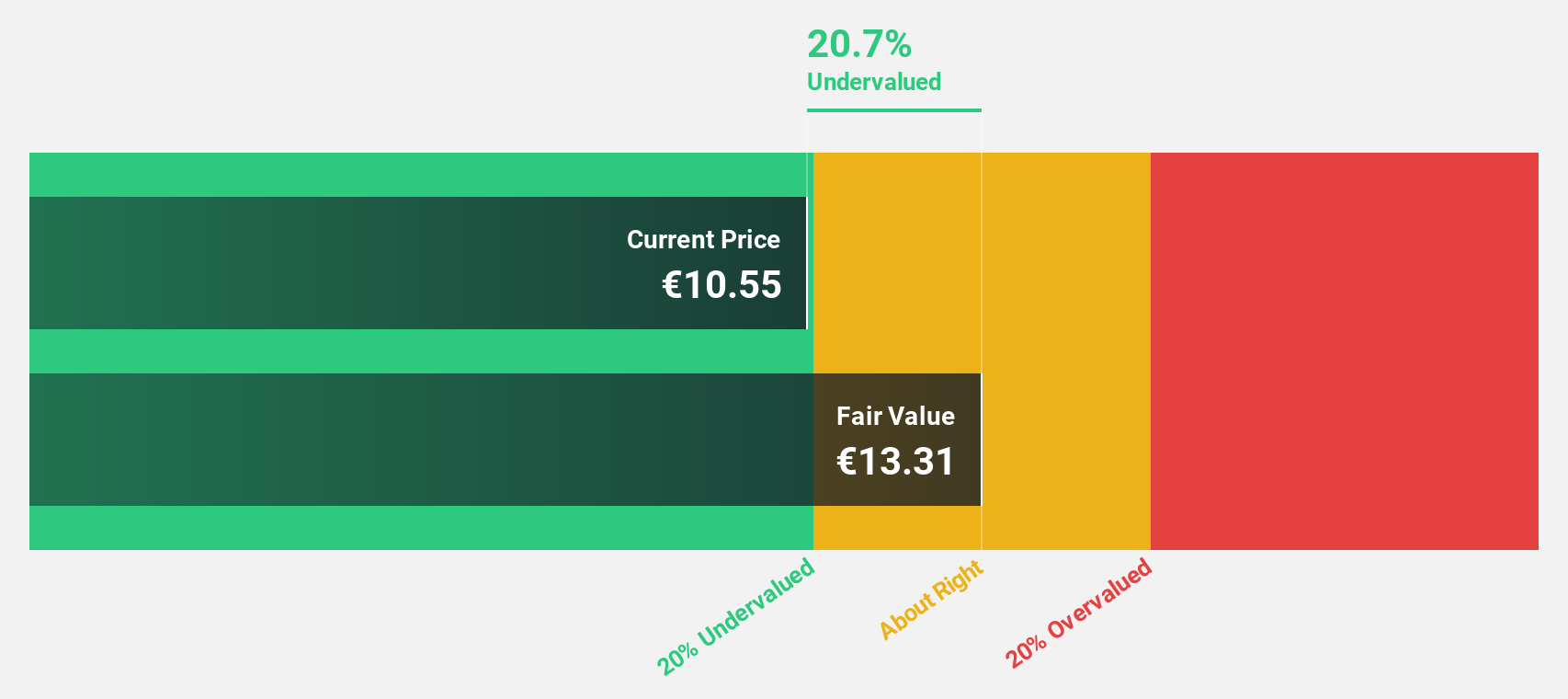

Estimated Discount To Fair Value: 30.8%

Kempower Oyj is trading at €10.96, significantly below its estimated fair value of €15.84, suggesting undervaluation based on cash flows. Despite a volatile share price recently, the company is forecast to achieve profitability within three years and grow its earnings by 56.2% annually. Revenue growth is projected at 17.9% per year, outpacing the Finnish market average of 2.6%, although recent leadership changes and lowered revenue guidance for 2024 may impact short-term performance.

- In light of our recent growth report, it seems possible that Kempower Oyj's financial performance will exceed current levels.

- Take a closer look at Kempower Oyj's balance sheet health here in our report.

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining and chemical products, with a market cap of approximately CN¥119.68 billion.

Operations: The company generates revenue from coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin sales.

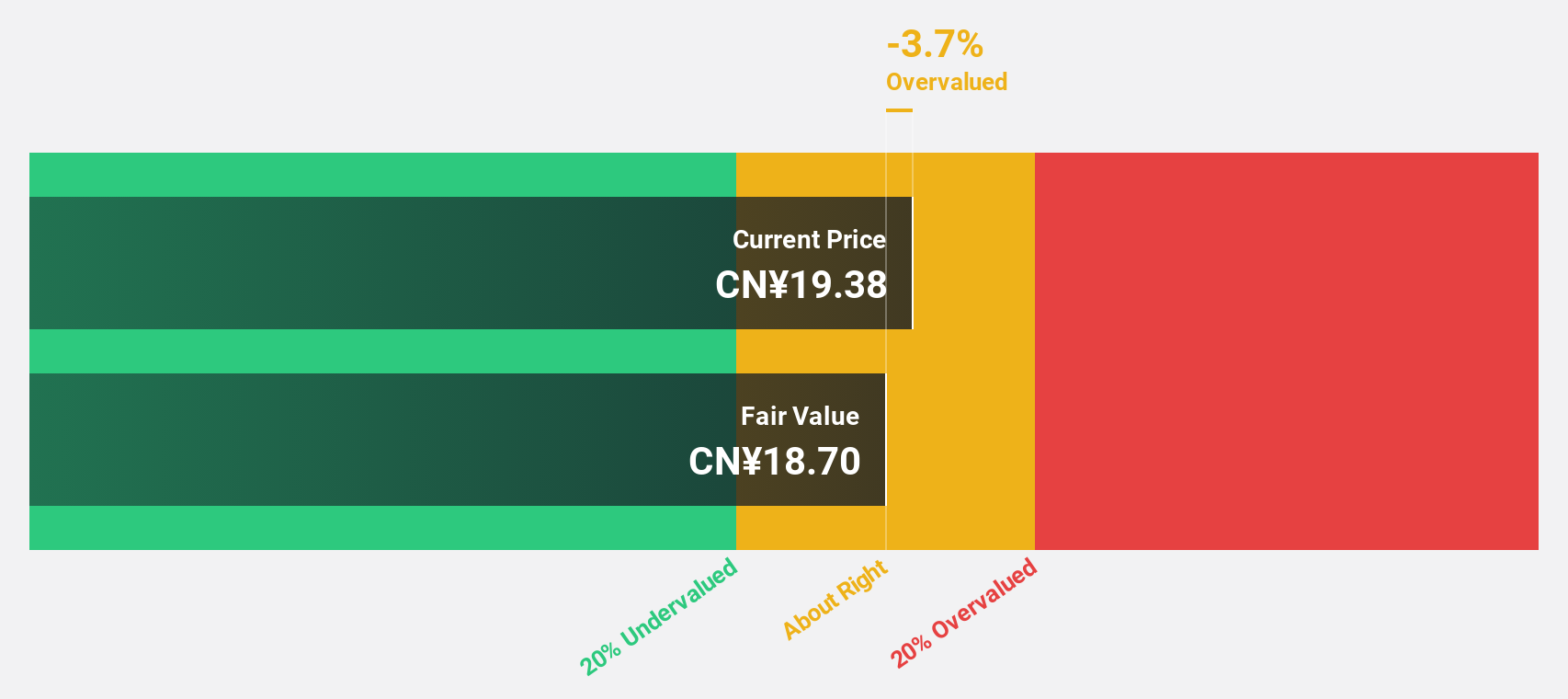

Estimated Discount To Fair Value: 32.3%

Ningxia Baofeng Energy Group, trading at CN¥17.53, is valued below its estimated fair value of CN¥25.89, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to CN¥4.54 billion for the first nine months of 2024 from CN¥3.89 billion a year ago. Despite high debt levels and an unsustainable dividend yield of 1.6%, projected revenue and earnings growth rates surpass market averages significantly over the next three years.

- Our comprehensive growth report raises the possibility that Ningxia Baofeng Energy Group is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Ningxia Baofeng Energy Group's balance sheet health report.

Relo Group (TSE:8876)

Overview: Relo Group, Inc. provides property management services in Japan and has a market cap of ¥275.20 billion.

Operations: The company's revenue segments include the Welfare Program generating ¥26.52 billion, the Tourism Business contributing ¥15.17 billion, and the Relocation Business accounting for ¥97.34 billion.

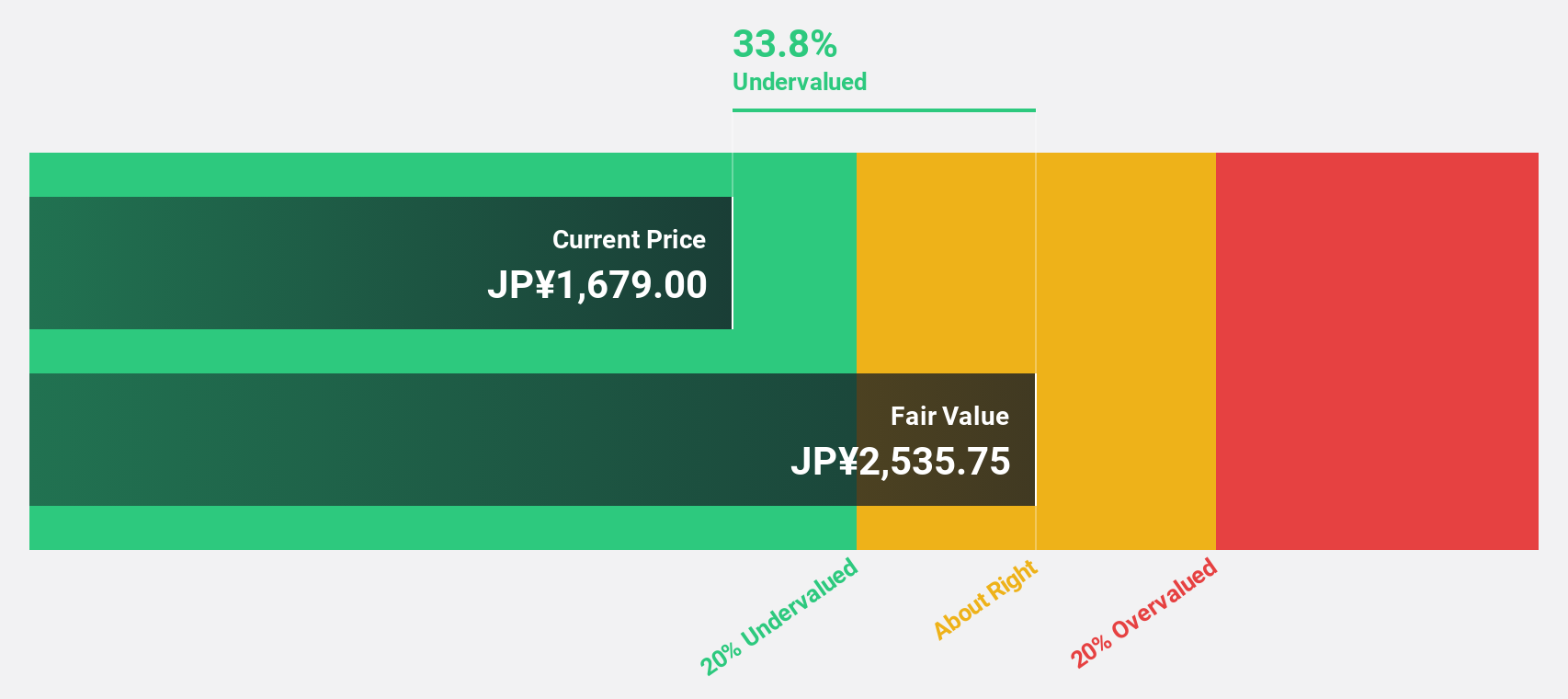

Estimated Discount To Fair Value: 36.2%

Relo Group, trading at ¥1,851, is significantly undervalued with a fair value estimate of ¥2,900.13. The stock's forecasted earnings growth of 18.69% per year and expected profitability within three years indicate strong potential despite slower revenue growth of 5.6% annually. Recent share buybacks totaling ¥5.50 billion may enhance shareholder value even as the dividend yield remains inadequately covered by earnings. Analysts anticipate a price increase of approximately 23.4%.

- Upon reviewing our latest growth report, Relo Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Relo Group with our detailed financial health report.

Key Takeaways

- Click this link to deep-dive into the 887 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Baofeng Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600989

Ningxia Baofeng Energy Group

Produces, processes, and sells coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed, methanol, and olefin products.

Undervalued with high growth potential.

Market Insights

Community Narratives